UnitedHealth’s Worst Day Since the 1998 Russian Crisis

And this time, they can’t pin it on Luigi Mangione or "macroeconomic factors." This disaster is 100% self-inflicted.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

Today was a truly historic day for UnitedHealth (UNH). But not in a good way. With a 22.4% stock price loss, it was the fourth worst trading day in the company’s history, the worst since August 1998 during the Russian ruble crisis, and the first ever self-inflicted one.

All the others were macro events. This? Pure, unfiltered incompetence.

How much of a monopoly do you have to be for a little Trump’s Medicare inflation—not even the multiple fraud cases—to crash a $500B corporation like UnitedHealth?

You have to be Sir Andrew Witty-level bad. That is, clueless and totally unprepared for a shifting market environment.

And yes, there have been multiple fraud cases against UnitedHealth. Just the most recent ones:

An upcoding scheme using the fraudulent QuantaFlo device that netted UNH $1B in a single year—from just one device, for just one diagnosis (PAD)!

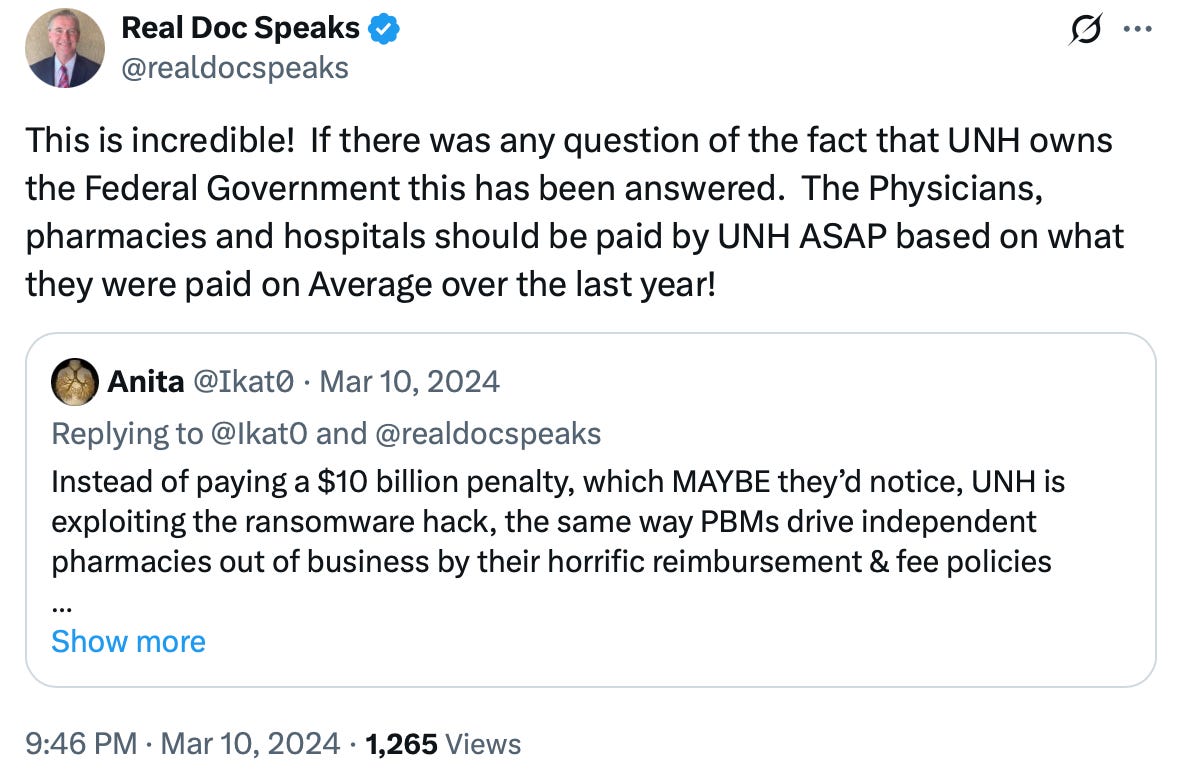

The Change Healthcare cyberattack (UNH subsidiary) didn’t hurt UNH. It did devastate providers. According to the American Medical Association (AMA), 80% of practices suffered revenue losses, 55% used personal funds to stay afloat, and many shut down—later scooped up by Optum (another UNH subsidiary!) at fire-sale prices. How convenient.

UNH forced staff to follow Optum’s NaviHealth AI (“nH Predict”) to deny Medicare patients post-acute rehab. UNH made billions. The settlement? $20.25M. That’s million—with an M. (Source: The Minnesota Star Tribune.)

Need perspective?

🕵️♂️ FTX fraud: $8 billion. Sam Bankman-Fried got 25 years.

🕵️♂️ Madoff: $65 billion. Life sentence.

🕵️♂️ UnitedHealth: $50+ billion... and counting. Zero consequences — until today.

Just to give some color: not only does UnitedHealth have some of the most powerful lobbyists in the world, but they’ve also apparently operated above the law.

UNH’s corporate defense lawyers have adopted a legal strategy so aggressive that even the mob never dared to try it—when facing litigation from the government, they turn around and file misconduct charges against the attorneys bringing the charges.

(Source: BIG newsletter, by Matt Stoller.)

In November 2023, the SEC looked the other way as UnitedHealth’s chairman Stephen Hemsley and other top execs sold $101.5M in stock—right before a U.S. antitrust probe into the company became public. (Sources: Bloomberg, BIG newsletter, by Matt Stoller.)

The reason why Andrew Witty and Stephen Hemsley think they’re above the law and therefore can commit insider trading all day long, is because he has seen the worst case scenario play out in front of him: in 2007, the SEC (not the DOJ - so no jail time already) went after then-CEO of UnitedHealth, William W. McGuire, accusing him - you guessed it - of insider trading. To the SEC's credit, they went hard after him, but the case was still settled for a whopping $1B (with all the penalties and returned stock options), without admitting any guilt, of course. So yes, it was a tough day for Mr. McGuire, as roughly half of his wealth was wiped out, but, unlike those much less affluent defendants in similar cases, he doesn’t have a criminal record, can work anywhere, and his lifestyle didn’t suffer a bit. In fact, a few years later he bought a professional soccer team, Minnesota United FC. I don’t think people realize how crazy rich these executives have become from their companies' paychecks, mainly due to equity-based compensation.

Blaming increased Medicare costs for running your business poorly is like shouting at puppets when you're the one holding all the strings. Yet that’s precisely what CEO Andrew Witty was doing on an earnings call this morning.

I’ve been advocating for breaking up UnitedHealth for years now. If Biden’s antitrust didn’t do it, Trump’s certainly won’t. But perhaps market forces will?

UnitedHealth is so big, there is no more room for the insurance business to grow any further, so it had to open other businesses: UnitedHealthcare, Optum Health, Optum Insight, Optum Rx, Optum Ventures and Optum Financial (including Optum Bank). In fact, the non-insurance business now comprises over 1/3 of the company revenue. However, despite the diverse business distribution, the UnitedHealth motto stays strong and consistent across its businesses: “We’re so big, we don’t give a shit about our customers. What are you gonna do about it?”

I wholeheartedly agree with Dr. Jeffrey Pfeffer:

UnitedHealth Group shouldn’t even exist, as it’s merely an intermediary between payers and providers, adding no real value.

By the way, after today’s Medicare-cost debacle, what do you think United’s next move will be regarding reimbursement rates? Brace yourself—provider carnage incoming.

It’s astonishing how Witty and UNH have brought American healthcare to its knees. They brazenly dismiss every single fraud lawsuit, settling each for trivial amounts. Just yesterday, Semler—UnitedHealth’s medical upcoding device dealer—offered the DOJ a mere $30M settlement, despite UNH illegally making $1B on this device in a single year(!), and causing serious harm to countless patients with false-positive PAD tests at 8(!) times the normal rate.

The level of corruption and indifference at UnitedHealth is unfathomable.

That said, UNH did lose a whopping 22.4% of its value today. I propose starting a GoFundMe campaign for Andrew Witty. Who’s with me? 😉

Like what you’re reading in this newsletter? Want more in-depth investigations and research like this?

I’m committed to staying independent and unbiased—no sponsors, no advertisers. But that also means I’m a one-man operation with limited resources, and investigations like this take a tremendous amount of effort.

Consider becoming a Founding Member of AI Health Uncut and join the elite ranks of those already supporting me at the highest level of membership. As a Founding Member, you’re not just backing this work—you’re also helping cover access fees for those who can’t afford it, such as students and the unemployed.

You’ll be making a real impact, helping me continue to challenge the system and push for better outcomes in healthcare through AI, technology, policy, and beyond.

Thank you!

👉👉👉👉👉 Hi! My name is Sergei Polevikov. I’m an AI researcher and a healthcare AI startup founder. In my newsletter ‘AI Health Uncut,’ I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏

I have to say this is one of your best articles published!

Sergei, what's amazing to me is the kid gloves treatment UHG is getting in the healthcare press. I published last week at Telehealth and Telecare Aware (telecareaware.com) what I thought was a fairly hard-hitting analysis, building from UHG's several years long mountain of misery, a conclusion that the company had slipped its moorings and purpose, and two proposals for getting back on track. While I'm getting a lot of clicks, the lack of comments on LinkedIn and on Telehealth & Telecare Aware is stunning. You'd think it's a hot topic. Then today I read an analysis in MedCityNews, which usually takes a harder line than the HIMSS Media pubs, but this time other than a few good points (such as other insurers not having the same problems), it's a tap dance. Are people in journalism *SCARED* of UHG? Or does nobody care?