The AI Bubble? It's Really a Startup Bubble, and It's Popping Big Time

According to a new book by Dr. Jeffrey Funk, released on Amazon today.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

I usually don’t do promotions, but I’m making an exception here. I have a lot of respect for Dr. Jeffrey Funk, not only for his research but also for the daily knowledge he shares on LinkedIn. When he asked me to review his book, released on Amazon today, I didn’t hesitate to say yes.

I thought the best way to bring value to my readers would be to combine my observations on the AI bubble, particularly in healthcare, with Dr. Funk’s insights.

But first, a quick note.

🚨 Digital health event alert! My friend and colleague Alex Koshykov, the host of the popular Digital Health & Tech Innovation podcast, is embarking on a three-city tour with his talk, “Healthcare Meets AI: Understanding Implementation Complexities Through Practical Examples.” He’ll be in Philadelphia on October 22, New York City on October 23, and Washington D.C. on October 24 as part of the popular Health2Tech series. These events typically draw 70-100 industry professionals, including startup founders, clinicians, data scientists, engineers, investors, and students. I’ll be attending the NYC event. The event is free, but registration is required to get access to the venue. You can find the registration link here. Hope to see you there.

Now, let’s get into the meat of today’s story.

Here’s the TL;DR of this article:

1. My Take on Unicorns, Hype, and Bubbles by Dr. Jeffrey Funk

2. The Gartner Hype Cycle for Artificial Intelligence

3. The Big Startup Bubble

4. Are We in an AI Bubble? Buckle Up.

5. Tempus AI and Health AI Startups: Who Will Survive the AI Hype?

6. AI Copycats, Tech Parasites, and AI Tourism

7. How Dumb VC Money Burst the Big Startup Bubble

8. Healthcare’s Innovation Mirage: APIs Aren’t Breakthroughs

9. How VC Bros Use FOMO and the Wow! Factor to Push Lemons

10. VCs, Tech Bros, and the Fine Art of BS

11. The Myth of the Genius Entrepreneur

12. Conclusion

1. My Take on Unicorns, Hype, and Bubbles by Dr. Jeffrey Funk

Great book. Easy read. It’s 228 pages, but with a large font, the actual content is only 192 pages. The rest is notes and 307 (!) references, so you could finish it in just a few hours.

I think Dr. Funk’s book represents one of those instances where two people can conduct eerily similar research on the same topic, independently, and do a solid job of diagnosing industry problems while offering paths forward.

Where we differ is that I tend to jump deep into use cases and company insights (often drawn from anonymous sources), and I always back my arguments with graphs and charts. I know my readers are busy, and visualizing information is central to how I present my research and investigations.

Dr. Funk, on the other hand, doesn’t rely much on charts. But he is a remarkable storyteller. He expertly ties together the past, present, and future, and he’s meticulous with his references and citations. Without empirical evidence, it’s just “hysterics of an old woman,” as one of my friends once described my writing style. 😊

Some might call this book a pessimistic take on innovation. It’s hard to pin down exactly where it falls on the pessimism-realism spectrum because, let's be honest, no one—no one—knows the future, no matter how much they’re seen as the next Nostradamus.

The book’s value lies in its empirically grounded investigation into the hype and promises (what I call “pump-and-dump schemes”) relentlessly pushed by VC bros, tech bros, and corporations to sell their products and investments. These players have a very self-serving, biased view of things—and that’s dangerous.

This book is an excellent, well-referenced source for startup founders, investors, data scientists, engineers, policymakers, economists, and historians. I highly recommend it.

One critique I have is that while the book dives into use cases and practical experiences, it doesn’t spend enough time on the theory and economics of financial bubbles. For instance, numerous Ph.D. theses have been written on the “overreaction/underreaction” argument alone, and I wish Dr. Funk had explored that area more thoroughly.

2. The Gartner Hype Cycle for Artificial Intelligence

The Gartner Hype Cycle is a graphical representation that illustrates the maturity, adoption, and social application of emerging technologies. It comprises five key phases:

Innovation Trigger: A breakthrough, innovation, or technology creates significant interest and early proof-of-concept stories.

Peak of Inflated Expectations: Early publicity produces success stories—often accompanied by failures. Some companies take action; many do not.

Trough of Disillusionment: Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail.

Slope of Enlightenment: More instances of how the technology can benefit the enterprise start to crystallize, and become more widely understood.

Plateau of Productivity: Mainstream adoption starts to take off. The technology’s broad market applicability and relevance are clearly paying off.

Generative AI, encompassing technologies like GPT-3, GPT-4, DALL·E, and other advanced language and image generation models, has experienced a rapid surge in interest and investment. This technology has been at the forefront of discussions about AI’s potential to revolutionize industries ranging from content creation to customer service.

As of late 2023, Generative AI is perceived to be moving beyond the Peak of Inflated Expectations and entering the Trough of Disillusionment. This shift indicates that while the initial excitement highlighted the transformative possibilities of Generative AI, organizations are now confronting the practical challenges associated with its implementation.

Factors Contributing to the Shift:

Technical Limitations: Despite impressive capabilities, Generative AI models can produce incorrect or nonsensical outputs, raising concerns about reliability.

Ethical and Legal Considerations: Issues such as data privacy, intellectual property rights, and potential misuse have become more prominent.

Integration Challenges: Incorporating Generative AI into existing systems and workflows can be complex and resource-intensive.

Cost and Scalability: The computational resources required for training and deploying large models are significant, impacting scalability.

Generative AI is following a similar trajectory to other AI technologies like Knowledge Graphs, ModelOps, and Synthetic Data, which have also moved past the peak and are navigating the trough. These technologies initially garnered substantial hype but faced practical hurdles that tempered expectations.

Knowledge Graphs: After initial enthusiasm, organizations realized the challenges in data integration and maintenance.

ModelOps: The complexity of operationalizing AI models led to a reassessment of its immediate benefits.

Synthetic Data: While promising for augmenting datasets, concerns about data quality and representativeness emerged.

Entering the Trough of Disillusionment is a natural progression in the Hype Cycle and does not signify the end of a technology’s relevance. For Generative AI:

Refinement and Maturation: Ongoing research is addressing current limitations, improving model accuracy, and reducing biases.

Use Case Clarification: Organizations are identifying realistic applications where Generative AI adds genuine value.

Best Practices Development: As more implementations occur, best practices for integration and deployment are emerging.

Regulatory Frameworks: Developing guidelines and regulations will help navigate ethical and legal concerns.

It is expected that Generative AI will progress to the Slope of Enlightenment as these challenges are addressed, leading to more widespread and effective adoption.

Exactly like The Wizard of Oz. Follow the yellow brick road and hope it leads you somewhere meaningful. But spoiler alert: you’ll probably just end up pulling back the curtain on a tired old man with a megaphone, not the innovation (sorry, wizard) you imagined. Kind of like Amazon’s Just Walk Out, which is actually overseen by over 1,000 humans in India, or Tesla’s Optimus humanoid robots that are really controlled by humans. 😊

Speaking of the AI bubble and when it might burst, there’s a fantastic recent Substack article titled “When the AI Bubble Bursts” by my colleague James Wang, General Partner at Creative Ventures. With experience at both Bridgewater and Google X, James is an expert on AI, especially in the context of VC funding. I’m a subscriber and avid reader of his Substack newsletter, Weighty Thoughts, and I highly recommend you check it out as well.

3. The Big Startup Bubble

Dr. Funk’s book discusses the emergence of an “AI bubble” within the larger context of a big startup bubble, highlighting the significant losses incurred by many tech startups despite substantial venture capital (VC) investments. It emphasizes the initial hype surrounding technologies like artificial intelligence (AI), driverless vehicles, blockchain, and others, which were expected to revolutionize industries and generate massive wealth. However, the anticipated productivity gains and profits have not materialized for most startups, leading to skepticism about the sustainability of current investment practices.

The Big Startup Bubble and AI Hype:

Overvaluation and Losses: Many high-profile startups such as Uber, Lyft, WeWork, Pinterest, and Snapchat have consistently reported significant losses, with Uber’s cumulative losses exceeding $25 billion.

Unrealized Expectations: Technologies like AI, blockchain, virtual reality, and the Internet of Things were predicted to drive unprecedented productivity growth and wealth creation. This optimism fueled massive VC investments, reaching record highs between 2015 and 2019.

Unicorn Startups’ Performance: Over 90% of American “unicorns” (startups valued at $1 billion or more) were unprofitable in 2019 or 2020, even though many were founded over a decade ago. Similar trends are observed in Europe, India, and China.

Venture Capitalists’ Initial Hype and Recent Descent:

Low Returns on VC Investments: Returns on VC investments have fallen significantly over the past 20 years, barely matching public stock market indices.

Shift from IPOs to Acquisitions: Startups are increasingly being acquired rather than going public, resulting in lower returns for investors since acquisitions typically yield smaller profits than IPOs.

Shift from IPOs to Secondaries: In private deals, you can offload the lemon to the next unsuspecting buyer without public transparency. (Source: Bloomberg.)

Alarming Rate of Unprofitable IPOs: Dr. Jay Ritter at the University of Florida has shown that the percentage of startups profitable in the year before their IPO fell from 90% in 1980 to 12% in 2022.

Historic Low VC Funding: The declining profitability and returns have led to a decrease in VC funding, as investors become wary of the inflated valuations and lack of sustainable business models.

AI Bubble and Potential Burst:

Limited Technological Breakthroughs: Many startups have not introduced genuine breakthrough technologies, and the rapid improvements seen in previous tech eras are lacking in current AI developments.

Exaggerated Expectations: There is a growing concern that the hype around AI is not matched by its economic returns. For example, while OpenAI’s ChatGPT has garnered significant attention, the revenues generated are insufficient to offset the high operational costs.

Warnings from Analysts and Investors:

Jevons Paradox: Goldman Sachs and Sequoia Capital have raised concerns about the sustainability of the AI investment surge, suggesting that the technology may not generate enough revenue to justify the massive expenditures.

Potential Overinvestment: Predictions indicate that companies might overinvest in AI infrastructure without a clear path to profitability, similar to previous tech bubbles.

Healthcare Challenges:

Falling Valuations: Private valuations for the world’s 78 health unicorns fell by more than 40% between March 2022 and March 2023, indicating a significant loss of investor confidence in healthcare AI startups.

Decline in VC Funding: A noticeable decline in VC investments in digital health began in late 2022 and continued into 2023 and 2024.

Challenges in Monetization: Many health tech startups struggle to move beyond pilot programs into full-scale production, with only about 25% advancing past the initial stages due to high costs and integration challenges.

VC’s Funding Challenges:

Difficulties in Raising Funds: It has become 4(!) times harder for startups to raise Series B funding compared to previous years, with only about 9% of companies that raised Series A successfully securing Series B funding.

Networking Over Merit: The limited funding available is often funneled through established networks and connections rather than being based on the intrinsic merit of the startups, making it challenging for innovative but less-connected companies to secure investment.

Impact on Innovation: The reduction in funding and increased investor skepticism may stifle innovation, as startups struggle to find the necessary resources to develop and scale new technologies.

4. Are We in an AI Bubble? Buckle Up.

I’ve been trying to make sense of why AI startups turned IPO - Tempus AI, Zapata AI, and in fact,

All recent IPOs that have “AI” in either the name or the ticker - tank seemingly the moment they start trading.

Just look at the list of recent digital health startups turned IPO compiled by Blake Madden. It’s a bloodbath of red.

Add the following recent digital health companies to this list (Source: Halle Tecco):

👎 Science 37: -96.3% (valued at $1.05 billion at SPAC-managed IPO in October 2021, sold in January 2024 for $38 million to eMed, a vulture company preying on dead digital health companies, which also acquired the remains of Babylon Health out of bankruptcy for around $50 million in September 2023.)

👎 Invitae: -100% (filed for bankruptcy in February 2024)

👎 MedAvail: -100% (SPAC-managed IPO in November 2020, filed for bankruptcy in February 2024)

👎 Better Therapeutics: -100% (SPAC-managed IPO in October 2021, shut down in March 2024)

👍 BrightSpring (BTSG): +34.1% since its IPO on January 26, 2024

👍 Waystar (WAY): +30.6% since its IPO on June 7, 2024, seven months after acquiring the disgraced Olive AI’s assets.

👍 Tempus AI (TEM): +21.7% since its IPO on June 14, 2024 (after dropping 37.6% in the first 7 trading days—what a rollercoaster!).

While the last three have been a shining star, most of these digital health companies are a disaster unfolding, all while the broader market hits new highs almost daily!

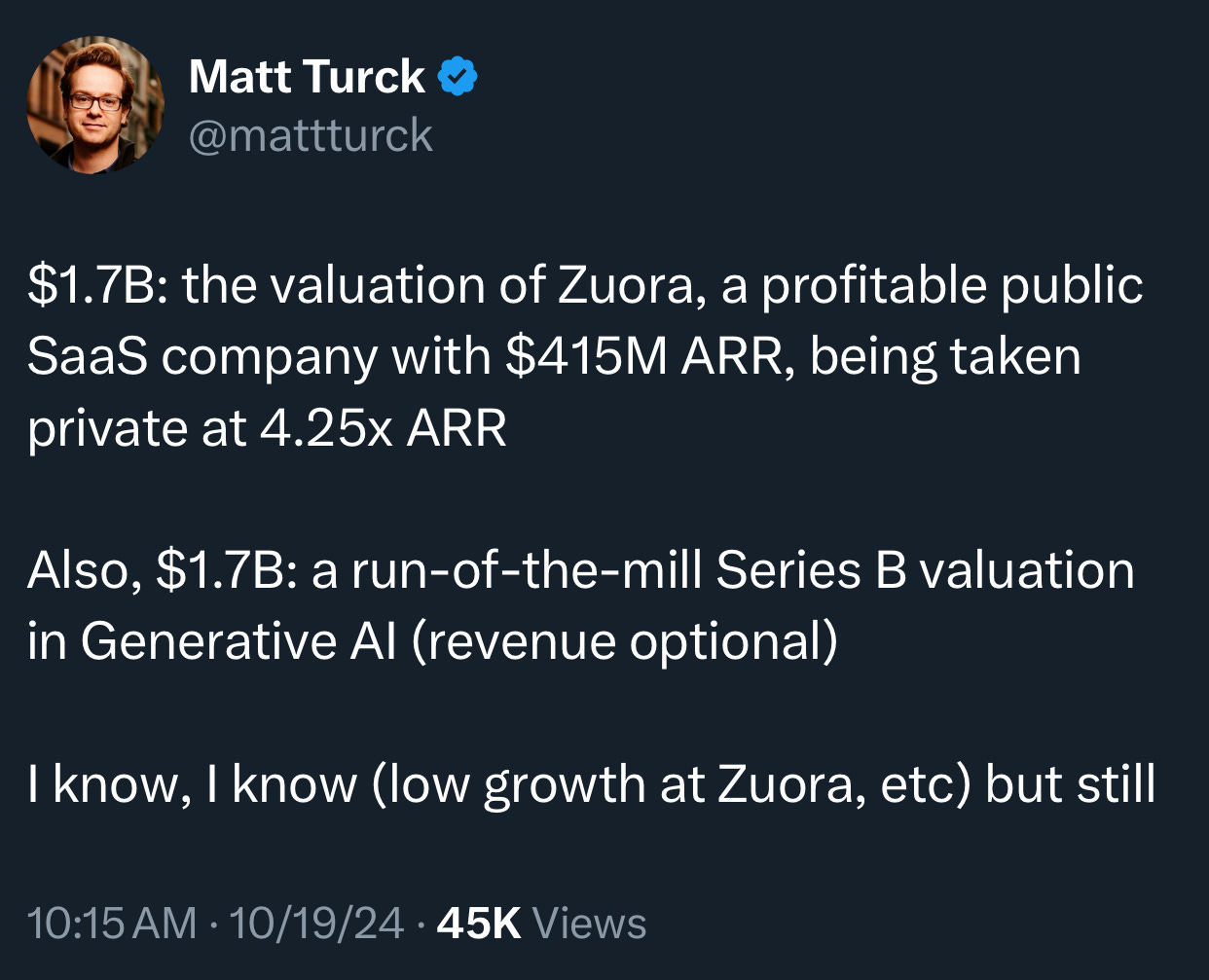

I’d like to address the related question of whether we’re in an AI Bubble, as many experts claim. Perhaps the answer to that question will help us address the dichotomy between the AI hype of GPU owners and the devastation of the AI startups.

Once Jensen Huang, CEO of Nvidia, started signing women’s chests like a 1980s rock star, it became official: we’re at the peak of the AI bubble. 😊 (Source: YouTube.)

Corporate media and experts have been sounding the alarm about the “AI bubble” for a while now. They not only agree we’re in a bubble, but many are also discussing the repercussions of its inevitable burst. (Sources: When the AI Bubble Bursts, by James Wong, Silicon Valley’s False Prophet, by Edward Zitron, Dr. Jeffrey Funk on LinkedIn.)

In his book, Dr. Jeffrey Funk argues that the story of unicorns is one of hype and bubbles, and of startups with big goals but no way to reach them. Many of these startups did not use new technologies and were thus destined to fail. Others used new technology but assumed the technologies would diffuse so fast that they didn’t need to think about the first users and applications. Dr. Funk highlights AI as a prime example of this misguided optimism.

VCs, and to some extent startup founders, also play a significant role in the story of tech unicorn bubbles. VCs create bubbles to enrich themselves at the expense of retail and angel investors. Plain and simple.

Back in the 1980s and 1990s, no respected venture capitalist, and certainly no respected investment bank, would take a tech company public if it was losing money. It was just unheard of. Today, especially in digital health, it’s rare to find a startup going IPO that is actually profitable. Dr. Jay Ritter at the University of Florida has shown that the percentage of startups profitable in the year before their IPO fell from 90% in 1980 to 12% in 2022.

The textbook definition of a bubble is when the price of an asset rises significantly over its intrinsic value, driven by exuberant market behavior and speculative activity.

That’s an awesome definition. But I still have no clue. Are we in an AI bubble?

If AI is a bubble, it looks different to me from the two bubbles I’ve lived through: the Dot-com Bubble of the late 1990s and the Housing Bubble of the mid-2000s.

🎈 In the Dot-com Bubble, all you needed for your startup or business to take off was to have “WWW” in its name. Everything even remotely Internet-related was skyrocketing. No fundamentals. No financials were ever looked at.

🎈 In the Housing Bubble, it was the same story. It wasn’t just about subprime mortgages. Real estate prices across the board were soaring due to low-interest rates and easy credit given to those who could never afford to pay it back.

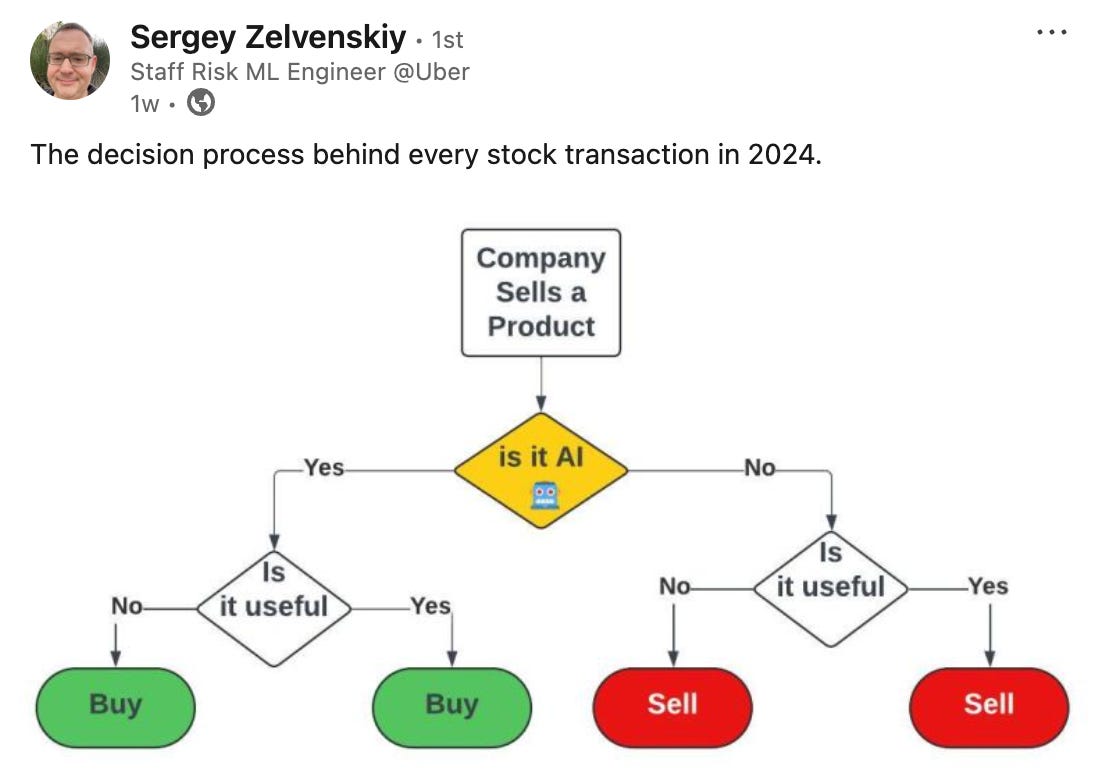

With AI, we see a rally in a handful of highly profitable companies. For those companies that have never had profit, mentioning “AI” has actually been their kryptonite.

Just look at this picture. It perfectly illustrates the dichotomy I’m talking about.

While merely mentioning AI has turned everything to gold for GPU owners, it’s been a kiss of death for AI startups that go public.

I’ve picked four startups here. These are the only startups that have gone public recently and either have “AI” in their name or their market ticker:

🤖 iLearningEngines (AILE)

🤖 Tempus AI (TEM)

🤖 c3.ai (AI)

🤖 Zapata AI (ZPTA)

3 out of 4 have lost significant value for their investors. In fact, Zapata AI was supposed to be the next big thing in quantum computing. Yet, less than 7 months after its IPO, it’s trading for pennies and counting its days to bankruptcy.

When do we know for sure if we’re in a bubble? We’ll know when a massive correction occurs. Until then, no one really knows. Everyone speculates.

So what will happen when the bubble bursts, given that the original inflation of the bubble was limited to a handful of companies that can seemingly withstand the burst, while the rest of the AI world never even experienced the initial “hypey” and “tulipy” phase of the bubble?

I don’t know. I guess we’ll wait and see.

5. Tempus AI and Health AI Startups: Who Will Survive the AI Hype?

Well, no one knows. But at least I can pretend that I know and try to speculate. 😉

So I thought it would be very interesting to run a horse race between three somewhat similar, but also different, companies: Babylon Health, Palantir, and Tempus AI.

🔷 Babylon Health: Just like Tempus AI, Babylon Health claimed to utilize advanced AI technologies to analyze healthcare data and provide actionable insights. They also claimed to employ AI for diagnosing diseases, recommending treatments, and predicting health outcomes, similar to how Tempus AI uses AI to personalize patient care through genomic and clinical data integration. Of course, as the world found out later, it was all smoke and mirrors.

🔷 Palantir: Just like Tempus AI, Palantir specializes in aggregating and analyzing vast amounts of data using AI. Palantir’s platforms, such as Foundry and Gotham, integrate data from disparate sources to generate insights.

Why these three? Well, because all three fit roughly the same profile at their IPO date: they gathered billions from VC bros, then quickly burned those billions (and more), never turned a profit, had some big-name VCs and other investors, and were all about AI.

One of them ended up allegedly defrauding investors and customers and filed for bankruptcy only 19 months after its IPO. The other one eventually became scalable, profitable, and gained over 400% in market value.

So by comparing the notes across the three companies, we may get an idea of what could happen to Tempus AI.

In my recent research article, I presented the 21-criteria Health AI IPO Checklist, using Babylon Health, Palantir, and Tempus AI as examples.

6. AI Copycats, Tech Parasites, and AI Tourism

Since the 2010s, we’ve seen thousands of startups with one simple mission: “repackage” new tech, slap on a fresh coat of paint, and present it as revolutionary.

Launching an AI startup today is pretty much a rinse-and-repeat process. Step 1: Pick a buzzy name like Zapier. Step 2: Plug into the OpenAI API. No need to tell your VC—don’t waste their time with trivial things like, oh, the fact that your entire product is built on someone else’s work. Step 3: Burn through their cash. When it all falls apart (because it was never a real company), blame it on “market conditions” and hit them up for more funding.

This isn’t unique to one corner of tech—it’s the playbook for digital health. Dr. Funk labels these startups “copycats,” others refer to them as “tourist AI engineers,” but I’ll call them what they really are: “tech parasites.” In my two-part series, These 14 Health AI Companies Have Been Lying About What Their AI Can Do, I break down how 14 digital health companies have deceived the public and gotten rich quick in the process.

In his book, Jeffrey Funk contends that many of the successful technologies from the 2010s—such as OLED displays, solar cells, electric vehicles, mRNA vaccines, and Big Data/AI—do not match the transformative impact of the technologies they replaced. For example, while OLEDs are slightly better than LCDs, the improvement is minor compared to the significant leap from CRTs to LCDs. Electric vehicles offer marginal benefits over internal combustion engines but haven’t revolutionized society like Henry Ford’s automobiles did. Similarly, mRNA vaccines, despite their rapid development and benefits, don’t equate to the paradigm shift brought about by vaccine technology introduced 70 years ago. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, pages 33-34.)

He further argues that these technologies have been highly unprofitable because they didn’t provide value exceeding their costs. One reason is the lack of experimentation with different designs, customer bases, and business models—a strategy less prevalent today due to an obsession with growth. Funk emphasizes that selecting promising business opportunities and engaging in experimentation are key to increasing productivity and generating higher revenue per employee. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, page 39.)

7. How Dumb VC Money Burst the Big Startup Bubble

Venture capitalists are a unique breed. Many have never been entrepreneurs—they haven’t tasted the failures, rejections, and gut-wrenching rebuilds that come with owning a business. Yet, they’re the ones steering the AI and tech revolution. It’s no surprise that venture capital returns have hit rock bottom, the lowest since the industry’s inception nearly 80 years ago.

“One reason today’s VCs and founders aren’t doing well is because they are copycats, all funding the same type of startup, often funding multiple ones doing the same thing. The result is there have been more than ten startups funded to develop each of ride hailing, food delivery, crypto, peer-to-peer loans, and buy-now-pay-later businesses. As Albert Einstein apocryphally said, ‘Insanity is doing the same thing over and over and expecting a different result.’”—Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, page 37.

Copycats, tech parasites, AI tourism, and outright plagiarism are the reasons behind the near extinction of IPOs and unicorns this year, especially in digital health. 2023 and 2024 stand as historically low years for public listings. VCs might inflate private valuations with a clique of their “VC bros,” but they’re fully aware that exposing these “lemons” to the scrutiny of millions of public investors would likely drive prices straight to zero.

So, what’s the VC’s next move? Secondary markets. According to Bloomberg’s Ed Ludlow, secondary markets have become “more liquid,” while Mitchell Green, founder and managing partner of Edge Capital, points out that startups’ reluctance to IPO is “100% facilitated by large secondaries.” Why are secondary markets becoming more popular than IPOs among VC bros? Simple. In private deals, you can offload the lemon to the next unsuspecting buyer without public transparency. (Source: Bloomberg.)

Private financing is Craigslist. IPOs are Kelly’s Blue Book. Which one do you think offers a more accurate price for your car?

The bottom line: VCs don’t care if the startup is a lemon or a breakthrough. As long as there’s an exit, they cash in either way.

Dr. Funk points out that VC funds charge fixed fees that allow them to profit even if their startups fail, leading to a lack of due diligence. A Harvard Business Review article titled “Venture Capitalists Get Paid Well to Lose Money” explains how VCs take a percentage of the funds raised from investors as their profits, which reduces their incentive to make good investments. These fixed fees encourage VCs to raise large amounts of money and hire people skilled at fundraising and spinning narratives.

VCs convinced not only investors but also cities, states, and countries that startups were key to economic growth. They crafted narratives about new business models emphasizing rapid growth, often embellished through close relationships with the media. As startup shares rose, validating these narratives, it became easier to persuade the media. Even after substantial losses were identified, VCs skillfully convinced the media that this was normal—citing examples like Amazon, which succeeded after years of losses.

The VCs’ success in raising money complemented founders who were prone to hype their personal capabilities. An empirical analysis concluded that “acting like an expert even without experience can help secure venture capital funding.” This mutual hype, combined with abundant funding, led to larger funding rounds and wealthier founders, who became hard to remove due to being flush with cash. Part of this arrangement was that VCs pushed a “growth at all costs” approach on startups, making it more difficult for them to become profitable. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, page 38.)

8. Healthcare’s Innovation Mirage: APIs Aren’t Breakthroughs

Healthcare is lagging behind other industries in digital tech by nearly two decades. Sure, we’ve seen breakthroughs in drug discovery, like DeepMind’s AlphaFold—recently spotlighted by Nobel Prize-winning AI researchers—but outside of biotech and genome research, the pace of innovation in areas like primary care, medical diagnosis, and treatment has been sluggish at best. I’ve discussed this digital health innovation drought before, and it shows no signs of a breakthrough.

Healthcare has long been the lowest spender on information technology, primarily due to poor incentives that fail to benefit individual doctors or hospitals directly. As Clayton Christensen noted in The Innovator’s Prescription, it would be “an extraordinarily selfless act” for independent physicians to adopt electronic health records (EHRs) that primarily aid other clinicians. Robert Wachter, M.D. further observed in The Digital Doctor that replacing trusted paper systems with complex health information systems (HIS) wasn’t a priority for most physicians.

The digitization efforts have led to multiple, disparate databases for scheduling, insurance, payments, and patient records. This fragmentation forces doctors and nurses to spend excessive time navigating outdated systems, detracting from patient care. Despite their resources, Big Tech companies have not solved this problem. Their attempts—such as Microsoft HealthVault, Google Health, Apple HealthKit, and Amazon’s Haven—focused on creating new databases or leveraging their core businesses rather than integrating existing systems to reduce staff workload.

Startups, flush with over $40 billion in venture funding in 2021, have similarly fallen short by addressing only fragments of the broken system. They offer telehealth services when most care occurs in person, provide direct payment solutions in an insurance-dominated market, and target the “worried well” instead of patients with acute, complex needs. Even when they tackle significant issues, like addiction through digital therapeutics, they often rely on unproven methods. Many solutions were only pertinent during the pandemic, failing to offer lasting impact.

Dr. Oliver Kharraz aptly compares this approach to treating symptoms rather than curing the disease: “It is tempting to fix the symptoms, but ultimately, we must address the underlying cause.” The lack of substantive progress is evident, with only 1 of 17 publicly traded healthcare unicorn startups turning a profit in 2022—a profit some attribute to accounting irregularities. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, pages 59-60.)

The healthcare industry faces a vast and complex problem that requires holistic solutions. The current focus on APIs and fragmented innovations amounts to an innovation mirage. These are not the breakthroughs the industry needs. Both startups and tech giants must move beyond piecemeal attempts and address the fundamental challenges to effect real change.

9. How VC Bros Use FOMO and the Wow! Factor to Push Lemons

Dr. Jeffrey Funk critiques how venture capitalists (VCs) leverage the Fear of Missing Out (FOMO) and the “Wow! Factor” to promote startups offering sh*tty products. The “Wow! Factor” emphasizes ambitious goals without detailing practical methods to achieve them. For instance, VCs claim that ride-sharing will eliminate all private cars and parking lots, freeing millions of acres of space. They assert that cloud kitchens will replace traditional restaurants because people are too busy or affluent to cook for themselves. Neo-banks are promoted as replacements for traditional banks by eliminating physical branches, and algorithms are touted to make better financial decisions than humans. Cryptocurrencies are presented as a means to prevent central banks from causing inflation, and telehealth is suggested to render in-person doctor visits unnecessary.

Funding and high valuations are often misrepresented as measures of success for these startups, overshadowing profits or customer satisfaction. Terms like “unicorn,” “decacorn,” and “hectocorn” describe startups valued at over $1 billion, $10 billion, and $100 billion, respectively. These valuations largely reflect the amount of money raised rather than actual performance, demonstrating how inputs are often confused with outputs. VCs use these inflated valuations to avoid addressing issues of profitability and traditional performance metrics. Instead, they appeal to investors’ FOMO by promoting the notion that we are living in “the most innovative era in human history,” where economic details are deemed less important.

The abundance of capital and the increasing number of hedge funds, angel investors, and other influential players have led to a unique situation among the wealthy: a competition to give away money. A small number of top firms typically secure the most promising investments, intensifying the pressure and urgency for other investors. This environment has led to what insiders describe as “insanity,” with fundraising rounds so large that there’s “no conceivable use for the capital.” Whispers of concern have emerged among VCs and entrepreneurs alike, acknowledging the unsustainable nature of this frenzy.

VCs have raised record amounts of money by reducing minimum investment thresholds, widening their net of potential investors, and creating markets for pre-IPO shares in privately held startups. While this approach was wildly successful in attracting funds, many insiders voiced concerns. If things went poorly for these startups, none of the numerous investors would step up to help because “no single investor cares enough.” This sentiment reflects a lack of accountability and support within the investment community, where everyone assumes someone else will take responsibility. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, pages 66-68.)

The reality is that many investors are more interested in getting in early to profit by encouraging “greater fools” to invest later. (Your classic VC pump-and-dump scheme.) In this narrative, losses don’t matter as long as the initial investors can exit profitably. This strategy raises ethical concerns, as it involves promoting investments that may not be viable to less informed investors. Startups like Party Round have even developed tools to help other startups easily raise money from personal networks, including family members, former co-workers, and acquaintances. This exploitation of FOMO extends the investment frenzy to friends and family, further fueling the cycle.

Dr. Funk draws parallels to the adage, “Repeat a lie often enough and it becomes the truth,” illustrating how persistent hype can influence and corrupt public opinion. This mantra indicates how the internet and social media can be used to sway large numbers of people, especially when the message is positive or promises to improve lives. By spending significant resources on websites and influencers, VCs and startups can convince huge audiences of their viewpoint, feeding into the neuroses of those experiencing FOMO.

Consultants often reinforce this hype, echoing much of the business school mantra because many hold MBAs themselves. They repeat stories of rapid technological adoption and the frequent failure of incumbents, sometimes stemming from a strong belief that new technologies will conquer existing markets. These narratives create fear among potential clients—that without consultant expertise, they might become cautionary tales studied in prestigious MBA programs. The biggest fear among consultants, however, is that the failure of so many hyped innovations will reduce the demand for their services. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, pages 156-8.)

10. VCs, Tech Bros, and the Fine Art of BS

Jeffrey Funk delves into how venture capitalists (VCs) and influential tech figures—or “tech bros” like Marc Andreessen, Jack Dorsey, Sam Altman, Mark Zuckerberg, and Elon Musk—master the fine art of manipulating media narratives to hype their investments and technologies. Firms like Andreessen Horowitz are portrayed as “media companies that monetize through VC,” employing strategies such as selling op-eds to prestigious outlets like The Wall Street Journal, hosting exclusive events for favored reporters, and promoting founders as “geniuses” and “rockstars.”

This orchestrated hype contributes to the creation of numerous micro-bubbles within the tech industry. The mythos surrounding these VCs and tech bros began to unravel in the late 2010s as significant losses from companies like Uber, WeWork, and other SoftBank investments came to light. These losses exposed the shaky foundations of the narratives that had been aggressively marketed to both investors and the public. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, page 68.)

Funk argues that these tech leaders aim to control industry narratives to stay in the limelight and suppress logical critiques of technological evolution. This environment allows them to promote themselves and their ventures at the expense of sound investment principles. He warns that investors and innovators must guard against these “false prophets” and instead focus on logical analysis to achieve genuine success, rather than being swayed by the pervasive but often misleading hype engineered by VCs and tech bros mastering the fine art of BS. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, pages 160-1.)

11. The Myth of the Genius Entrepreneur

Venture capitalists (VCs) and the media have perpetuated the myth of the genius entrepreneur, contributing to irrational exuberance in the startup sector. By spotlighting young founders as prodigies—such as those featured in Forbes’ “30 Under 30” list, which included individuals later indicted for fraud, such as Charlie Javice, Sam Bankman-Fried, and Martin ‘Pharma Bro’ Shkreli—the focus shifted away from the fundamental economics of their businesses.

Speaking of Forbes, I recently dug into their absurd "Midas List." It’s a superficial ranking of VC firms, built on all the wrong metrics—unicorn investments, fund size—basically, everything that props up their bias. But the one thing that actually matters—VC fund performance (hello!)—is nowhere to be found. Forbes has become less of a revolving door and more of an open gate. Anyone can stroll in and out, and the credibility walks right out with them.

Critics argue that many celebrated entrepreneurs are disorganized and lack the capability to solve real societal problems. A social media executive noted that discussions about potential CEOs were like “fantasy-baseball,” with ideas being “thrown at the wall.” Andrew Orlowski of The Telegraph took the criticism further, describing disruption by startups and VCs as “nothing more than a QAnon-like cult.” He added, “SoftBank’s Son and other Big Beasts of Venture Capital would announce an apparently random and inscrutable investment in a new startup, creating an astronomical valuation.”

Satirical portrayals like the TV series Silicon Valley highlight these exaggerations, though some industry insiders dismiss them as mere clichés. However, these clichés reflect the nature of bubbles and irrational enthusiasm. Founders are glorified on the way up and vilified on the way down, a cycle that harms the industry and misleads investors.

The bubble was inflated over years and is now being dismantled in some sectors while still growing in others. Recovery from such bubbles can take a long time; it took Silicon Valley ten years to recover from the dot-com crash, and it may take longer this time.

Multiple parties share the blame—from VCs and founders to the media and universities. There’s an overemphasis on personality and style rather than on rigorous economic analysis that illuminates industry trade-offs and technological progress. When substantive analysis is lacking, superficial factors become the dominant narrative.

Despite known losses, hype for startups and VCs continued through the 2010s, with funding only starting to decline in 2022 and VC fundraising in 2023. The adulation of founders and the promotion of entrepreneurship by various institutions have fueled this hype.

The key lesson for rational innovators and investors is not to buy into the startup sector’s propaganda. True success requires careful planning, experimentation, and sound economic analysis—not reliance on the myth of the genius founder. Hype distracts from critical issues that determine a venture’s viability. Investors and innovators should focus on tangible factors contributing to sustainable success, looking beyond the facade of brilliance. (Source: Jeffrey Funk (October 22, 2024). Unicorns, hype, and bubbles: How to spot and exploit investment fads. Harriman House, pages page 69, 71, 72, 73, 78, 79.)

12. Conclusion

Unicorns, Hype, and Bubbles by Dr. Jeffrey Funk is, in my opinion, a gem of a book. It offers a balanced and realistic view of technological inventions and tech copycats. Whether you’re an investor or a founder, Dr. Funk provides an empirically supported framework to assess ideas and inventions, using historical lessons to avoid falling into hypes or bubbles. The consequences of a bubble burst can be devastating for business owners and customers, while VCs and tech bros often manage to slip away just in time.

I highly recommend Dr. Funk’s book. If you enjoy his insights (and I believe you will), you’ll definitely appreciate my Substack newsletter as well. The shared knowledge and added value from both sources are undeniable. 😉

I also analyze the AI hype infecting the digital health space, calling out the AI copycats, tech parasites, and the wave of AI tourists looking to cash in without adding value. The lack of innovation in digital health, fueled by the incompetence of VC bros and the overconfidence of tech bros, has led to the devastating mass destruction of digital health startups, including those that brand themselves as AI companies.

Considering the stark contrast between the AI hype from GPU owners and the collapse of many AI startups, my conclusion is that the AI bubble has already begun to burst. Time will tell…

👉👉👉👉👉 Hi! My name is Sergei Polevikov. In my newsletter ‘AI Health Uncut’, I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏