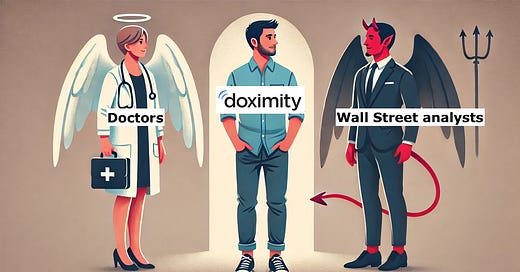

Doximity: Wall Street's Pariah, Doctors' Darling

Once again, Wall Street analysts have proven they're as useless as Diet Coke at an all-you-can-eat buffet.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

As you probably know, Doximity (DOCS), the “LinkedIn for medical professionals,” crushed it on Friday. The stock delivered its highest one-day return in its 3-year history since going public on June 24, 2021, skyrocketing by 39% in a single day! It obliterated “analysts’” expectations, smashing both last quarter’s financials and forward guidance. (Sources: Yahoo Finance, MarketWatch, Seeking Alpha, Investing.com.)

In just one day, DOCS blew past the entire range of analysts’ target prices, rendering every single one of these 12 “analysts” absolutely useless!

My readers know I’ve been bullish on Doximity for a while. On November 17, 2023, I said,

“The rapid advancements in tech are rendering these basic telehealth models obsolete. Providers can now effortlessly launch their own telehealth services using the tools they already have on their desktop or phone, like Doximity or EHR systems.”

On February 21, 2024, I added,

“Patients and physicians appreciate convenience. They don’t want to create new accounts for the same telehealth services they already use within their Doximity or Epic MyChart accounts.”

And on May 6, 2024, I stated,

“Standalone telehealth on a bad app with a random doctor is not a sustainable strategy. That’s bad news for Teladoc Health and Amwell, but great news for companies like Doximity and Epic.”

I tossed a few of Doximity’s so-called competitors onto a 1-year performance chart. Let’s be real though. Doximity is in a league of its own when it comes to medical communication, and it’s been quietly kicking the teeth out of everyone in telehealth—probably without even breaking a sweat. 😊

But let’s be clear. DOCS isn’t basking in the COVID-induced glow anymore. That $19 billion market cap high on September 10, 2021? Total fever dream. Now it’s more like $7 billion. But unlike the rest of the digital health industry, Doximity has been slicing costs with surgical precision, carries zero debt, and has been stacking profits for years. Wait, are we sure we’re still talking about digital health? What?

Doximity is a standout in the digital health space. It’s worth taking a deep dive into what makes Doximity special and dissecting why Wall Street analysts consistently fumble their recommendations—not just for Doximity, but across the board.

I’m about to show you some jaw-dropping performance numbers for every single publicly traded company—28,114 in the U.S. and 63,785 globally.

Spoiler alert: From 1926 to 2020, the data reveals that dart-throwing monkeys have consistently outperformed stock market analysts in predicting market outcomes.

If you think that’s a joke, it’s not.

I’ll break down why, and we’ll also explore a couple of Doximity’s latest key products:

Keep reading with a 7-day free trial

Subscribe to AI Health Uncut to keep reading this post and get 7 days of free access to the full post archives.