The 80% Error Rate Diagnostic Device at the Heart of UnitedHealth's Upcoding Fraud

This faulty device, which the media largely overlooked, should be a crucial piece of evidence in UnitedHealth's latest upcoding fraud investigation, launched by the DOJ on Friday.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

Luigi Mangione, in a tragically compelling way, has shone a spotlight on what might be the biggest cartel in the world—the American healthcare cartel—with UnitedHealth sitting squarely at its center.

I’ve been waiting for this moment for over a year, and I wish I had the bandwidth back then to break the story. But with the DOJ’s new civil probe revealed on Friday—accusing UnitedHealth of upcoding and insurer-driven diagnosis (I’ll define both below)—now is as good a time as ever to assist the DOJ and the public in exposing malpractice directly tied to this fraud. And it’s not just UnitedHealth. At least three other insurers—CVS’s Aetna, Humana, and Blue Cross Blue Shield (BCBS)—are also deeply involved, along with a vast network of companies and individuals servicing the health insurance industry.

For the first time, I show that this cartel extends far beyond UnitedHealth and even beyond the health insurance industry itself. It spans the entire healthcare ecosystem—manufacturers, resellers, and device testers.

When I say “faulty device,” I’m referring to the infamous QuantaFlo—originally designed as a screening test for Peripheral Artery Disease (PAD) but now heavily marketed by Semler Scientific (Nasdaq: SMLR) as a screening tool for Congestive Heart Failure (CHF) as well.

To any unbiased clinician, it’s “faulty.” But for the key players in this scheme, the device wasn’t faulty at all. It was “just right.” Because maximizing false positives means maximizing the number of “sick” patients. And you guessed it—maximizing cartel profits.

Having a device optimized to game the system with an alarming 80% error rate—8X higher than the industry standard of 10%—is like playing with marked cards or a rigged roulette wheel in a casino.

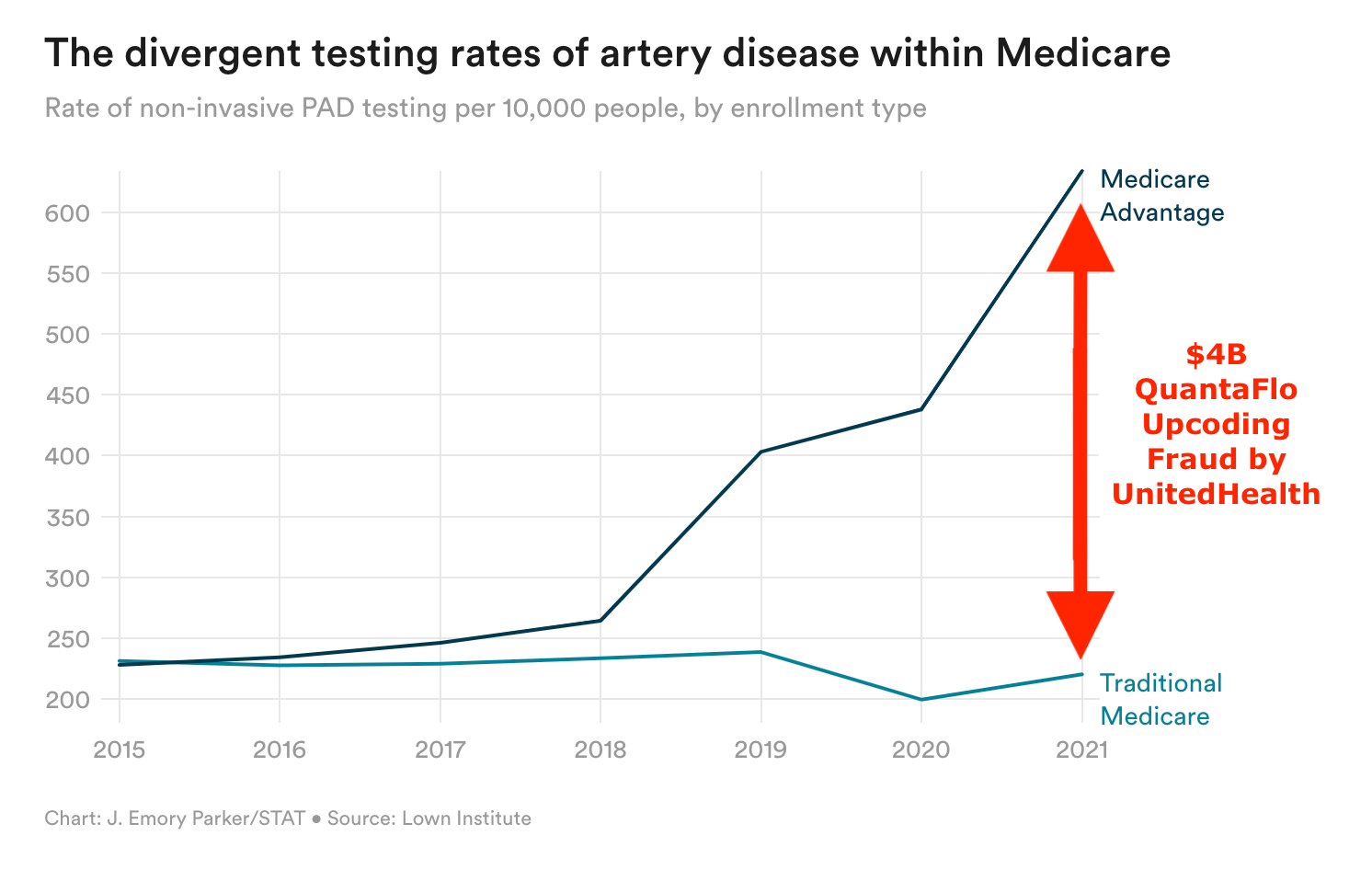

To be fair, while this particular investigation goes back years, I have to give credit where it’s due—STAT News got there first with its own exposé on QuantaFlo, even estimating that UnitedHealth raked in $4B in illegal profits from upcoding between 2018 and 2021.

That was a solid start. But the web of corruption stretches far beyond Semler (the manufacturer of QuantaFlo) and UnitedHealth. It covers the entire industry.

I lay out the web of lies. I name names in the org chart.

This is just the beginning. I want to point regulators and authorities to where the bodies are buried. Unfortunately, I can’t do everything—I’m a one-man operation.

Last year, The Wall Street Journal exposed a $50B upcoding fraud by UnitedHealth. But here’s what many forget—that figure only covers three years: 2019, 2020, and 2021. Will we ever see that $50B recovered? Of course not. UnitedHealth’s lobbying machine is as powerful as ever, and the largest fine it has ever faced barely reached the tens of millions—a rounding error for a company of its size.

It’s important to distinguish between the closely related concepts of risk adjustment and risk coding on one hand, which are valid practices when coding for medical services, and upcoding, insurer-driven diagnosis, bogus referrals, and hypercoding on the other, which are fraudulent practices used by providers and payers to artificially drive up their revenue.

Risk adjustment is a legitimate method used in healthcare reimbursement to account for differences in patient populations. Insurers and government programs (like Medicare Advantage) use risk adjustment to ensure payments reflect the actual health status of patients. For example, sicker patients require more care, so providers treating them receive higher payments.

Risk coding is the practice of assigning medical diagnosis codes that reflect a patient’s health conditions. These codes feed into risk adjustment models to determine expected healthcare costs. The goal is to ensure all relevant conditions are documented so that reimbursement reflects the true complexity of a patient’s health. For example, patient with diabetes, hypertension, and chronic kidney disease has all three conditions coded so the insurer accounts for the full risk burden.

Upcoding is a fraudulent practice where healthcare providers intentionally use diagnosis codes that make patients appear sicker than they actually are to receive higher reimbursement. Here’s how upcoding works. The treating doctor might say, “No treatment or minimal treatment necessary for this diagnosis.” However, UnitedHealth, without ever seeing the patient, overrides the doctor’s judgment, generates its own diagnosis code, and bills Medicare with this new code. This act alone brought UnitedHealth $50B over three years.

Insurer-driven diagnosis refers to the practice where Medicare Advantage (MA) insurers—not doctors—push for certain diagnoses to be recorded in patient charts. This is done to increase risk scores (RAF) and maximize reimbursements from the federal government under Medicare’s risk adjustment model.

Bogus referrals are unnecessary or inappropriate patient referrals that may be made for various reasons, including financial incentives, misunderstanding of medical conditions, or even pressure from payers or hospital systems. For example, a vascular surgeon is likely receiving many referrals for Peripheral Arterial Disease (PAD) in Medicare Advantage (MA) patients that may not be clinically warranted.

Hypercoding refers to the practice of aggressively documenting every possible diagnosis or comorbidity that a patient might have, even if those conditions are not actively treated or relevant to the visit, in order to maximize risk-adjusted payments, particularly in value-based care models like Medicare Advantage. For example, a patient with controlled diabetes and no complications is documented as having multiple related conditions (such as diabetic neuropathy or kidney issues) to increase their risk score (RAF).

This fraud reported by the WSJ was possible in large part because UnitedHealth owns physician practices through its subsidiary, Optum. When an insurer owns the physician practice, it can configure workflows, technology, and incentives to drive risk coding. UnitedHealth can preferentially schedule Medicare Advantage patients and choose to reach out to health plan enrollees it identifies with its data as having high ‘coding opportunities.’ It can require its doctors to go to risk-code training, and it can prohibit Optum-employed doctors from closing their notes before they address all the ‘suggested’ diagnosis codes.

The Wall Street Journal ran a series of investigations, culminating in yet another DOJ civil probe into UnitedHealth on Friday. (WSJ Investigation 1, WSJ Investigation 2, WSJ Investigation 3.)

UNH took a 7% hit on the day—wiping out $33B in market value—or, as they call it in the UnitedHealth boardroom, a “dinner and a movie.”

Do you know who else dropped around the same (8%) that day, followed by another 7% on Monday? Semler Scientific (Nasdaq: SMLR).

Full disclosure: I own no shares of UNH, SMLR, or any other company mentioned here, nor do I have any financial or other incentive tied to their stock movements.

PSA: If you have information about Semler Scientific, Matrix Medical Network, Signify Health, QuantaFlo, or any other company or tool potentially involved in fraud, my DMs on Substack, LinkedIn, and X are open. I work independently, report to no one, and treat all information with absolute confidentiality.

Most importantly, if you suspect fraud or any other crime, contact the FBI immediately via the FBI Tip Line. Do not waste your time with the SEC unless you’re prepared to wait years for them to take action. The SEC is useless, in my opinion.

TL;DR:

1. Who the Hell is Semler, and What’s Its Role in UnitedHealth’s Alleged Upcoding Fraud?

2. QuantaFlo Explained: What It Is and How It Works

3. Matrix Medical: Key Player in the Alleged QuantaFlo Medicare Fraud

4. Signify Health’s Role in Gaming Medicare with Bogus PAD Diagnoses

5. What is Peripheral Artery Disease (PAD)?

6. From PAD to CHF: Why the Shift? Just Follow the Money. 💰

7. Serious Statistical Flaws in QuantaFlo’s Predictive Model

8. Examining QuantaFlo’s Efficacy: Conflicts, Accuracy, and Skepticism

9. Medicare Advantage and the Risk-Adjustment Goldmine of Semler’s QuantaFlo

10. Conflict of Interest on Semler Board

11. What’s the Deal with Semler’s “₿itcoin Treasury Strategy?”

12. QuantaFlo and the Medicare Advantage Fraud: How Flawed PAD Screenings Inflate Federal Payments

13. Who’s Really to Blame for Upcoding Fraud?

14. Why Do Health Insurers Upcode If It’s Against the Law?

15. Semler and Corrupt Wall Street

16. Conclusion: QuantaFlo Is a Fraud at a Multi-Billion Dollar Scale

1. Who the Hell is Semler, and What’s Its Role in UnitedHealth’s Alleged Upcoding Fraud?

Semler Scientific, Inc. provides technology solutions aimed at improving the clinical effectiveness and efficiency of healthcare providers. Its mission is to develop, manufacture, and market innovative products and services that assist customers in evaluating and treating chronic diseases.

Semler developed, owns, and markets the QuantaFlo system.

97% of Semler Scientific’s annual revenue ($68.2M) comes from QuantaFlo fees—$37.3M from fixed-fee licenses and $29.0M from variable-fee licenses, according to the company’s most recent 10-K filing with the SEC.

Semler’s primary lessees are Matrix Medical Network and Signify Health. My focus is on Matrix for two reasons:

I have specific information and concrete data on how Matrix operates using Semler’s QuantaFlo, pushing insurer-driven diagnoses (such as PAD and CHF) to medical providers.

There have already been investigations into Signify Health’s alleged upcoding fraud, for example, by The Capitol Forum. However, to my knowledge, no one has closely examined Matrix’s operations regarding upcoding for PAD and CHF patients using Semler’s QuantaFlo.

That said, I do dedicate time in Section 4 to describing Signify Health’s role in this alleged fraud.

Semler sits at the center of questionable upcoding practices by many major payers—not just UnitedHealth, but also Aetna, BCBS, and Humana.

So why hasn’t WSJ or anyone else reported on Semler’s key role in this widespread healthcare fraud?

No idea. I’m just reporting the facts.

One of the victims of the WSJ’s previous reporting on Medicare Advantage upcoding fraud was Harriet Siskin, a retired customer-service worker. In 2022, a doctor visited her home on behalf of her insurer, Humana, and diagnosed her with obstructed arteries in her legs—an assessment that would allow Humana to collect roughly an extra $2,300 per year from Medicare.

“He told me that I may have some sort of artery blockage,” said Siskin, who tested negative a few months later after her regular doctor ordered a full work-up. “He did scare me.”

What device did Humana use to (mis)diagnose Ms. Siskin?

The (mis)diagnostic device at the center of this WSJ story—used by Humana and other insurers—has an 80% false positive rate, according to clinicians who have used it. The device is QuantaFlo, manufactured by Semler Scientific.

So why didn’t WSJ highlight this critical fact, despite covering the very incident where it was used? Your guess is as good as mine. Maybe they didn’t want to put Semler under the microscope without further investigation.

Maybe. But that’s where I step in.

This isn’t just about Humana or UNH. The real web of potential fraud centers on QuantaFlo, Semler, and Matrix Medical. Just look at this chart. It’s a tangled mess—one that demands serious untangling.

2. QuantaFlo Explained: What It Is and How It Works

The QuantaFlo® system was originally designed as a screening test for Peripheral Artery Disease (PAD) but is now also marketed by Semler as a screening test for Congestive Heart Failure (CHF).

QuantaFlo® is patented (US-20140316292-A1) as “a peripheral arterial flow detection system for providing a predictive diagnosis correlating to the diagnosis of peripheral artery disease.”

QuantaFlo is cleared by the U.S. Food and Drug Administration (FDA) as a rapid point-of-care test that uses volume plethysmography to measure arterial blood flow in the extremities.

Limitations and Questionable Validation of QuantaFlo

Reduced arterial blood flow is not exclusive to PAD but also linked to various conditions such as:

Cardiomyopathy, dehydration, hypotension, aortic stenosis, chronic venous insufficiency, congestive heart failure, hypothermia, autonomic dysfunction, autoimmune disorders, etc.

Only one published study validates QuantaFlo’s results for PAD detection.

As explained in Section 8.2 below, the study is highly dubious and contradicts direct clinical observations.

Peer-reviewed publication (Journal of Vascular Surgery) claims QuantaFlo predicts risk of mortality and major adverse cardiovascular events (MACE).

5 out of 6 study authors are directly employed by a major insurance carrier—yes, you guessed it, UnitedHealth—raising serious concerns about bias. There are other concerns, which are addressed in Section 8.1 below.

3. Matrix Medical and Its Connection to QuantaFlo

3.1. Matrix’s Mission

“We connect people to care anywhere that’s convenient, helping improve member care and health outcomes while overcoming common barriers to access.”

Matrix Medical Network is a privately owned company that has provided expert care and health services to millions of at-risk individuals for over 20 years.

Employs approximately 5,000 clinicians (Nurse Practitioners) who assess patient health and safety, identify and close care gaps, and provide life-changing services that empower patients to manage their health.

Many patients have undocumented risk factors, increasing their risk for adverse health events and impacting reimbursement. The Comprehensive Health Assessment (CHA) offers an extensive clinical review to identify unnoticed or undiagnosed risk factors and chronic conditions.

Contracts with Commercial Insurers (Aetna, Blue Cross, Humana, etc.) to provide services to Medicare Advantage patients.

Revenue (2022): ~$734M

3.2. Matrix’s Services

In-Home Wellness Assessment (IHWA)

A network of 5,000 expert clinicians provides in-home care for seniors and at-risk individuals, improving health outcomes and plan performance.

Assisted over 5 million underserved members in navigating the healthcare system and advocating for the best possible health outcomes.

In-Home Screening Study

Peripheral Artery Disease (PAD) Test – Uses QuantaFlo (Semler Scientific) to diagnose previously unrecognized cases of PAD.

3.3. The Gift Card Game: Buying Access to Diagnoses

A striking pattern has emerged: Nurse Practitioners (NPs) employed by Matrix Medical Network often provide incentives—like gift cards—to patients in exchange for an in-home assessment.

The question is: Why does Matrix feel the need to compensate patients just to gain entry into their homes? Is this a genuine healthcare service, or just a tactic to unlock access to more billable diagnoses?

3.4. Financial Incentives for Diagnosing More Conditions

The bigger concern is what happens after the NPs step inside. If Matrix employees—contracted by major insurers—were financially incentivized to “find” additional diagnoses, this would create a direct mechanism for insurers to artificially inflate Risk Adjustment Factor (RAF) scores. More diagnoses mean higher Medicare payments, leading to billions in overpayments under Medicare Advantage (MA) plans.

It’s worth digging deeper—c’mon DOJ, do your thing—are these NPs receiving bonuses based on the number of Hierarchical Condition Categories (HCCs) they document? Are certain conditions, like Congestive Heart Failure (CHF), now (in 2025) being prioritized over others (like Peripheral Artery Disease, PAD) because they drive higher payouts? I’d argue yes below—but this demands further investigation.

3.5. A Medicare-Fueled Credit Crisis?

Having witnessed the 2007 credit crisis firsthand on Wall Street, I find the pattern all too familiar. Just as mortgage companies incentivized lending officers to distort borrower qualifications, creating a house of cards that eventually collapsed, Matrix and its insurer partners may be engaging in a similar shell game—this time, with patient diagnoses.

If medical professionals are being paid to generate more diagnoses, how different is this from the reckless lending practices that tanked the financial system?

4. Signify Health’s Role in Gaming Medicare with Bogus PAD Diagnoses

Signify Health (acquired by CVS Health in 2023) is another major in-home assessment provider to Medicare Advantage plans

Signify’s aggressive PAD testing is comparable to, and by some measures even more expansive than, similar practices by Matrix Medical Network.

Signify Health has been one of Semler’s two largest customers (the other being UnitedHealth’s Optum/HouseCalls). Signify’s large-scale deployment of QuantaFlo in home visits involved ongoing purchase of QuantaFlo devices or pay-per-test licensing fees to Semler, contributing a significant portion of Semler’s revenue. For example, UnitedHealth and Signify made up approximately 41% and 29% of Semler’s 2021 revenue, respectively.

4.1. Signify’s Internal Policies Pushing to Perform PAD Tests Without Necessity

Signify Health’s internal policies and training clearly encouraged clinicians to perform QuantaFlo tests to capture PAD diagnoses. According to company emails and a workflow guide obtained by investigators, Signify required its field clinicians to perform the PAD test for members of most client health plans whenever the test was scheduled – even if the clinician felt it was not medically necessary. In fact, an email to Signify providers emphasized that for all plans except one (Humana), the PAD test “is required if ‘PAD’ is listed” in the visit itinerary; only in Humana’s case could a provider mark it “Not Clinically Relevant,” and even Humana patients over 70 were “strongly encouraged” to be tested regardless of symptoms. This mandate was repeated “over and over” in communications to clinicians during 2019–2021. Conversely, Signify instructed its staff not to perform a PAD screen on their own initiative if it wasn’t pre-scheduled by the company – even if a patient actually had PAD symptoms. One 2019 Signify email reminded providers: “Only members with a PAD note listed… should be considered for a PAD test,” underscoring that the test was driven by corporate scheduling, not clinical judgment. Several Signify clinicians have voiced concern that these tests were essentially a “fishing expedition” for lucrative diagnosis codes, rather than genuine health care:

One Signify clinician told reporters “they are looking for anything to upcode. That is what all the testing is about.”

Multiple investigations and internal accounts have revealed that Signify Health pressured its clinicians to perform PAD screenings with QuantaFlo even when not medically necessary. A November 2021 investigation by The Capitol Forum found that when Signify schedules a PAD screening as part of a home visit, clinicians “are required to perform the test” for members of certain Medicare Advantage plans “even if they determine it is not clinically indicated.” This mandate was not just informal: internal emails, training memos, and workflow guides reviewed by investigators repeatedly instructed staff that for most clients’ health plans, a scheduled PAD test “should be completed” in every instance. One company email emphasized that “All other plans are required [to do the PAD test] if ‘PAD’ is listed in the product section”, explicitly noting that clinicians should only mark a test “Not Clinically Relevant” for Humana plan members – and even Humana members were “strongly encouraged” to be tested if aged 70 or older, “even if no symptoms are present.”

Frontline clinicians have corroborated these pressures. In an online review, a Signify Health nurse practitioner described being “forced to do [PAD] testing on nearly every member regardless of their age or current medical diagnosis.” The reviewer noted Signify “receive[s] more money for [these] tests,” and if a clinician skips an unneeded PAD test, they “get an email reprimanding” them for failing to complete the “required test.” (Source: Indeed employee review.) This suggests Signify’s corporate culture prioritized capturing PAD diagnoses over clinical judgment. Ironically, clinicians also reported that Signify would not allow a PAD screening when it wasn’t pre-scheduled (even if a patient had symptoms) – highlighting that the goal was coding a profitable diagnosis rather than responding to medical need. Medical experts affirm that widespread PAD screening of asymptomatic patients is not evidence-based: the U.S. Preventive Services Task Force, an American Family Physician journal, and other guidelines do not recommend routine PAD screening without symptoms, due to insufficient proven benefit. Signify’s internal directives to test anyway underscore how the company’s practices pushed beyond clinical necessity.

The Capitol Forum also reported that Signify and Oak Street clinicians were “electronically prodded” to capture multiple diagnoses per visit and raised alarms that positive screening results rarely led to proper follow-up care. Instead, the goal seemed to be coding conditions for payment, not treating them – a practice now under increased scrutiny by regulators. Additionally, experts note that QuantaFlo’s accuracy is questionable for asymptomatic screening – potentially yielding false positives that nonetheless count as diagnoses for risk scoring. (Sources: The Capitol Forum, Lown Institute.) This has prompted criticism that

Signify and its clients were willing to accept flimsy or potentially inaccurate diagnoses in exchange for higher revenues.

(Source: Lown Institute.)

4.2. Clinician Compensation and Perverse Performance Incentives

Evidence suggests Signify’s compensation structure for its providers created financial incentives to find and document extra diagnoses, including through QuantaFlo screenings. Signify Health’s job postings for in-home assessment clinicians advertise productivity-based pay that rewards thorough data capture. For example, one posting for a physician assistant describes a base rate (~$77 per completed assessment) plus substantial extras: up to $30,000 in bonuses and a new “pay-per-test” model that pays clinicians more for each additional diagnostic test performed during a visit. This means that if a patient “qualifies to receive” extra screenings (such as a QuantaFlo PAD test or a diabetic eye exam), the provider is paid extra for completing those tests. Such pay-per-test incentives directly encourage clinicians to perform screenings that can lead to new diagnoses. In short, the more conditions they manage to document, the more a Signify contractor stands to earn.

Beyond direct pay, performance metrics and expectations also play a role. Signify’s software presents visiting clinicians with a pre-populated list of “suspected” diagnoses for every patient, and clinicians are prompted to indicate whether each is “Active,” “Resolved,” or “Not Confirmed”. Former Signify practitioners noted that many suggested diagnoses seemed inappropriate or erroneous (e.g. schizophrenia, amputations that the patient didn’t have), but the system implicitly pressures providers to confirm as many conditions as possible. This aligns with practices seen at other risk-coding-focused providers (e.g. Oak Street Health, which openly tracked how many lucrative diagnoses each clinic was capturing and even showed physicians the revenue value of each diagnosis on their “care gap” reports). While Signify’s exact performance scorecards are not public, the combination of pay-per-assessment, paid add-on tests, and software nudges to capture diagnoses indicates a corporate culture that rewards maximizing coded conditions.

4.3. Whistleblower Allegations Against Signify Health

Concerns about financially motivated overdiagnosis in Medicare Advantage have been validated by whistleblowers and investigators. A notable whistleblower lawsuit in 2014 (United States ex rel. Ramsey-Ledesma v. Censeo Health, LLC) targeted Signify Health’s predecessor company, Censeo, accusing it and dozens of Medicare Advantage plans of orchestrating in-home assessments to inflate risk scores. The whistleblower, a former coding specialist, alleged that Censeo pressured its contracted doctors to diagnose high-risk conditions based on minimal evidence and even supplied pre-populated forms nudging them toward lucrative diagnoses. According to the complaint, physicians were “pressured to code high-risk conditions” through incentive payments and other employment conditions. In one example, doctors were instructed to label patients with COPD if they had a cough or used oxygen, without pulmonary function tests – showing how clinical standards were bent in pursuit of billable codes. This case highlighted that:

Some Medicare Advantage vendors explicitly tied physician compensation or job retention to the volume of diagnoses generated, crossing ethical and legal lines.

5. What is Peripheral Artery Disease (PAD)?

5.1. Definition:

Peripheral arterial disease (PAD) is the narrowing of blood vessels that carry blood from the heart to the extremities. It is primarily caused by the buildup of fatty plaque in the arteries, a condition known as atherosclerosis.

While calcification and plaque in the artery walls are common with aging, PAD occurs when plaque buildup significantly narrows the vessel, reducing perfusion pressure to the extremities.

5.2. Other Definitions of PAD:

A symptom complex characterized by pain and weakness in a skeletal muscle group during exercise (e.g., leg pain while walking). This muscle limpness disappears after rest and is often associated with:

Arterial stenosis

Muscle ischemia

Lactate accumulation

Any disorder affecting blood flow through the veins or arteries outside the heart.

A condition involving deviation from or interruption of normal blood vessel function outside the heart.

A pathological process affecting any blood vessel in the vasculature outside the heart.

5.3. Diagnosis:

The gold standard for diagnosing PAD is the ankle-brachial index (ABI), a noninvasive test comparing ankle blood pressure to arm blood pressure.

Medical society consensus: PAD is strictly defined as an ABI < 0.9.

Prevalence: More than 20% of individuals over 65 have PAD (ABI < 0.9).

5.4. Symptoms:

The primary symptom of PAD is claudication (muscle pain with ambulation).

Many individuals with PAD have comorbid conditions (e.g., lung disease, heart disease, osteoarthritis) that limit mobility.

Approximately 50% of PAD patients are asymptomatic.

5.5. Health Risks:

Compared to age-matched individuals, PAD patients have an increased risk of:

✔ Stroke

✔ Heart attack

✔ Limb loss

5.6. ICD-10 Code:

I73.9 – Peripheral vascular disease, unspecified.

6. From PAD to CHF: Why the Shift? Just Follow the Money. 💰

Doctors were puzzled by the dramatic drop in PAD patients showing up in their offices in 2024. The answer? Follow the money.

The 2024 Medicare Advantage Risk Model (V28) removed standalone PAD (without complications) from risk adjustment. In other words, PAD is no longer a Hierarchical Condition Category (HCC) condition. That means PAD diagnoses no longer qualify to boost the RAF score of Medicare Advantage patients, making them financially irrelevant to insurers.

Side note: HCC (Hierarchical Condition Category) is a risk adjustment model used by Medicare Advantage (MA) plans and other insurers to predict healthcare costs and reimburse providers based on the severity of a patient’s conditions. The HCC model assigns risk scores based on ICD-10 diagnoses, adjusting capitated payments to health plans to ensure higher reimbursement for sicker patients who require more care.

So, is this a problem for Semler? After all, testing for PAD was the whole reason they started the company! Does this mean they’ll finally do what they should have been doing all along—honestly referring patients for the conditions they actually have instead of what insurers want them to have?

Oh, no no no. Of course not.

Semler simply checked which conditions still do qualify for Medicare Risk Adjustment under the HCC model and—voilà!—suddenly, QuantaFlo can now “identify” CHF (ICD-10 code I50.9 – Heart failure, unspecified). That was fast. Does it actually fit within QuantaFlo’s patent? Kinda, I guess. Let’s all just pretend it does.

Since screening for PAD no longer comes with a financial kickback, Semler has stopped bothering. Not that they ever truly cared about patient well-being—only the profits tied to diagnosis codes.

And that, ladies and gentlemen, is why Semler dumped PAD patients like last year’s iPhone and “pivoted” to diagnosing CHF with QuantaFlo. Not because of some groundbreaking innovation. Not because of a sudden epiphany about patient care. But because Medicare stopped paying for PAD, and Semler follows one god and one god only—the dollar.

7. Serious Statistical Flaws in QuantaFlo’s Predictive Model

7.1. Insufficient Sample Size for Logistic Regression

Logistic regression requires large sample sizes for reliable predictions. A common guideline suggests a minimum of 10 cases per predictor variable for the least frequent outcome. Given QuantaFlo’s model with 7 predictor variables and a 0.30 probability of the least frequent outcome, the required sample size is:

( 10 x 7 ) / 0.30 = 233

However, the model is based on only 137 observations, falling significantly short of this threshold.

7.2. Power-Significance Tradeoff and Misclassification Risk

Underpowering the logistic regression model with insufficient sample size inflates the significance level (alpha), leading to an increased risk of false positives. This means normal individuals are more likely to be misclassified as abnormal, undermining the model’s reliability.

7.3. Overfitting

With 7 coefficients and only 137 observations, overfitting is a significant issue. The model becomes too tailored to the training data, limiting its ability to generalize to new cases. This compromises its external validity and predictive accuracy.

7.4. Empirical Evidence of Misclassification

Without cross-validation to assess the model’s external validity, a real-world evaluation was conducted. Among 10 patients referred as abnormal, 8 were misclassified, providing direct evidence that the model fails in practical settings.

7.5. Additional Model Assumptions to Address

Beyond sample size concerns, several statistical assumptions must be evaluated and justified, including:

Collinearity among predictor variables

Impact of outliers

Other structural model dependencies

Given these limitations, QuantaFlo does not meet generally accepted statistical standards for power and sample size. Its predictive validity is highly questionable, and results should be interpreted with extreme caution to avoid misleading conclusions.

8. Examining QuantaFlo’s Efficacy: Conflicts, Accuracy, and Skepticism

8.1. The Journal of Vascular Surgery Study on QuantaFlo and the Authors’ Direct Affiliation with UnitedHealth

A study published in the Journal of Vascular Surgery (J Vasc Surg 2022;75:2054-64) investigated QuantaFlo’s efficacy, concluding that a positive QuantaFlo® result correlates with an increased risk of mortality and major adverse cardiovascular events (MACE). Notably, the study did not claim that a positive QuantaFlo result correlates with the presence of peripheral artery disease (PAD).

This study was funded by an unrestricted grant from Optum Labs. Five of its six authors are either employees or consultants of Optum Labs. While the paper asserts that Optum Labs is unaffiliated with Semler Scientific, it is significant that UnitedHealth Group (UHG)—Optum Labs’ parent company—contracts with Matrix Medical Network and Signify Health for services utilizing QuantaFlo in Medicare Advantage plans.

8.2. Benchmarking QuantaFlo Against Peripheral Artery Disease (PAD) Diagnosis

A separate study (Source: Gomes A. The accuracy of a volume plethysmography system as assessed by contrast angiography. J Prev Med. 2018;3(2):15.) evaluated QuantaFlo’s performance in detecting PAD, using contrast angiography as the diagnostic standard. The study reported:

Total patients: 48

True positives: 37

False positives: 0

True negatives: 5

False negatives: 6

Sensitivity: 86.00%

Specificity: 100.00%

Accuracy: 87.50%

The study concluded that QuantaFlo accurately aids primary care physicians in diagnosing PAD and identifying patients who may benefit from further vascular assessment.

8.3. Concerns and Methodological Issues

Despite the reported high accuracy, skepticism arises regarding the study’s methodology:

It was a retrospective study, raising concerns about selection bias.

Why would the 11 patients with normal QuantaFlo results have undergone an invasive angiogram? This selection raises questions about the study’s design.

The study analyzed patients rather than extremities—yet each patient has two legs, making limb-based reporting more appropriate.

These concerns highlight the need for further independent research to validate QuantaFlo’s reliability in clinical practice.

9. Medicare Advantage and the Risk-Adjustment Goldmine of Semler’s QuantaFlo

Medicare Advantage (MA) is a risk-based capitation model in which Medicare pays commercial insurers a fixed amount per enrollee to assume financial risk. Payments to insurers are adjusted based on patient diagnoses, with higher payments allocated for sicker patients to cover anticipated medical costs. This system has led to significant financial incentives for insurers to document additional diagnoses, particularly through tools like Semler’s QuantaFlo, which plays a controversial role in risk adjustment.

9.1. Medicare Advantage Enrollment

Over 51% of Medicare beneficiaries (approximately 30 million individuals) are enrolled in Medicare Advantage programs.

Enrollment continues to rise, driven by insurer incentives and patient preference for added benefits.

9.2. Medicare Advantage as a Risk-Based Capitation Model

Insurers receive fixed payments from the Federal Health Program for assuming financial risk.

Payments are adjusted based on documented diagnoses, which determine each patient’s risk score.

Higher risk scores translate into higher payments to insurers, particularly for patients with multiple chronic conditions.

9.3. Peripheral Artery Disease (PAD) and Increased Payments

PAD is a chronic vascular condition that qualified for increased Medicare payments.

The condition affects approximately 20% of individuals over the age of 70.

Over 50% of PAD patients are asymptomatic, making diagnosis complex and often dependent on screening tools like QuantaFlo.

ICD code I73.9 (PAD) mapped to Hierarchical Condition Category (HCC) 108, which increased payments from CMS to insurers by $1,000 - $2,000 per patient per year.

9.4. The Role of In-Home Wellness Assessments (IHWA)

Federal law entitles Medicare Advantage patients to an annual In-Home Wellness Assessment (IHWA).

IHWA is intended to identify latent diseases and improve patient care, but insurers use it strategically for risk score inflation.

Matrix Medical Network employs over 5,000 Nurse Practitioners to conduct these assessments.

Matrix contracts with commercial insurers to perform IHWA for Medicare Advantage enrollees.

QuantaFlo Screening Test is frequently administered during IHWA to diagnose PAD.

9.5. Financial Implications of Risk Adjustment

Medicare Advantage insurers benefited financially by diagnosing more chronic conditions, particularly PAD, even in asymptomatic patients.

QuantaFlo’s widespread use raises concerns about overdiagnosis and exaggerated risk scores, which inflate CMS reimbursements to insurers.

The validity and accuracy of QuantaFlo’s findings remain questionable, leading to concerns that financial incentives—rather than clinical necessity—drive its use.

9.6. Regulatory and Ethical Concerns

Federal officials have raised concerns that home visits and diagnostic tools like QuantaFlo may contribute to excessive risk score inflation without delivering meaningful medical benefits.

CMS attempted to terminate the IHWA benefit (2017?), but insurers vehemently protested, and IHWA remains part of all Medicare Advantage plans.

Estimated overpayments from Medicare Advantage between 2008 and 2013 totaled $70B.

Critics argue that these risk-adjustment tactics increase Medicare costs without significantly improving patient care.

Medicare Advantage provides substantial financial incentives for insurers to document more diagnoses, with QuantaFlo playing a central role in identifying PAD. While insurers argue that in-home assessments and screening tools improve care, it is clear they primarily serve to inflate risk scores and maximize CMS payments.

10. Conflict of Interest on Semler Board

Semler Scientific’s board of directors has included individuals who have held senior roles in health insurance organizations. Notable examples include:

Dr. Arthur “Abbie” Leibowitz – A board member from 2014 to 2023, he previously served as Vice President and Chief Medical Officer at Aetna U.S. Healthcare in the 1990s. In that role, he oversaw medical affairs and policies at one of the nation’s largest health insurers. (Source: The SEC filings.)

Daniel S. Messina – A Semler board member since 2020, he was formerly President of Magellan Health and, before that, Chief Financial Officer and head of business strategy at Aetna Health (1998–2000). He also spent a decade as a vice president at Cigna. (Sources: Semler, The SEC filings.) This gives him nearly 40 years of experience spanning healthcare systems and insurance companies.

Dr. Wayne T. Pan – A longtime Semler director (from 2014 to 2023), Dr. Pan has direct Medicare Advantage experience. From 2022 until March 2023 he served as Medical Director in Banner Health’s insurance division, responsible for Banner’s Medicare HMO, PPO, and D-SNP plans. He has also been a part-time medical director at San Francisco Health Plan, a regional health insurer. Dr. Pan’s career thus straddles the device company and active roles in insurance plan management. (Source: Biospace.)

These overlaps illustrate a close relationship between Semler’s leadership and the insurance industry. Such board composition means individuals who understand – and have a stake in – how health plans operate (including risk adjustment strategies) are helping steer the company that makes QuantaFlo, Semler’s flagship medical device.

11. What’s the Deal with Semler’s “₿itcoin Treasury Strategy?”

“On May 28, 2024, we announced that our board of directors adopted bitcoin as our primary treasury reserve asset on an ongoing basis, subject to market conditions and our anticipated cash needs and that we purchased 581 bitcoins for an aggregate amount of $40.0 million…

As of September 30, 2024, the fair value of our digital assets (comprised of 1,018 bitcoins) was $64.5 million, which reflects a cumulative reduction in fair value of $3.9 million since acquisition. As of September 30, 2024, the original cost basis of our bitcoins was $68.4 million.

We view bitcoin as a reliable store of value and a compelling investment. We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability. Bitcoin is often compared to gold, which has been viewed as a dependable store of value throughout history. Gold’s value has appreciated substantially over time. For example, 25 years ago, the price of gold was approximately $500 per ounce. In 2024, the price of gold has traded higher than $2,400 per ounce. As of September 30, 2024, the total market capitalization of gold was approximately $18.0 trillion compared to approximately $1.3 trillion for bitcoin.” (Source: The SEC.)

12. QuantaFlo and the Medicare Advantage Fraud: How Flawed PAD Screenings Inflate Federal Payments

Semler Scientific, Matrix Medical Network, and Signify Health aggressively market QuantaFlo screening tests to Medicare Advantage patients, inflating the prevalence of hierarchical condition category (HCC) 108 to drive up federal reimbursements. Beyond the financial harm to Medicare, these actions burden patients with undue anxiety and waste vascular specialists’ already stretched resources with unnecessary visits and tests.

12.1. Negligence in Test Development and Deployment

Semler Scientific developed a flawed peripheral arterial disease (PAD) screening test without adhering to established statistical and mathematical methodologies.

Matrix Medical and Signify Health lease this faulty equipment and sells services that produce unreliable results to major Medicare insurers, artificially inflating risk adjustment factor (RAF) scores.

12.2. Systematic Overuse and Patient Misrepresentation

Matrix Medical’s network of 5,000 medical professionals failed to verify positive QuantaFlo results in patients without risk factors, symptoms, or physical signs of PAD—potentially due to financial incentives that reward the documentation of abnormal findings.

Patients are induced into participating through financial remuneration, further driving up false-positive rates.

Commercial insurers exploit these flawed screenings to justify excessive HCC 108 coding, leading to an estimated $1,000–$2,000 per patient per year in federal overpayments.

12.3. UnitedHealth’s QuantaFlo Playbook: A Case Study in Profit-Driven Diagnoses

A 2024 STAT News investigation revealed that UnitedHealth Group (the largest Medicare Advantage insurer) pressured its 90,000 affiliated physicians to use QuantaFlo to screen nearly all Medicare Advantage patients for PAD.

The device’s rapid results made mass testing feasible, even for asymptomatic seniors. Positive results were then recorded as formal diagnoses, artificially increasing risk scores. (Sources: STAT News, Lown Institute.)

The financial impact:

Each new PAD diagnosis boosted a patient’s risk score, increasing UnitedHealth’s annual Medicare payment by an estimated $3,600 per patient.

From 2018 to 2021, UnitedHealth added over 1.3 million PAD (or related vascular disease) diagnoses, translating to roughly $4B in additional federal reimbursements.

Adding a diagnosis of Peripheral Arterial Disease (PAD)—whether based on QuantaFlo measurements or any other method—was increasing the risk score, thereby generating thousands of dollars in extra revenue per patient for the insurance industry, regardless of whether the diagnosis was meaningful (acted upon) or merely a capture (for revenue).

The QuantaFlo case exemplifies the systemic exploitation of risk score coding in Medicare Advantage, where flawed diagnostic tools and aggressive screening mandates generate billions in unwarranted payments—at the expense of both taxpayers and genuine patient care.

13. Who’s Really to Blame for Upcoding Fraud?

Should Semler, Matrix Medical, and Signify be held responsible in the UnitedHealth fraud case? That’s definitely what UNH and the rest of the health insurance industry want you to believe.

But the truth is: UnitedHealth, Humana, and other payers are the ones liable for the diagnosis and for the upcoding, not the tool providers. (See Doctors Go to Jail. Engineers Don’t.) It’s no coincidence that UNH, Humana, Aetna, and BCBS have all chosen QuantaFlo as their diagnostic tool. After all, it’s in their absolute financial interest to use a tool with the highest false positive rate.

That said, Semler isn’t exactly innocent either.

Having health insurers—its key clients—on its board of directors is a glaring conflict of interest.

Also, Semler explicitly targets Medicare Advantage use cases for QuantaFlo. The company’s filings note that its primary market is health organizations with many Medicare patients, especially MA plans, and that its strategy is to license QuantaFlo to insurance plans and their providers. With tens of millions of Americans over 65, Semler touts the vast opportunity to screen for PAD in this population. The value proposition for insurers is clear: QuantaFlo can “assist doctors and other providers to suspect PAD” in an office or home visit, enabling more diagnoses to be captured under risk adjustment. Semler has acknowledged that the shift toward capitated, risk-adjusted payment models is beneficial for its business, since insurers are incentivized to identify every codifiable condition. As the company stated, “risk factor adjustments per patient provide payment that is higher for sicker patients who have conditions that are codified,” and it expected that trend in Medicare Advantage to “be mainly positive for our business”. (Source: The SEC.)

In short, both the device maker and insurers financially benefit when QuantaFlo finds more cases of PAD.

Semler Scientific should face scrutiny for marketing a device that fails standard validation criteria.

Matrix Medical Network and Signify Health benefit financially from upcoding fraud and should be investigated.

UnitedHealth, Aetna, Humana, and BCBS must be held accountable for knowingly inflating risk scores.

The DOJ has already launched an investigation into UnitedHealth, but the scope should extend to Semler and Matrix Medical.

14. Why Do Health Insurers Upcode If It’s Against the Law?

Of course, upcoding is illegal under the False Claims Act (FCA). So why have UNH and the rest of the industry been doing it? Simple: it’s just business. The legal and liability costs—running in the millions—are a drop in the bucket compared to the revenue—measured in billions.

Risk adjustment has been the primary revenue engine for Medicare Advantage insurers. Each patient is assigned a risk score, and if you’re a “skilled” (wink-wink) plan, you make sure to “capture” (i.e., upcode) everything.

Take UnitedHealth, for example. Its risk adjustment factor (RAF) of 1.2 is the highest in the industry. (Being king has its perks. 👑) Every additional decimal point in RAF (e.g., increasing from 1.0 to 1.1) can translate to as much as $2,800 in extra revenue per patient per year.

(Source: Guidehouse.)

15. Semler and Corrupt Wall Street

An estimated 5,000 to 10,000 sell-side analysts are believed to operate in the United States. Astonishingly, about 99% of them are deemed absolutely useless, producing “cookie-cutter” reports because that’s what they learned during the CFA (Chartered Financial Analyst) program—which, in my view, is a kind of “extortion” scheme, albeit a topic for a separate conversation. Over 90% of these analysts cherry-pick financial models and data that provide the best evidence for their Buy or Hold rating. They almost never produce a Sell rating because such a rating would raise eyebrows among their bosses and could get them fired.

So, they lie. It’s a pathetic way to make a living, but it’s a lucrative one.

Another reason for assigning Buy or Hold ratings is to please the management of the companies they cover. A Buy or even a Hold recommendation usually results in a pop in the stock price. If you give a Buy rating, company management might invite you to business meetings to offer you the “insights” they supposedly wouldn’t reveal to anyone else. And that’s another strong point for selling their “research”: “Look, I had a long meeting with the company CEO and boy, do I have a scoop for you.”

There is only one analyst covering SMLR—Brooks O’Neil of Lake Street Capital Markets—who appears to be completely in bed with company management, for reasons I outlined above. Even when PAD—the very reason Semler was founded—was removed from the Hierarchical Condition Category (HCC) and could no longer be used for risk adjustment, Mr. O’Neil still called SMLR “an attractive buying opportunity” in his research report on July 17, 2023.

No one can predict stock prices, but when your only product, QuantaFlo, is allegedly tied to an upcoding scheme and accounts for 97% of your revenue, you’d think there would be some mention of significant risk—not just a glowing “Buy” recommendation year after year.

Ironically, Wall Street analysts will keep screaming “Buy, Buy, Buy” even when they see the storm coming—because, in their world, that’s the best way to keep their job.

16. Conclusion: QuantaFlo Is a Fraud at a Multi-Billion Dollar Scale

QuantaFlo isn’t just a flawed medical device—it’s a key tool in an industry-wide fraud scheme. Medicare Advantage insurers use it to justify billions in fraudulent risk-adjusted payments, harming both taxpayers and patients.

Having a device optimized to game the system with an alarming 80% error rate—8X higher than the industry standard of 10%—is like playing with marked cards or a rigged roulette wheel in a casino.

Expect insurers to eventually scapegoat Semler Scientific if scrutiny intensifies, but the true masterminds—UnitedHealth, Aetna, Humana, and BCBS—continue to escape accountability.

While real web of potential fraud centers on QuantaFlo, Semler, Matrix Medical, and Signify Health, it’s a tangled mess—one that demands serious untangling.

The consequences of this diagnosis-incentive scheme are severe. Patients are burdened with exaggerated or unnecessary diagnoses. Insurers rake in inflated Medicare payments. Taxpayers foot the bill for billions in upcoding and other fraudulent schemes.

The question is: Will regulators finally catch up to Matrix, Signify, Semler, and the other culprits of the healthcare cartel, or will they once again turn a blind eye—letting this spiral into yet another financial crisis, this time in healthcare?

For those of you waiting for Part 2 of my investigation into Hippocratic AI—thank you for your patience. It will be out soon.

In Part 1, we uncovered how the healthcare VC mafia, led by its Godfather, Hemant Taneja, operates. We also explored how Hippocratic AI’s CEO, Munjal Shah, allegedly defrauded his business partners and was already pitching Hippocratic AI to VC bros before bankruptcy proceedings for his previous company, Health IQ, had even begun.

In Part 2, we’ll learn about the corrupt culture within Hippocratic AI, the reality of $45/hour human nurses chaperoning $9/hour Hippocratic AI nurses, and the glaring gaps in Hippocratic AI’s Polaris AI model—the so-called core of its agentic AI.

Stay tuned…

Acknowledgment: This article owes its clarity, polish, and sound judgement to the invaluable contributions of Rachel Tornheim.

Like what you’re reading in this newsletter? Want more in-depth investigations and research like this?

I’m committed to staying independent and unbiased—no sponsors, no advertisers. But that also means I’m a one-man operation with limited resources, and investigations like this take a tremendous amount of effort.

Consider becoming a Founding Member of AI Health Uncut and join the elite ranks of those already supporting me at the highest level of membership. As a Founding Member, you’re not just backing this work—you’re also helping cover access fees for those who can’t afford it, such as students and the unemployed.

You’ll be making a real impact, helping me continue to challenge the system and push for better outcomes in healthcare through AI, technology, policy, and beyond.

Thank you!

👉👉👉👉👉 Hi! My name is Sergei Polevikov. I’m an AI researcher and a healthcare AI startup founder. In my newsletter ‘AI Health Uncut,’ I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏

Sergei, You know I love your stuff. But I think you are missing a major aspect here that applies to worldwide health: people will run the system, any system, to maximize reimbursement. For example, there is nothing in the rules that says a person needs to be "suffering" from something to be paid if the diagnosis is legitimate. Heaven knows, the covid debacle showed that the government can decide to impact the lives of perfectly asymptomatic and well people by diagnosing them with a lab test. And the government did this to the tune of trillions of YOURS and MY dollars.

So if a health plan/medical practice reads the rules and says "if we can document this diagnosis using community standard tools we will make more money" this behavior is entirely to be expected. It is the behavior of all people in all circumstances for practical purposes.

I am a physician who has fought against many of these things for many years. I have worked in many countries and have discovered that the health cadence (e.g., number of visits for a diagnosis) is absolutely determined NOT by the disease but by the reimbursement for the disease. In EVERY case.

So it seems mildly disingenuous to now throw the book at United (and the others) for doing what could confidently be expected from a well run business. One can have many conversations about whether health care should be a business or whether it should be completely run by Florence Nightingales, but the fact that good businesspeople will use the rule sets they are given (setting aside any real fraud which does not seem the case here) to optimize things deserves less scorn than you attach here, I think.

But keep on piling on the HIT and H-AI vendors. That IS fraud and they deserve whatever you can find.