Optum's Telehealth Shutdown Is Just the Tip of the Iceberg

Telehealth is collapsing, but you already knew that.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

I’ve written four research articles on the telehealth industry:

✅ The Telehealth Masquerade: How Corporate ‘Geniuses’ Sold Us the 1876 Wine in a New Bottle. November 17, 2023.

✅ Digital Health 2024: 7 Predictions & 50 Names You Don’t Want to Miss. January 1, 2024.

✅ Livongo Killed Teladoc. February 21, 2024.

✅ Livongo Killed Teladoc, Part Two: CEO Out. April 8, 2024.

As I predicted in all these articles, telehealth, as we know it, is collapsing, with the market value of standalone telehealth products gradually moving to zero. I thought the death was going to be by a thousand paper cuts. However, things may be moving faster than I expected.

“As we know it” is a key phrase here. We’re witnessing one of the biggest transformations any industry has experienced.

The truth is that venture capital “sugar daddies”, the COVID pandemic, and the “zero interest rate policy” (ZIRP) all end at some point, and what’s left is the Emperor with no clothes.

Standalone telehealth has never been an innovation, and it never made a profit.

No patient wants to see a random doctor from the Amwell Medical Group network (yes, it’s a real thing!) every time they schedule a telehealth appointment.

I’ll be honest, I did not expect things to unfold so quickly. I actually had Amwell and Teladoc collapsing much quicker on my bingo card than Optum’s telehealth. I didn’t anticipate the collapse to happen during one of the Goldilocks periods in the U.S. economy, famously characterized by the three “3s”: 3.3% real GDP growth, 3.1% inflation rate, and 3.7% unemployment rate. Not to mention that the stock market is making new highs seemingly every week. I was actually waiting for some kind of market correction.

But if the telehealth collapse is unfolding during good economic times, it tells us things are bad.

Also, don’t believe anyone who says they can predict the timing of an event in financial markets. I’ve known plenty of people who have been predicting a market crash every year (which means that, historically, they were wrong 11 out of 12 years), and then the year we’ve had a market crash, they are all over the media being proclaimed as the next Nostradamus. 😉

So Why Is Optum Shutting Down Its Telehealth Business?

Optum is reportedly closing its telehealth business, known as Optum Virtual Care. (Sources: Endpoints, Becker’s Hospital Review, Business Insurance, PYMNTS, Seeking Alpha.)

The announcement came shortly after Optum employees started sharing on social media, beginning April 18, 2024, about a massive workforce reduction of 20,000 at Optum. Reports indicate that most, if not all, of these layoffs are within Optum Virtual Care. (Source: Becker’s Hospital Review.)

While there are numerous theories, it’s difficult to definitively state the exact reason for the closure. (For instance, there’s a notable article by Christina Farr, featuring insights from Rebecca Mitchell, MD, and Matt Sakumoto.)

Here are a few hypotheses of my own.

⚫ First, remember that this is one of the most challenging times for UnitedHealth, the parent company of Optum, in terms of scrutiny from the U.S. government.

1️⃣ This year, UnitedHealth faced not just one, but two unprecedented cyber attacks on its Change Healthcare payment system, compromising the Personal Health Information (PHI) of over 100 million Americans!

2️⃣ At the end of 2023, the Department of Justice (DOJ) filed an antitrust lawsuit against UnitedHealth.

3️⃣ UnitedHealth executives, including the CEO, were accused of insider trading. They allegedly sold over $100 million worth of UNH stock before the DOJ announcement went public.

Certainly, the financial health of Optum Virtual Care is a far cry from where it was at its launch in 2021 when they capitalized on people’s fear of COVID. By discontinuing telehealth services, perhaps UnitedHealth is attempting to argue that they are not a monopoly: “Do you think a monopoly would be losing money on such an important part of care as telehealth?”

⚫ Losing money while being one of the most powerful incumbents in the industry is a special skill, a testament to how outright poor Optum’s telehealth services are, as some providers have testified both privately and publicly.

“Product experiences matter, and Optum’s telehealth experience was quite awful, even for UHC members.” —Dan O’Neill.

⚫ As with Amwell and Teladoc, if your own doctor doesn’t use Optum, why would you, as a patient, choose telehealth with a random doctor? It’s important to note that nearly all of Optum’s 60,000 doctors joined the company through acquisitions. With the backing of one of the largest monopolies in the world, UnitedHealth Group, organic growth is not an option for Optum. Instead, they expand through acquisitions. When negotiating these acquisitions, which often resemble bullying as evidenced by numerous medical practices going bankrupt due to UnitedHealth’s failure to make payments, it’s likely that their Virtual Care is mentioned, but many doctors probably respond with, “Thanks, but no thanks. We already have telehealth.”

For all these reasons, there was no feasible way for Optum to scale its telehealth business profitably. This is likely why shutting it down was the only viable option.

However, this raises a question. With one of the most powerful lobbies in Washington, it’s peculiar that UnitedHealth has never acquired an EHR company with an existing telehealth solution. This is the direction telehealth is headed, whether we like it or not. Now, with the Feds scrutinizing their every move, UnitedHealth can’t currently afford to make any rash decisions, especially such big decision as an acquisition.

Regardless of the specific reasons behind Optum’s exit from telehealth, the general trend is evident: clinicians don’t need new apps, especially shitty apps. They would much prefer to stick with what’s already installed on their computers, which is usually a telehealth system provided by their EHR software.

If Optum, Teladoc, and Amwell Are Losing Money in Telehealth, Where Is the Telehealth Money Going?

In discussing the telehealth sector, it’s crucial to highlight the curious contrast between so-called market leaders like Teladoc and Amwell, and some lesser-known yet significant players. While Amwell and Teladoc often tout their telehealth solutions, which, frankly, are not much more than glorified phone calls, there are other companies in this space doing remarkable work, yet they barely get a mention. This oversight is particularly striking given that these companies, too, offer telehealth services.

The reason is because telehealth should be viewed as an integral component of comprehensive patient care, not as an isolated service. Comparing it to a stethoscope is apt. Sure, a stethoscope was a marvel to brag about a couple of centuries ago, but in today’s healthcare landscape, it’s just one of many tools. Similarly, telehealth is now a standard element of the patient care experience.

Therefore, most of these companies that provide a wide array of digital health and virtual care solutions don’t harp on about telehealth or the specific functions that Teladoc and Amwell emphasize. This approach is deliberate. They aim to be perceived by the market as sophisticated, all-encompassing medical care providers, rather than being pigeonholed into the narrow niche of telehealth. This strategy speaks volumes about their understanding of the healthcare industry and where it’s headed.

So, here are publicly traded companies that are using telehealth (as well as stethoscopes 😂):

📺 Privia Health (PRVA) - doesn’t even mention telehealth in its latest 10-Q. This is because telehealth is a natural part of the experience, whether it’s through Fee-For-Service (FFS) or Value-Based Care (VBC) primary care. It’s like mentioning that they do physicals and that they use a stethoscope to listen to patients’ hearts. Of course, they use telehealth! It’s part of healthcare, as it should be.

📺 Doximity (DOCS) - often dubbed the “LinkedIn for medical professionals”, boasts its dedicated telehealth platform, Doximity Dialer, with a user base nearing half a million. Here’s the kicker - in its latest 10-Q, telehealth gets zero mentions. That’s right, this company, sitting atop a digital goldmine of clinician-patient interactions, doesn’t even count telehealth as a revenue stream.

📺 GoodRx (GDRX) - mentions telehealth four times in its latest 10-Q and considers telehealth as the smallest source of revenue, after prescriptions/PBMs, Pharma manufacturer solutions, and Gold and Kroger Savings subscription offerings.

📺 Health Catalyst (HCAT) - never even mentions telehealth in its latest 10-Q report.

📺 Hims & Hers (HIMS) - they mention telehealth many times, but keep in mind that their definition of telehealth is much wider than that of Teladoc and Amwell. Remember the definition of telehealth by the Health Resources Services Administration (HRSA) I mentioned above? Well, Hims & Hers have most of that through their subscription service, but their main sources of revenue are actually selling prescription drugs, personal care products, hair loss products, sexual health products, birth control products, skin products, etc. So HIMS is not exactly a telehealth company in the traditional sense. In fact, in their latest 10-K report, they are cautious about the growth of their telehealth solutions, and it seems like business in general, expecting some of the COVID hype to slow down: “The COVID-19 pandemic has increased interest in and consumer use of telehealth solutions, including our platform, and we cannot guarantee that this increased interest will continue as the pandemic declines.”

📺 Phreesia (PHR) - a software company that automates patient intake and scheduling. Get this: they offer a solution called “Intake for Telehealth”, but not a single mention of telehealth in their latest 10-Q report, not one - because yes, patient intake sometimes follows by telehealth appointment. It’s obvious. There is no particular innovation here worth mentioning.

There are private companies in this space as well. Since I can’t find any information on their financials, I’m assuming, just like most telehealth companies, they are having financial challenges. But a few are worth mentioning:

📲 Premise Health - a private telehealth company with a platform called Premise Virtual backed by OMERS private equity. They don’t focus on “telehealth” in their marketing per se, instead emphasizing “whole-person care”.

📲 Curai Health, a San Francisco-based AI health startup, offers a virtual care platform used by Amazon Clinic, another telehealth service from the tech giant. Notably, Amazon Clinic operates on a cash-pay basis, contrasting with One Medical for Prime, which is accessible via membership.

📲 Included Health, another San Francisco-based company, has been a Walmart partner since 2016, initially as Doctor on Demand. Included Health emerged from the 2021 merger of Doctor on Demand and Grand Rounds, a digital second opinion company. Their collaboration dates back to 2016, starting with Doctor on Demand’s virtual urgent care services. In January 2020, they began a pilot program providing virtual primary care to employees in three states, expanding to 21 states by 2023. Included Health also offers mental health services and second opinions. This three-year, multi-state pilot with Walmart has yielded results deemed significant by executives.

📲 Andor Health, backed by M12, Microsoft’s venture fund, is delivering largely AI-driven virtual care.

However, the most obvious entity to which Optum, Teladoc and Amwell are losing money is your neighborhood EHR system, such as Epic’s MyChart.

Telehealth Market Financial Performance. (AKA the telehealth crash.)

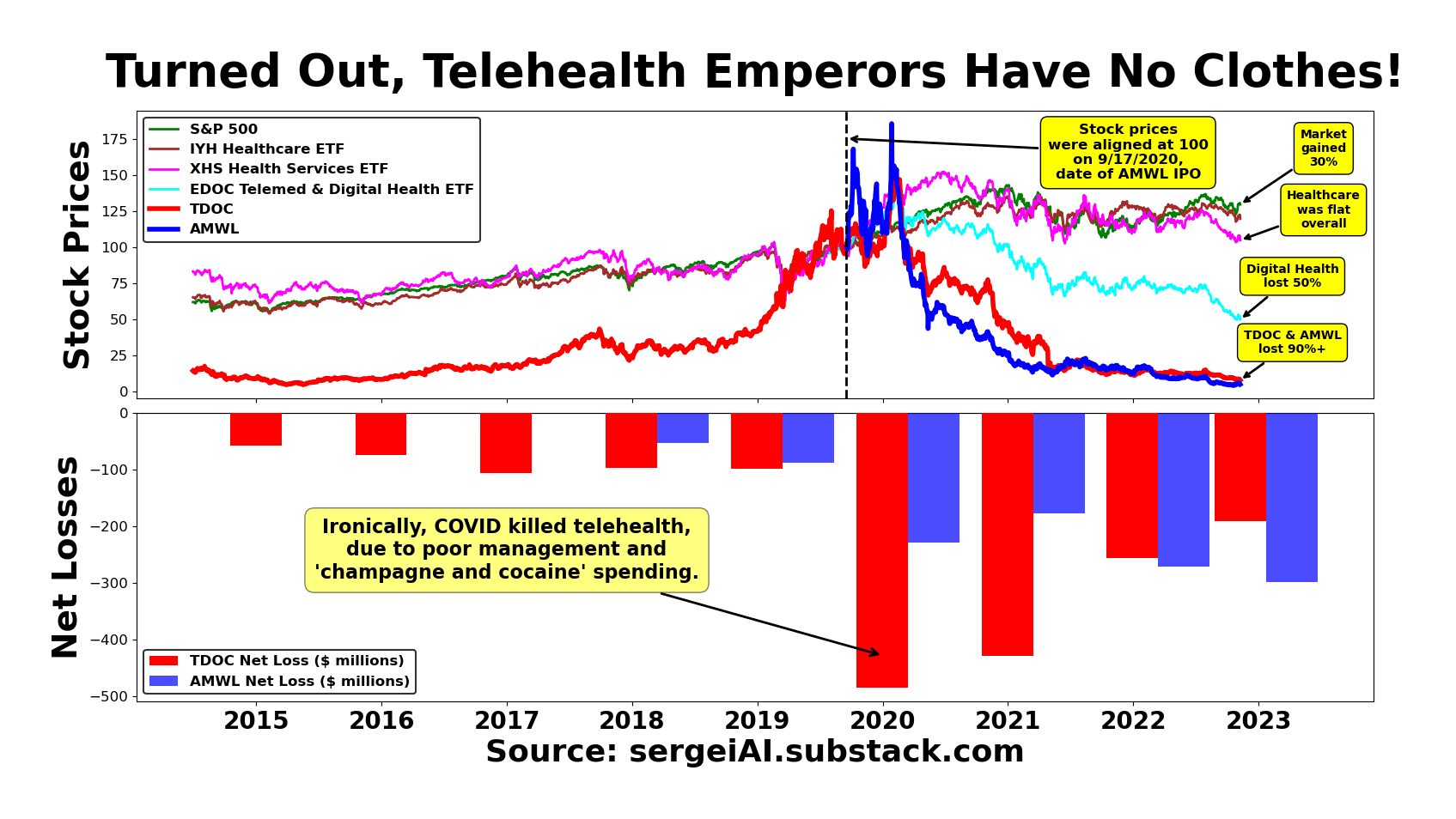

The first chart kicks off in 2015, when Teladoc went public. The index of 100 was aligned for every stock price on the chart to Amwell’s IPO date, September 17, 2020. Teladoc, never making profit since its launch in 2002, was cruising along until COVID hit. Suddenly, every telehealth stock was the new darling. But here’s the hard truth: there was no tech backbone robust enough for this surge. Teladoc and Amwell, in a frenzied ‘champagne and cocaine’ spending spree, threw money at everything - new platforms, staff, operations. The management of these companies was on a financial high, clueless on how to navigate. COVID, ironically their supposed savior, turned executioner. Telehealth overspent and overinvested, and now, as COVID subsides, the market has relegated them to mere shadows of their former glory. Since 2020, the market is up 40%, healthcare is flat, digital health halved its value, and Teladoc and Amwell? Nearly wiped out.

Zoom in on the second chart, aligning all stock prices at 100 at mid-2021. Telehealth initially boomed in 2020 and early 2021, but then the bottom fell out. In the past 2.5 years, the market’s flatlined. Digital health and health services bled out nearly 50% and 30%, respectively, and Amwell and Teladoc? Almost total losses. And who’s winning when everyone else is bleeding? The big insurance companies - UnitedHealth, Cigna, Elevance, Humana. They’re the fat cats, monopolizing profits. The rest? Scrambling for scraps. It’s a rigged game. The healthcare industry is catering to these giants, trying to optimize their systems, improve risk management, and innovate outdated EHR platforms. But these monopolies treat everyone else like second-class citizens. The healthcare industry is feasting on the leftovers from the healthcare cartel’s table.

What’s needed is disruption from outside, not from the inside, shaking these giants to their core. Until then, we’re stuck in this rigged cycle, as clear as day on these charts.

Let’s dissect another facet of Teladoc and Amwell’s stock performance: their wild volatility. It’s like watching a rollercoaster off its tracks compared to the rest of the market. These stocks don’t act like they belong to established companies. If you just glanced at their day-to-day market behavior, you’d bet they were either fledgling startups or on their last legs. That’s the alarming part – they behave like a business on the brink.

Remember Google’s IPO in 2004? Even as a fresh tech entity, its volatility was child’s play compared to this. Here’s the catch with Teladoc and Amwell: their stocks dance to the tune of short sellers. Market dips? Short sellers feast. On upbeat days, these stocks pop without news, classic ‘short squeeze’ scenarios. But this isn’t normal. It’s a red flag. When short sellers steer the ship, it’s rarely smooth sailing. This isn’t about fundamentals. It’s a speculative frenzy, and that’s hardly ever good news for any stock.

Conclusion

Optum’s decision to shut down its telehealth operations is just the tip of the iceberg of what appears to be a massive collapse of telehealth industry, as we know it.

The “champagne and cocaine” era of venture capital “sugar daddies”, the COVID-19 pandemic, and the “zero interest rate policy” (ZIRP) have all ended, which is particularly painful for the telehealth industry that struggled to turn a profit even during what could only be called the era of “easy money” for the U.S. economy.

Telehealth should be viewed as an integral component of comprehensive patient care, not as an isolated service. Comparing it to a stethoscope is apt. Sure, a stethoscope was a marvel to brag about a couple of centuries ago, but in today’s healthcare landscape, it’s just one of many tools. Similarly, telehealth is now a standard element of the patient care experience.

This is the reason why physicians are increasingly abandoning standalone telehealth services like Amwell and Teladoc and are instead integrating telehealth tools that are already available on their computers, such as EHR systems or Doximity. Doctors don’t want more apps, especially shitty apps. They want to focus on caring for their patients.

👉👉👉👉👉 Hi! My name is Sergei Polevikov. In my newsletter ‘AI Health Uncut’, I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏