Livongo Killed Teladoc, Part Two: CEO Out

[Not the "I told you so" edition. 😉] Once an uncontested leader in digital health, Teladoc Health continues to fall out of favor. This time, the board of Teladoc made its CEO the scapegoat.

On Friday, April 5, 2024, the board of Teladoc Health fired its CEO Jason Gorevic, making him the scapegoat for the underperforming stock price and for one of the largest tragedies in corporate finance history: the Teladoc-Livongo deal.

When the ship is sinking, the rats turn on each other.

In other words, in times of crisis, fingers start pointing. And the board is clearly pointing fingers at Mr. Gorevic.

The story from Teladoc’s board of directors is that Teladoc’s stock price dipped below its 2015 IPO price of $19 for the first time in 7 years on September 22, 2023. They argue that the company has lost value for its shareholders under CEO Jason Gorevic since it went public. However, the real story is that this is the board’s attempt to make Mr. Gorevic a scapegoat for the Livongo fiasco, particularly for making a shady deal with 7wireVentures VC firm.

The market clearly didn’t believe that story, as the stock price was subdued on Friday. This indicates that the blame for Teladoc’s failures is being placed by the stock market almost entirely on the board of directors and its chair, David B. Snow Jr.

It’s a sad day for many of us in digital health who consider Teladoc an industry pioneer.

Here is the outline of the article:

1. The Legacy of Jason Gorevic: The Good, the Bad, and the Unapologetically Ugly

2. Telehealth Market Financial Performance. (AKA the telehealth crash.)

3. Corrupt Wall Street Analysts. (The lies about TDOC, AMWL, and the rest of the telehealth market.)

4. I Told You So 😉

5. My Take

1. The Legacy of Jason Gorevic: The Good, the Bad, and the Unapologetically Ugly

Jason Gorevic’s legacy at Teladoc started 15 years ago when he took on the role of CEO in 2009. Teladoc was a clear leader in virtual care and the first to commercialize video calling in medicine. Gorevic steered the company through its IPO in 2015. That year, Teladoc reported $77 million in revenue. By 2023, the company’s revenue had grown to $2.6 billion.

However, the COVID pandemic, which initially seemed like a blessing in disguise for Teladoc, turned out to be a complete disaster. The company overspent and overinvested, making 2020 the worst year for Teladoc’s bottom line.

But the shady Livongo deal put a final nail in Teladoc’s coffin. 7wireVentures, the firm attempting to offload Livongo, a struggling platform, found Teladoc to be the willing party to accept the deal, albeit with heavy equity financing at the expense of existing Teladoc shareholders.

It turned out that what 7wireVentures was selling was a "lemon." The value of Livongo’s assets was written down to $1 billion from the roughly $15 billion 7wireVentures claimed it was worth at the time of the merger in 2020.

Teladoc has never made a profit since its inception in 2002. For 22 straight years, the company made a lot of money - billions, in recent years - and then burned through all this cash and more. As a result, the company, once valued at $42.6 billion, is now down to $2.4 billion and falling.

I’ve been listening to the February 20, 2024, annual earnings call. I didn’t appreciate Mr. Gorevic’s myriad of reasons for the poor earnings performance and low revenue guidance. He resorted to general phrases like "challenging macro-economic environment." Really? How come the Nasdaq keeps setting records in the same macro-economic environment?

Imagine what Mr. Gorevic’s legacy could have been if he had actually taken responsibility for his actions.

He never did, not even in his final statement on Friday.

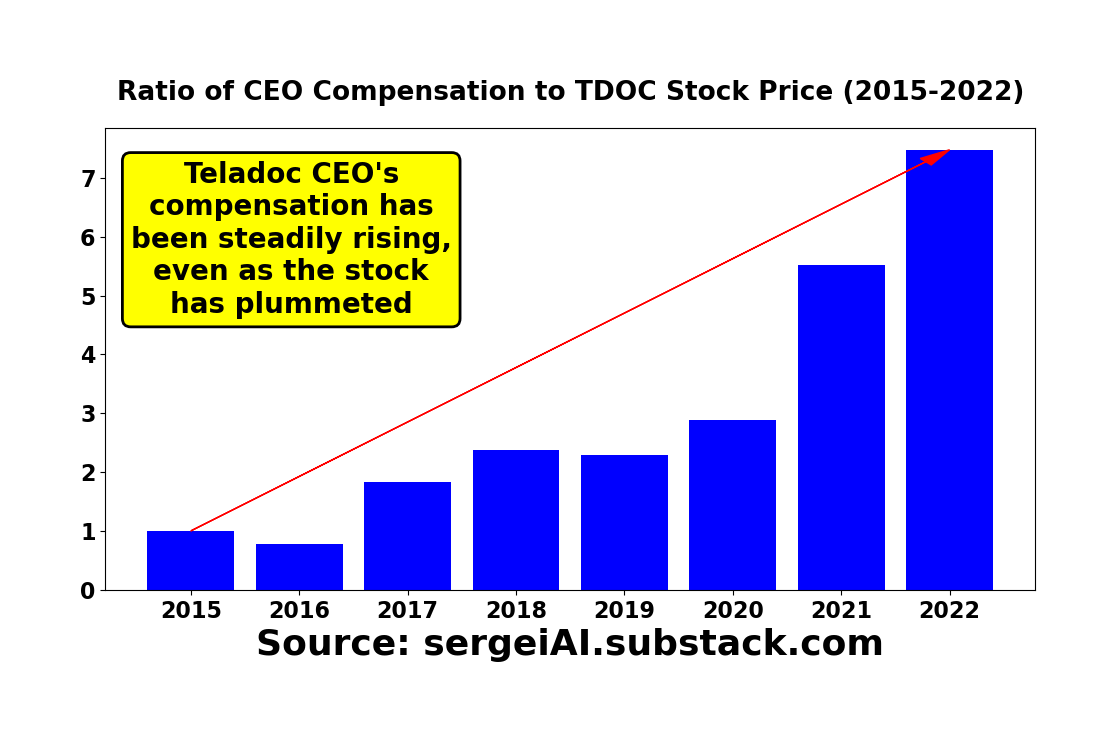

Mr. Gorevic has earned way over $100 million during his 15-year tenure as Teladoc’s CEO, including $45.5 million in 2020, the COVID year.

In the end, while Mr. Gorevic’s tenure at Teladoc was marked by both successes and failures, shareholders have lost out at a time when the broader stock market has been setting new highs.

2. Telehealth Market Financial Performance. (AKA the telehealth crash.)

This chart kicks off in 2015, when Teladoc went public. The index of 100 was aligned for every stock price on the chart to Amwell’s IPO date, September 17, 2020. Teladoc, never making profit since its launch in 2002, was cruising along until COVID hit. Suddenly, every telehealth stock was the new darling. But here’s the hard truth: there was no tech backbone robust enough for this surge. Teladoc and Amwell, in a frenzied ‘champagne and cocaine’ spending spree, threw money at everything - new platforms, staff, operations. The management of these companies was on a financial high, clueless on how to navigate. COVID, ironically their supposed savior, turned executioner. Telehealth overspent and overinvested, and now, as COVID subsides, the market has relegated them to mere shadows of their former glory. Since 2020, the market is up 40%, healthcare is flat, digital health halved its value, and Teladoc and Amwell? Nearly wiped out.

Zoom in on this next chart, aligning all stock prices at 100 at mid-2021. Telehealth initially boomed in 2020 and early 2021, but then the bottom fell out. In the past 2.5 years, the market’s flatlined. Digital health and health services bled out nearly 50% and 30%, respectively, and Amwell and Teladoc? Almost total losses. And who’s winning when everyone else is bleeding? The big insurance companies - UnitedHealth, Cigna, Elevance, Humana. They’re the fat cats, monopolizing profits. The rest? Scrambling for scraps. It’s a rigged game. The healthcare industry is catering to these giants, trying to optimize their systems, improve risk management, and innovate outdated EHR platforms. But these monopolies treat everyone else like second-class citizens. The healthcare industry is feasting on the leftovers from the healthcare cartel’s table.

What’s needed is disruption from outside, not from the inside, shaking these giants to their core. Until then, we’re stuck in this rigged cycle, as clear as day on these charts.

3. Corrupt Wall Street Analysts. (The lies about TDOC, AMWL, and the rest of the telehealth market.)

An estimated 5,000 to 10,000 sell-side analysts are believed to operate in the United States. Astonishingly, about 99% of them are deemed absolutely useless, producing “cookie-cutter” reports because that’s what they learned during the CFA (Chartered Financial Analyst) program—which, in my view, is a kind of “extortion” scheme, albeit a topic for a separate conversation. Over 90% of these analysts cherry-pick financial models and data that provide the best evidence for their Buy or Hold rating. They almost never produce a Sell rating because such a rating would raise eyebrows among their bosses and could get them fired.

So, they lie. It’s a pathetic way to make a living, but it’s an affluent one.

Another reason for assigning Buy or Hold ratings is to please the management of the companies they cover. A Buy or even a Hold recommendation usually results in a pop in the stock price. If you give a Buy rating, company management might invite you to business meetings to offer you the “insights” they supposedly wouldn’t reveal to anyone else. And that’s another strong point for selling their “research”: “Look, I had a long meeting with the company CEO and boy, do I have a scoop for you.”

Sure enough, as is almost always the case, Wall Street analysts persist in their rallying screams of "Buy Buy Buy", even in the wake of the Teladoc CEO’s departure. For example, in a research note on Friday, Bank of America analyst Allen Lutz remarked that Teladoc’s steadfastness on its Q1 and 2024 guidance "is an important positive as Teladoc makes this [leadership] transition." (Source: Fierce Healthcare.)

4. I Told You So 😉

As I highlighted in my three recent articles, “The Telehealth Masquerade: How Corporate ‘Geniuses’ Sold Us the 1876 Wine in a New Bottle” (published on November 17, 2023), “Digital Health 2024: 7 Predictions & 50 Names You Don’t Want to Miss” (published on January 1, 2024), and “Livongo Killed Teladoc” (published on February 21, 2024), the telehealth industry, as we have come to know it, is disappearing, along with its once towering giants, Teladoc and Amwell.

For the sake of Teladoc shareholders, I hope the incoming CEO will succeed in revitalizing the company and boosting its stock price. However, as I mentioned many times before, I have serious doubts.

Here is is a purely hypothetical scenario (and please do not regard this as investment advice!) meant to show that being short Teladoc (and indeed telehealth in general) and long a broad market index could have effectively offset the market risk and generated significant returns.

I want to emphasize: do not, under any circumstances, interpret my research as investment advice. Exercise caution in your investment decisions.

5. My Take

Jason Gorevic’s departure as Teladoc’s CEO marks the end of an era in digital health leadership. While Mr. Gorevic enjoyed early successes, he also faced monumental failures, including the Livongo debacle and the "champagne and cocaine" overspending/overinvestment during the COVID pandemic, which initially seemed like the best possible scenario for Teladoc.

I disagree with those who claim that hindsight is 20/20, particularly regarding the Livongo deal. When the Livongo deal was announced amidst the pandemic, many, if not most, in the medical community, along with just basic math, were opposed to the deal. Valuing Livongo at the same valuation as Teladoc itself and pursuing a leveraged buyout with a venture firm that had never before implemented a leveraged buyout (LBO) was highly questionable. Moreover, Livongo had a really bad reputation with both physicians and patients. Patients with diabetes received little benefit from Livongo. There were many red flags. So no, this isn’t a case of 20/20 hindsight. It’s just common sense.

Mr. Gorevic has also become a very wealthy man from his Teladoc paycheck, amassing well over $100 million during his tenure as Teladoc’s CEO. At 52, he is a young man who doesn’t need to work another day in his life. I hope he dedicates his life and wealth to good causes in healthcare.

We cannot overlook Teladoc’s board of directors and its chair, David B. Snow Jr. While the board is desperately trying to portray Mr. Gorevic as a scapegoat for all of Teladoc’s problems, it’s important to remember that Mr. Snow and some key board members have overseen every strategic decision and should absolutely share the blame.

It’s a sad day and the end of an era. But life goes on, and I’m optimistic about the future of innovation in digital health.

Disclaimer:

I don’t sell Teladoc Health’s stock short. Never have. I don’t own or long Teladoc Health’s stock. Never have. In fact, I currently don’t sell short or own any stock.

👉👉👉👉👉 Hi! My name is Sergei Polevikov. In my newsletter ‘AI Health Uncut’, I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏