The results are in, and they aren’t pretty.

Teladoc is slowly moving toward bankruptcy and is likely looking for a buyer. The “champagne and cocaine” era of COVID is over, and the Livongo leveraged buyout, pushed onto Teladoc management by the VC industry, was criminal towards TDOC shareholders.

As I mentioned in my recent telehealth industry review, the telehealth masquerade continues, and the value of standalone telehealth products is gradually moving to zero, as I predicted in my Digital Health 2024 overview. Unfortunately, the death is going to be by a thousand paper cuts. But the death is coming.

So What Happened?

Same sh*t. Teladoc reported annual earnings after the market closed yesterday, February 20, 2024. Very poor revenue guidance. But, as always, on the earnings call, CEO Jason Gorevic was desperately trying to spin the story. And of course, it’s never the management’s fault. According to Gorevic, 2023 experienced a “challenging macro-economic environment”. I almost choked when he said that. I was thinking to myself, “Dude, the macro-economic environment in 2023 is what kept your company afloat.” The moment it becomes challenging, you’d be talking bankruptcy.

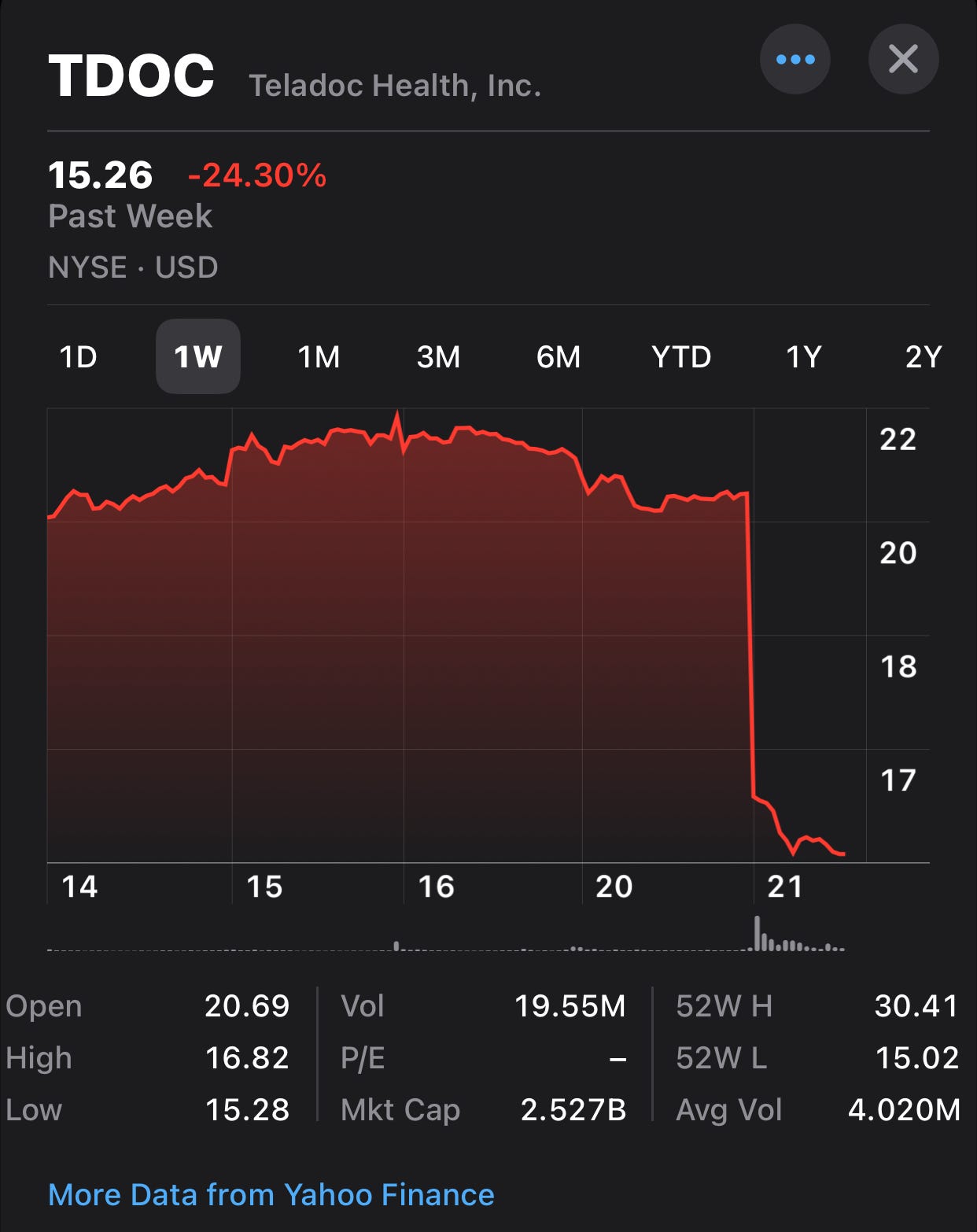

And of course, all 27 Teladoc’s “pocket” Wall Street analysts, who seemingly went to the Tucker Carlson school of softball journalism, were taking it on the chin. None of them would ever ask management hard questions because, as I explain below, their jobs literally depend on whether companies like Teladoc and Amwell are around. That’s why none of them, 0 out of 27, have a Sell recommendation. Their job is about creating a positive spin and inflating the stock price. But eventually, the lies catch up with them, and today is one of those times. The stock went down another 25% overnight and is now down 94% from the highest market value Teladoc ever recorded, $42.6 billion, on February 12, 2021.

Notice, among all this, turning to positive profit, like ever, is not even part of the conversation any longer. It’s all about trying to figure out where the revenue is going to come from.

Also note that all this is unfolding while the broader market is hitting historic highs almost daily. I believe this broad market rally is what’s keeping Teladoc afloat. But frankly, the moment there’s a market correction, we’re likely to be discussing bankruptcy prospects for both Teladoc and Livongo.

Let’s dive into the analysis and try to understand where Teladoc and the rest of the telehealth industry are heading.

Here is the outline:

1. Livongo: A “Lemon” Disguised as a Ferrari

2. Teladoc CEO’s Compensation Continues to Rise Despite Stock Price Volatility

3. What’s With “90 Million Members”?

4. If Teladoc and Amwell Are Losing Money in Telehealth, Where Is the Money Going?

5. Telehealth Market Financial Performance. (AKA the telehealth crash.)

6. Corrupt Wall Street Analysts. (The lies about TDOC, AMWL, and the rest of the telehealth market.)

7. What’s Going to Happen Next for Teladoc?

8. Conclusion

1. Livongo: A “Lemon” Disguised as a Ferrari

Teladoc was founded in 2002 with the grand vision that everyone should have the freedom to access the best healthcare anywhere in the world, on their own terms. The company quickly gained traction, attracting both customers and venture capital. However, achieving profitability proved challenging. Despite these financial hurdles, Teladoc went public in 2015 and continued to grow organically. Unfortunately, this growth was later hampered by a series of reckless management decisions.

Keep reading with a 7-day free trial

Subscribe to AI Health Uncut to keep reading this post and get 7 days of free access to the full post archives.