WSJ: UnitedHealth Committed a $50 Billion Medicare Upcoding Fraud

In light of these revelations, it's an appropriate time to reveal my list of atrocities UnitedHealth has committed against the U.S. healthcare system.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

According to a shocking new investigation by the Wall Street Journal, UnitedHealth Group committed a $50 billion fraud over the three years of 2019, 2020, and 2021, including $8.7 billion in 2021. For comparison, the FTX crypto fraud, which led to founder Sam Bankman-Fried being sentenced to 25 years in jail, amounted to $8 billion. The Madoff Ponzi scheme was a $65 billion fraud.

“Insurer-driven diagnoses by UnitedHealth for diseases that no doctor treated generated $8.7 billion in 2021 payments to the company,” according to an analysis by the Journal. UnitedHealth’s net income that year was approximately $17 billion.

In simpler terms, the treating doctor might say, “No treatment or minimal treatment necessary for this diagnosis.” However, UnitedHealth, without ever seeing the patient, overrides the doctor’s judgment, generates its own diagnosis code, bills Medicare with this new code, and this act alone brought UnitedHealth $50 billion over three years.

That’s not upcoding. That’s a $50 billion Medicare fraud.

Insurer-driven diagnosis occurs when private insurers overseeing Medicare plans submit a diagnosis code that differs from the doctor’s original diagnosis code.

This fraud was possible in large part because UnitedHealth owns physician practices through its subsidiary, Optum. When an insurer owns the physician practice, it can configure workflows, technology, and incentives to drive risk coding. UnitedHealth can preferentially schedule Medicare Advantage patients and choose to reach out to health plan enrollees it identifies with its data as having high ‘coding opportunities.’ It can require its doctors to go to risk-code training, and it can prohibit doctors from closing their notes before they address all the ‘suggested’ diagnosis codes.

Will any of UnitedHealth executives ever go to jail?

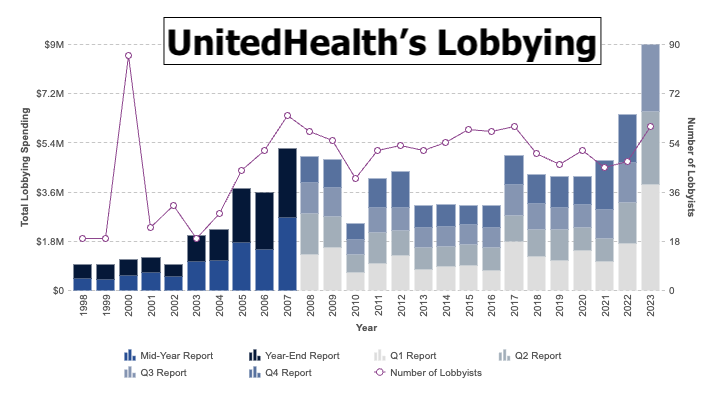

Of course not. UNH has some of the most powerful lobbyists in Washington.

Here is a list of some of the atrocities UnitedHealth has committed against American healthcare, with no or little consequences:

🩸 UnitedHealth has committed multiple pharmacy drug frauds through its Pharmacy Benefit Manager (PBM), OptumRx, but always magically “settled” for a tiny penalty. (Source: Ohio Capital Journal.)

🩸 Given its unprecedented monopoly and lobbying power, it’s no surprise that UnitedHealth has the highest risk score (RAF) in the health insurance industry. This means UnitedHealth can charge Medicare over $10,000 per patient per year more than its competitors.

🩸 UnitedHealth has discriminated against African Americans in its AI algorithms. (Sources: Wall Street Journal, Why Is Shitty, Dangerous Health AI Being Pushed by Multi-Billion-Dollar Conglomerates?)

🩸 UnitedHealth encourages its employees to follow Optum’s NaviHealth algorithm to cut off Medicare patients’ rehab care. (Sources: Stat News, Why Is Shitty, Dangerous Health AI Being Pushed by Multi-Billion-Dollar Conglomerates?)

🩸 UnitedHealth constantly denies coverage to chronically ill patients. (Source: Propublica.)

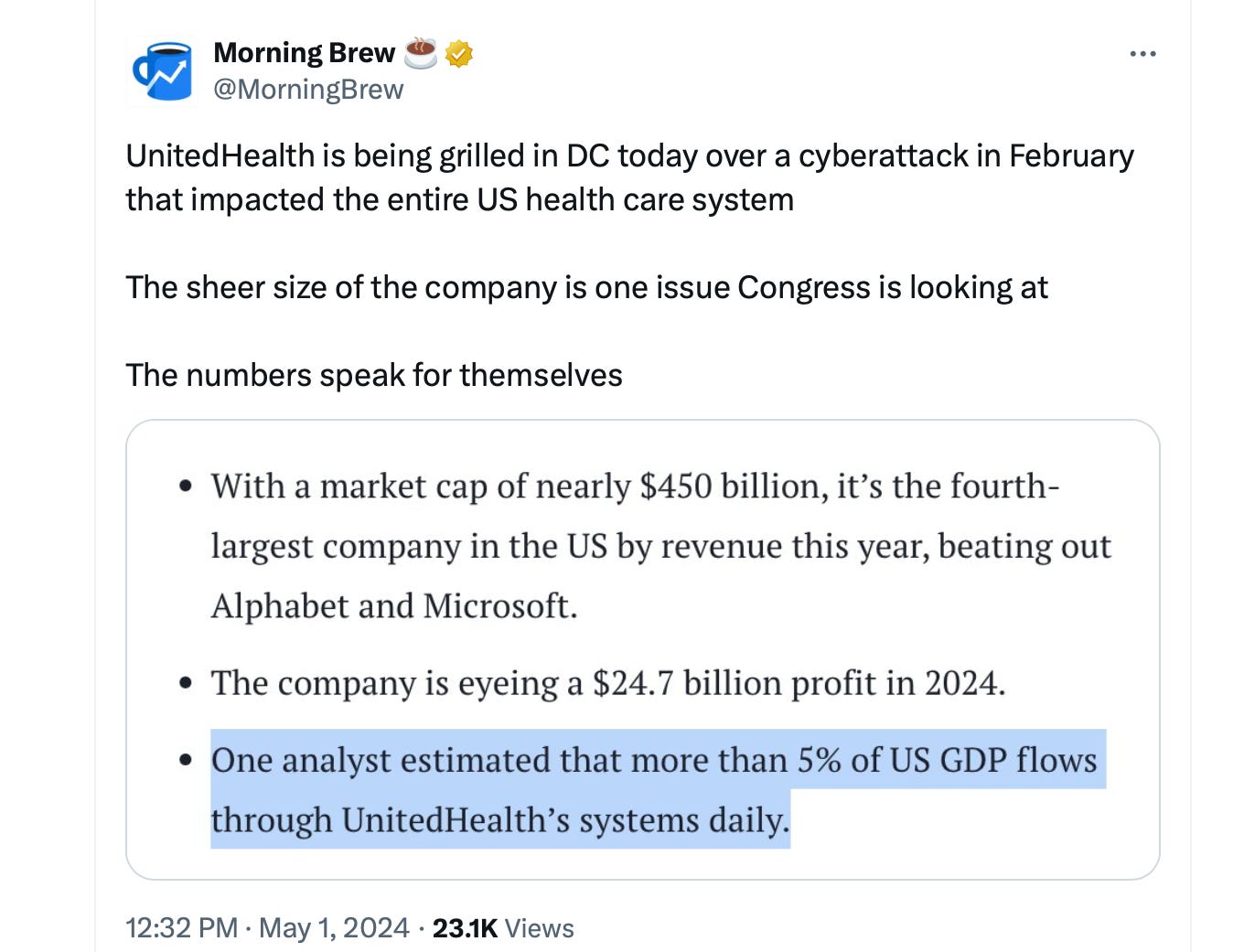

🩸 Not only was UnitedHealth not penalized for one of the worst cyber attacks in American healthcare history on its subsidiary, Change Healthcare, in February and April 2024, it benefited tremendously. UnitedHealth has never established best practices for data security. They have no incentives to do so. During the Change disaster, UnitedHealth has been suffocating medical practices by not reimbursing them, citing the paralyzed payment system. In the meantime, through its subsidiary, Optum, UnitedHealth has been “snatching” the same medical practices for ridiculously low prices because those practices have been running out of cash and are looking to either shut down or do a fire sale of their businesses.

🩸 The UnitedHealth lobby appears to be just too strong for the DOJ to handle. The DOJ has failed to sue UHC 12 times before, due to court blocks. The DOJ filed a 13th antitrust suit in November 2023. (Source: The Examiner.)

🩸 UnitedHealth executives, including the CEO, Andrew Witty, were accused of insider trading. They allegedly sold over $100 million worth of UNH stock in October 2023 before the DOJ announcement went public. (Source: Bloomberg.)

🩸 The reason why Andrew Witty thinks he is above the law and can commit insider trading is because he has seen the worst-case scenario play out in front of him. In 2007, the SEC (not the DOJ - so no jail time already) went after then-CEO of UnitedHealth, William W. McGuire, accusing him of insider trading. To the SEC’s credit, they went hard after him, but the case was still settled for a whopping $1 billion (with all the penalties and returned stock options), without admitting any guilt, of course. So yes, it was a tough day for Mr. McGuire, as roughly half of his wealth was wiped out, but unlike those much less affluent defendants in similar cases, he doesn’t have a criminal record, can work anywhere, and his lifestyle didn’t suffer a bit. In fact, a few years later, he bought a professional soccer team, Minnesota United FC. People don’t realize how crazy rich these executives have become from their companies’ paychecks, mainly due to equity-based compensation.

🩸 UnitedHealth has not updated the primary care physicians’ reimbursement fee schedule since 2018 despite raising insurance premiums by 22%. (Source: KKF.)

For the full list of UnitedHealth abuses against U.S. healthcare, please check out this UnitedHealth Abuse Tracker brilliantly compiled by Matt Stoller and the American Economic Liberties Project.

Here are some other shocking facts about UnitedHealth:

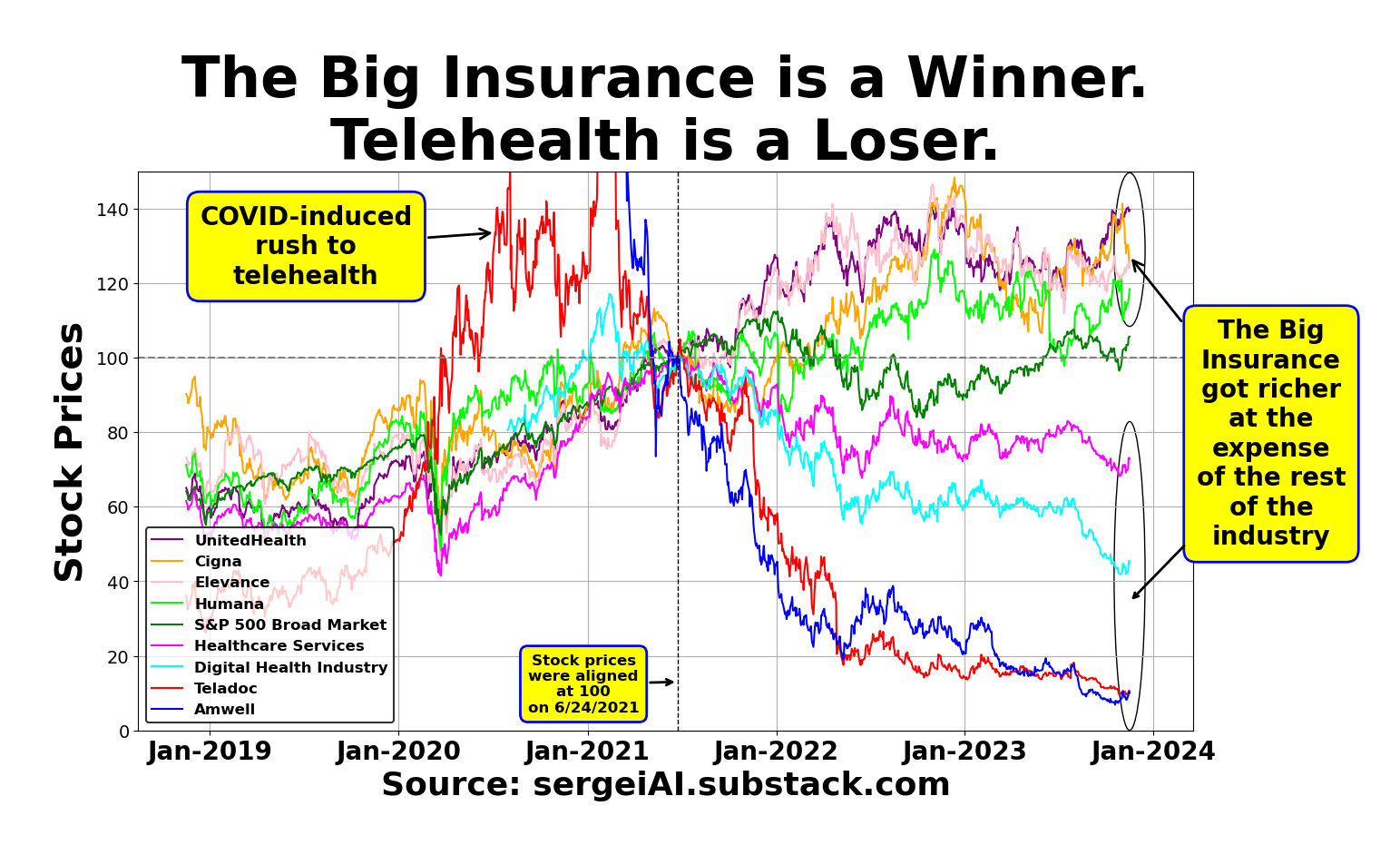

🏥 The UNH stock has grown at the expense of other healthcare participants due to UnitedHealth’s exercise of its enormous monopoly power.

🏥 UnitedHealth has grown so big that there is no more room for the insurance business to grow any further. It had to acquire other businesses: UnitedHealthcare, Change Healthcare, LHC Group, Amedisys, Optum Health, Optum Insight, Optum Rx, EMISAR, Optum Financial (including Optum Bank). In fact, the non-insurance business now comprises 28% of the company.

🏥 UnitedHealth is so big that it now accounts for 11% of the total U.S. healthcare market ($0.5 trillion vs. $4.5 trillion, respectively).

So why the insatiable hunger for more cash through fraud?

Simple. The need for greed is in monopoly DNA—whatever it takes: stifling innovation, killing startups, imposing racial biases, committing fraud…

Whether it’s the FTC, the DOJ, or Congress, it’s high time to break up UnitedHealth and save American healthcare.

👉👉👉👉👉 Hi! My name is Sergei Polevikov. In my newsletter ‘AI Health Uncut’, I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏