How Venture Capital Mass Murdered Digital Health Startups

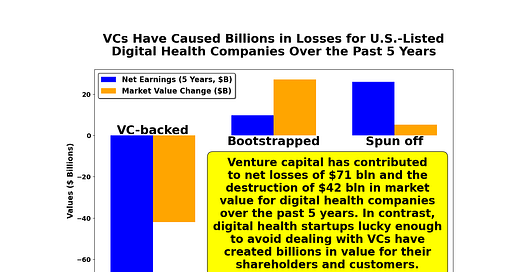

I investigate 132 U.S. publicly traded digital health companies—the largest sample of its kind. 92 were VC-backed and believed they had "made it." That is, until venture capital backstabbed them.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

This is the most comprehensive and detailed study of its kind.

Perhaps the “murder” theme isn’t the most well-timed, and for that, I apologize. But please remember—I’ve been immersed in this research for months and am eager to share it with you now that the results have been validated.

For those who’ve followed my work, you’ll know I’ve spent significant time dissecting the “pump and dump” schemes in venture capital. Until now, the bulk of my analysis has been laser-focused on the “pump” phase—examples abound here, here, here, here, and here.

But for the first time, I’m taking a hard look at the “dump” phase—the moment when digital health startups, drunk on the “champagne and cocaine” of inflated, often entirely fabricated private valuations, are shoved off a cliff into the icy waters of public markets by the same VC bros who were their “best buddies” just months before.

Leveraging this knowledge, I’ve recently introduced the 21-Step Health AI IPO Checklist: How to Spot the Next Unicorn or Sniff Out the Next Donkey—your guide to separating the hype from the harsh reality in healthcare AI landscape.

The irony is palpable: this article was agonizing to write as I witnessed the colossal damage venture capital has inflicted on the American healthcare system. Yet, it offers the simplest advice on how to invest in digital health and health AI companies:

If you want any chance of making money in publicly traded digital health companies, avoid those that were VC- or PE-funded before their IPO—at all costs.

That’s the bottom line. Plain and simple. But arriving at this conclusion took months of painstaking research and countless sleepless nights. I couldn’t believe the numbers I was uncovering, so I kept verifying, re-verifying, and then verifying again.

In the end, the truth was undeniable: the numbers don’t lie.

This brings us full circle to why venture capitalists never discuss their overall performance. Instead, they point to outliers with the fervor of carnival barkers: “Remember, I invested in Airbnb?” This is precisely why Forbes’ annual “Midas List”—allegedly a ranking of top VC funds—conspicuously avoids publishing any performance metrics. Not one. How pathetic is that? Hopefully, after reading this article, you’ll understand why.

Venture capital’s relentless imposition of the “cash burn” strategy on founders is not only impossible to “unlearn,” but it actively contributes to corporate deaths after IPOs.

As a token of my infinite gratitude—and a holiday gift to my paid subscribers—I’ve spent months scrutinizing every single VC-backed and non-VC-backed digital health company that made it to the IPO stage. This article is the culmination of that labor.

Ironically, this should have been their crowning moment—the time of their corporate lives. They had “made it.” According to their VC overlords, the IPO was the ultimate goal, the champagne-popping celebration of success. But instead, these companies—corrupted by venture capital’s destructive “champagne and cocaine” mentality—found themselves woefully unprepared for the disciplined, public-facing demands of life as a publicly traded company.

Many of these so-called success stories quickly filed for bankruptcy post-IPO. Others are languishing, underperforming so badly they’ve become cautionary tales. Why? Because their VC backers “dumped” them, either right before or shortly after the IPO, leaving these cash-bloated startups ill-equipped to survive the unforgiving reality of public markets.

But first, let’s pause for a moment. I have a personal confession to make…

My regular readers may have noticed my unusual silence during the uproar following the murder of the CEO of UnitedHealth's insurance business. Any TikToker would tell you this was the perfect moment for clickbait and subscriber grabs.

Instead, I chose to stay quiet—so quiet, in fact, that I’ve lost some of my paid subscribers over the past month. That said, I still have a loyal, intimate group of about 200 paid subscribers and 4,000 unpaid ones who, I hope, see the value in my research. I trust they’ll stick with me through thick and thin as we work toward a world where AI and technology deliver a seamless patient experience, and the bloodthirsty middlemen—venture capitalists, PBMs, and insurers—are rendered obsolete.

As I often tell my readers, and anyone else who will listen, I refuse to post just for the sake of it. If I have nothing valuable to add—nothing that would elevate the conversation beyond noise—I’d rather stay silent, especially when people are grieving the loss of a life. If daily posts are your expectation, then let me say it now: unsubscribe. Quality research, even in the age of AI, still requires time and thought.

This December, my silence wasn’t just about reflection—it was also personal. Two major developments have unfolded in my life. First, my mom visited from Europe. I hadn’t seen her in nearly three years. Second, I underwent knee surgery. I’m thrilled to report that both turned out to be successes. 😊

Here’s an example: my mom and I at Edisto Beach, SC. The beach was deserted, and for good reason—the water temperature was close to freezing. But my mom is a “polar bear.” I couldn’t drag her out of the water. And how did I end up joining her? Well, once you’re down to your swim trunks, you’ve got to take at least one plunge. And so I did. 😊

Here’s a shot of me before my knee surgery. I was all smiles then—not so much afterward. Recovery ain’t exactly fun, but the procedure was a success. Does this mean I should ease up on my criticism of the U.S. healthcare system? I think not. 😊

One more announcement: I’m about to explore something monumental that no one else seems to be tackling—the state of antitrust in the healthcare industry. Why have Lina Khan and other self-proclaimed antitrust trailblazers conveniently avoided addressing the breakup of UnitedHealth and other healthcare oligopolies? It’s a glaring issue, and I intend to find out why. Stay tuned.

Now, speaking of murder—in this research piece, I’ve undertaken the ambitious task of analyzing every publicly traded digital health company on U.S. exchanges over the past 5 years. That’s 132 companies: 13 dead and 119 still standing. My mission? To uncover the reasons behind their success—or more often, their death at the hands of VC bros.

The failures are where the real lessons lie. VC bros love to wave their shiny success stories in your face—“Look over here, not over there!”—but I refuse to be fooled. Survivorship bias is real, and I’ve taken care to “resurrect” the dead companies, painstakingly piecing together the stories behind their downfall. Don’t worry—I’m on it. 😉

If you make it to the Conclusion section, you’ll find my recommendations for fixing the broken financing system that continues to stifle competition and innovation in digital health. It’s time to build a system that prioritizes patients and the medical community over flashy but fleeting wins.

For my fellow data geeks, I’ve made the full Excel file—covering all 132 digital health companies—available here.

I took a close look at 132 publicly traded digital health companies.

To ground the analysis, I included a control sample of 40 non-VC-backed companies that went public. By comparing these with their VC-backed counterparts, I aimed to uncover meaningful insights.

This is the most comprehensive study of its kind—both in scope and cross-sectional sample size.

Frankly, I was tired of skeptics constantly asking me over and over, “Really? VCs are destroying digital health startups? You must be joking. Aren’t they providing the lifeblood—capital—for these startups? What are you even talking about?”

Well, I now have an answer—or at least one answer—and I’m working on uncovering more.

So, let’s get to it.

Here’s the TL;DR:

1. What Question Am I Asking In This Study?

2. Dataset

3. Six Key Results

4. Four Key Takeaways for Investors

5. Conclusion

Keep reading with a 7-day free trial

Subscribe to AI Health Uncut to keep reading this post and get 7 days of free access to the full post archives.