"We Bought a Hospital We Couldn't Afford": General Catalyst Becomes General Hospital

If someone, other than Houdini, has $1 billion and decides to buy something for $2 billion, the math simply doesn't add up. Aside from this, General Catalyst is saying all the right things.

If someone, other than Houdini, has $1 billion and decides to buy something for $2 billion, the math simply doesn’t add up. Aside from this, General Catalyst is saying all the right things about what it plans to do with the hospital. However, in a leveraged buyout, things could go south, and it might be the bank, not the venture capital firm, that ends up owning the hospital.

Imagine you have $1 billion and create a separate ‘shell’ entity mainly to acquire a hospital. This shell company won’t have $1 billion. Let’s say it has $0.5 billion. It wants to purchase a hospital valued at $10 billion for $2 billion, and, surprisingly, the hospital agrees. It’s an excellent deal, but the shell company still doesn’t have the money.

This is an oversimplification, but the essence remains: General Catalyst (GC), a venture capital firm, recently announced the acquisition of Summa Health, a hospital system, through its shell company HATCo, reportedly for $1 to $3 billion – funds it doesn’t have. (As they say in the private equity biz, “it’s a shell game.”) Whether GC obtained the rest of the money from a bank, another financing method, a group of investors, or some agreement with Summa Health (prompting the question, “Why are you being so generous to a VC firm?”), the fact is GC is now highly leveraged. GC’s entire business proposition hinges on this hospital. If the hospital thrives, so does GC. If it fails, GC faces bankruptcy. To clarify, this discussion concerns General Catalyst the company, not General Catalyst the portfolio. The failure of this hospital would be catastrophic regardless of the portfolio’s diversification.

But let’s start at the beginning. A few months ago, General Catalyst, a venture fund with $25 billion in assets under management (AUM), announced its intention to acquire a hospital. Everyone was like, “Yeah, right,” which is a normal reaction to something that has never happened before. But GC said, “No, no, we’re serious, and to prove we’re serious, we’re going to create another company. We like hats, so we called it HATCo.” Sure enough, two days ago, General Catalyst announced that HATCo had bought the Ohio-based Summa Health hospital system for reportedly “$1-$3 billion,” pending regulatory approval. (Sources: Forbes 1, Forbes 2, Axios 1, Axios 2, Med City News, Fierce Healthcare, Healthcare Dive, Becker’s Hospital Review.)

I won’t rehash all the news stories on this topic. A simple search for “General Catalyst Summa Health” will yield numerous similar articles.

The deal is indeed unprecedented. A VC firm has never before bought a U.S. health system, though there are some parallels outside the country, such as the Samsung hospital in South Korea.(Source: Med City News.)

What these stories failed to mention (as media reporting has seemingly become a “copy and paste” business) is that General Catalyst doesn’t have “$1 to $3 billion”, and HATCo likely doesn’t even have $500 million. Hence, the additional funds must come from elsewhere. They probably secured favorable financing terms. Nonetheless, until the debt is cleared – a challenge given GC’s promise of no cost-cutting – it might be the bank, rather than the venture capital firm, that effectively owns the hospital.

Summa Health Finances

Fortunately, we have comprehensive knowledge about Summa Health’s finances. Being a tax-exempt 501(c) organization, it is required to file Form 990 with the IRS.

Summa Health is expected to generate $1.8 billion in revenue in 2023 and to incur expenses of $1.9 billion. It has $1.8 billion in assets and $1.3 billion in debt.

The Math Doesn’t Add Up

In over two dozen articles breaking this story in the last 48 hours, I have not seen a single clear explanation of how exactly the deal is going to be financed. Not. A. Single. One.

Here’s the simple math. (I know GC the business and GC the fund are seemingly two separate entities, but please bear with me.) The entire GC fund is only $25 billion in assets under management (AUM). There’s no rational way, even if the firm was extremely successful and somehow magically retained all its earnings, that GC would have much more than $1 billion in assets on its own books. This suggests that HATCo would have something much smaller than that.

Now, even if HATCo is paying 1x Summa’s revenue, i.e., $1.8 billion, it might seem like a great deal for HATCo, hypothetically.

However, with a $1.8 billion price tag, that would result in a very leveraged buyout. I know venture capitalists are risk-takers, but this is something else. I hope it doesn’t lead HATCo, and GC with it, down a detrimental path. Historically, leveraged buyouts don’t end well.

If You Think General Catalyst’s Limited Partners and the Private Companies GC Holds Aren’t Affected, Think Again

So, if my math is right, General Catalyst is essentially becoming General Hospital. You can’t tell me that the GC portfolio is separate from all this, and that GC investors are safe. They are not.

General Catalyst is now a leveraged company, meaning that if something bad happens to Summa, that same bad happens to General Catalyst. And if GC goes bankrupt, guess what? The GC portfolio would have to be dissolved - all $25 billion, not just the $1 billion GC would’ve owed, for example. In other words, the GC portfolio would be sold at a ‘fire sale.’ I went through a ‘normal’ private equity sale, not a ‘fire sale,’ and it was brutal. If you think there is a secondary market for private equity assets, think again. The liquidity is drier than the New Mexico desert. There are just no buyers. So be ready to receive $5-10 billion for something that was worth $25 billion literally weeks before that.

In this adverse scenario, not only would investors (limited partners) lose money, but the underlying holdings - i.e., all those great digital health companies GC owns - would also be drastically marked down.

No one is talking about this very possible scenario. But I think it’s very real.

GC’s Fiduciary Duty

If my math is right and General Catalyst does need to borrow funds to finance the Summa Health deal, the “no disclosure” policy regarding the terms of the deal is bullshit. It is a direct responsibility and fiduciary duty of GC to inform its investors and the companies in its portfolio about the exact terms of the deal.

Positives

✅ This deal is a bellwether of a VC’s aptitude to transform an industry that’s long proved resistant to Silicon Valley’s move-fast-and-break-things zeal for disruption. (Source: Axios 1.)

✅ Summa’s integrated delivery structure gives General Catalyst a chance to incentivize preventive, lower-cost care even as it makes money. (Source: Axios 2.)

✅ Summa has been a non-profit - believe it or not, in the healthcare industry, it’s much better than being for-profit. As a 501(c) organization, its goal is to break even. To its credit, Summa has successfully achieved this, offering a breath of fresh air in an industry where almost everyone is losing, except for big health insurance, big PBM, and big EHR.

✅ If $2 billion is the price GC paid, it’s an incredible valuation for a break-even company, which in a sane world is probably worth at least $10 billion. This kind of deal just doesn’t happen in healthcare these days. I’m sure that was exactly the argument GC used with its lenders. Need proof? CVS paid $10.6 billion for Oak Street, a primary care company with $2 billion in revenue and $0.5 billion in net losses! CVS now seemingly regrets the Oak Street acquisition. It turns out primary care is hard. (Source: Sergei Polevikov on LinkedIn.)

✅ Value-based care is a key part of General Catalyst’s investment thesis for healthcare. (Source: Med City News.)

✅ Better technology solutions are needed to enhance patient care and boost health system efficiency. (Source: Med City News.)

✅ The digital health startups in GC’s portfolio will benefit from incentive-aligned, long-term pilots as well as ready access to training data and clinical expertise. They will also have a testing and development site. (Source: Med City News.)

✅ There is an opportunity to innovate and reshape care delivery, an area riddled with issues and ripe for disruption. Numerous point solution pilots may end up disrupting clinical and administrative workflows at Summa. (Source: Med City News.)

✅ It would be interesting to see if digital health startups with pilots at Summa hospitals can be successful at other health systems that are not financially aligned with them in the same way. (Source: Med City News.)

✅ Summa Health plans to own an EHR platform (watch out, Epic!) - interoperability was one of the reasons HATCo was created. This could be interesting. Expect pressure from Epic in Washington to ensure that Summa’s EHR complies with both HIPAA and the 2009 HITECH Act.

Negatives

❌ Unfortunately, there is a history of private equity firms overtaking and restricting hospitals at the expense of quality of care and to the detriment of the patients. (Sources: JAMA, Health Exec, Advisory Board.) Of course, General Catalyst announced from the get-go that this is not “another ‘private equity’ deal”. (Source: General Catalyst.) However, it may actually be more complicated than a typical private equity deal, as this could be a leveraged private equity deal.

❌ GC may be shifting the health system’s focus from patient-centric care to profit maximization, which could potentially undermine care quality and accessibility. (Source: Med City News.)

❌ There is significant capital and operational outlay required to manage the health system. (Source: Med City News.)

❌ As part of the deal, HATCo will pay down $800 million of Summa’s total $1.3 billion in debt. (Source: Cleveland.com.)

❌ HATCo would continue the system’s existing charity care commitment, which in 2022 came as $210 million in community benefit. While it’s commendable that they are committed to charity, this could strain the hospital’s finances. (Source: Fierce Healthcare.)

❌ Summa Health is keeping its current executives, including CEO Cliff Deveny, and none of Summa Health’s 8,500 employees would be let go. While this is great news for the hospital and its employees, it raises questions about how GC could afford all this. (Source: Fierce Healthcare.)

🚨 So, how can General Catalyst afford all this?

How Can General Catalyst Afford All This?

Although everything appears beneficial for the patient on paper, it’s challenging to see how this deal will be financially viable.

General Catalyst’s leaders appear to follow their business school lessons to the letter: if someone offers a low-PE deal, take it and ask questions later. So they have embraced this deal like kids in a candy store, fully living in the moment.

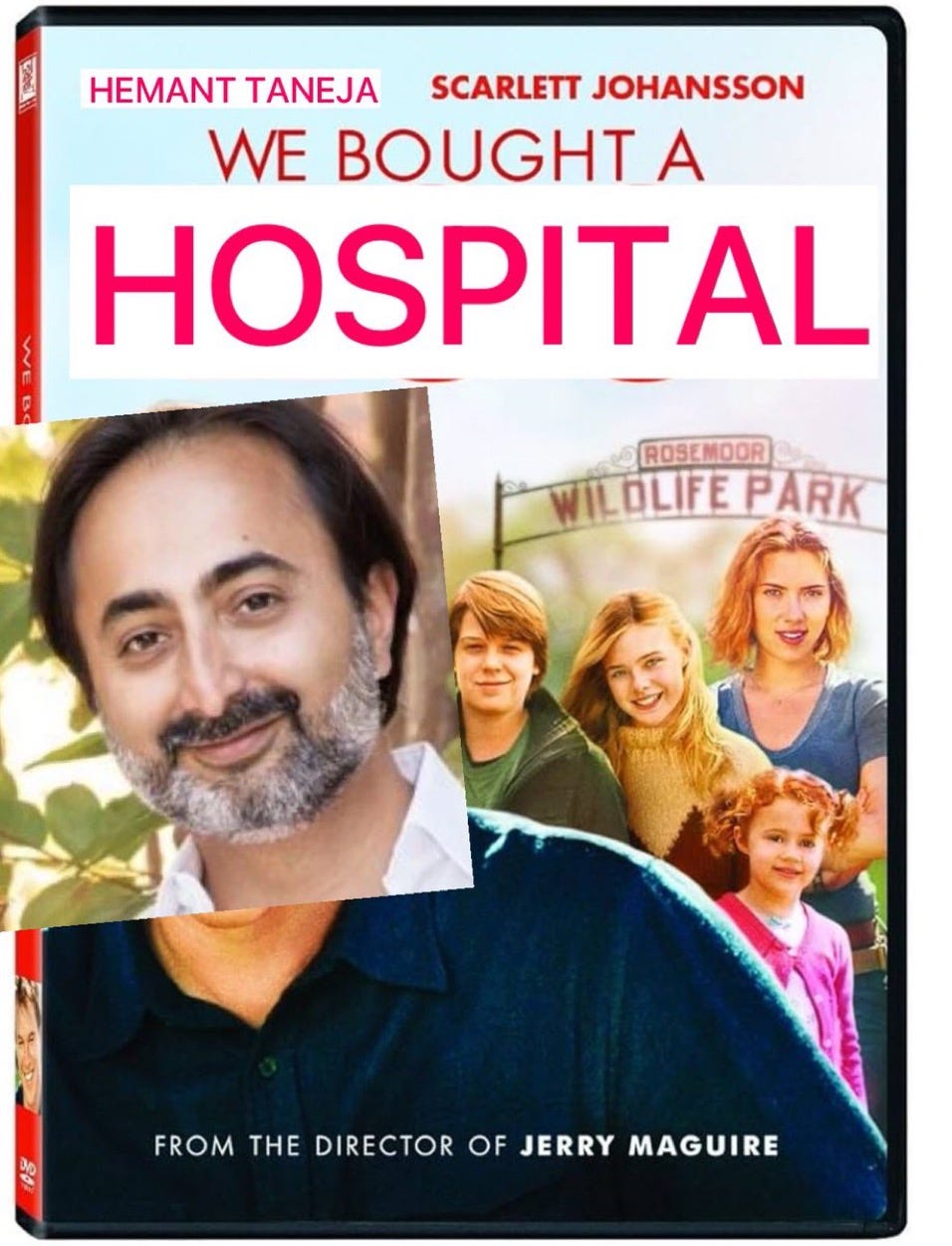

General Catalyst has stated they are not a typical profit-maximizing private equity firm. In a joint blog, Hemant Taneja, CEO of General Catalyst, and Marc Harrison, CEO of HATCo, emphasized their partnership with Summa Health as a ‘fundamentally different kind of partnership and approach in several ways’. They stressed that their focus isn’t on cutting costs, but on putting innovation in. This commitment includes retaining all jobs at Summa Health, including those of the 50 executives, maintaining Summa’s $210 million per year charity program, and assuming Summa’s $800 million debt burden. (Source: General Catalyst, Chief Healthcare Executive, Becker’s Hospital Review.)

Making profits through innovation… It’s adorable, but it suggests that General Catalyst and HATCo have no concrete plan. Those working for Summa Health should be concerned.

One thing is certain: if HATCo were publicly traded, both its stock price and General Catalyst’s would likely have experienced a double-digit decline. The stock market penalizes uncertainty and indecisiveness.

I believe that vowing to leave the cost structure of Summa Health intact is a noble public announcement that could potentially ruin Summa Health and, like a house of cards, also ruin HATCo, General Catalyst, GC’s portfolio companies, GC’s investors, and the investors of GC’s portfolio companies. As mentioned earlier, borrowing heavily puts a multitude of people and entities at risk.

At a minimum, HATCo owes these stakeholders due diligence in reviewing Summa Health’s compensation and administrative costs.

1️⃣ Executive compensation: According to W-2 and 1099 forms, the 50 executives at Summa Health are being paid more than $18 million per year, with CEO Clifford Deveny’s salary at $2 million. While it may not be the $1 billion paycheck of Cigna’s CEO, one must question the necessity of having all 50 executives on the payroll.

2️⃣ Administrative costs: General Catalyst and HATCo might consider taking a page from the playbook of another Ohio hospital system in Cleveland, 40 miles from Akron, called University Hospitals. Five years ago, University Hospitals set a strategic goal to achieve ‘Medicare Breakeven,’ aiming to align their costs with Medicare’s reimbursement rates. To achieve this, they eliminated 450 administrative jobs and reduced costs by $250 million per year by the end of 2023. No total jobs were eliminated, only administrative ones. University Hospitals continues to hire for clinical positions, such as nurses and doctors, aiming to deliver high-quality and cost-effective care. (Source: Eric Bricker, MD on YouTube.)

Perhaps General Catalyst bought the wrong Ohio hospital? 😏

Regulatory Scrutiny

It’s interesting that just two months ago, the FTC blocked a much smaller $142.5 million hospital takeover. On November 17, 2023, the FTC, along with the State of California, sued to block John Muir Health’s proposed acquisition of Tenet’s remaining interest in San Ramon Medical Center. The FTC’s complaint alleged that the deal would drive up healthcare costs and eliminate competition to improve services. (Sources: FTC, National Law Review.)

The Summa Health deal is a little different. It’s not horizontal integration. However, General Catalyst would have to provide valid proof to the FTC that patients will be protected and prices won’t increase.

Along with antitrust agencies becoming more aggressive in general, nonprofits have faced notable scrutiny while transitioning to for-profit companies. (Sources: Healthcare Dive 1, Healthcare Dive 2.)

We shall see.

Teladoc-Livongo: A Textbook Lesson of How Not to Do a Leveraged Buyout

It may not be the best comparison, but it conveys the real risk of a leveraged buyout.

Teladoc’s acquisition of Livongo is a compelling cautionary tale of how not to do acquisitions.

Livongo had no real technology, the management was far from understanding the reality of the business, and, most importantly, physicians hated the product. Despite this, Teladoc went ahead and paid $18.5 billion for Livongo, a sum Teladoc was never even close to having (the picture above speaks louder than a thousand words). At the time, Teladoc had a total of $2 billion in assets. Post-acquisition, it added roughly $15 billion in Livongo-related ‘goodwill’ - i.e., the self-proclaimed value of Livongo’s “know-how”, boosting its assets from roughly $2 billion to $17 billion overnight! Of course, the market recognized the true value of Livongo’s assets, which was closer to $1 billion, not $15 billion. Hence, due to the process known as ‘goodwill impairment test’, Teladoc had to either adjust the value of its assets or explain to the SEC why the value of its assets was so dramatically different from the market value of its stock. Unsurprisingly, Teladoc adjusted the value of its assets from $17 billion to around $4 billion, by writing off the goodwill value of Livongo.

It would be funny if it weren’t so sad for Teladoc’s shareholders, who have endured a tumultuous journey due to the company’s poor management decisions, losing 92% of their stock value so far. Teladoc’s market value dropped from $42.7 billion on February 8, 2021, shortly after the deal announcement, to the current $3.3 billion.

The acquisition of Livongo was the final nail in Teladoc’s coffin, as the company struggles to avoid bankruptcy. Teladoc’s balance sheet deteriorated, with its debt-to-asset ratio soaring to around 50%. Despite these financial strains, the company still navigates through partnerships and collaborations, seemingly desperate to stay afloat. Yet, with the fading impetus of COVID-19 and no significant strategic shifts under the current CEO, Teladoc’s prospects look grim, possibly veering towards default or bankruptcy. Meanwhile, CEO Jason Gorevic, who earned a salary of $10,876,053 in 2022, continues to lead the company, apparently unscathed by the disastrous outcomes of his decisions.

My Take

The General Catalyst’s Summa Health deal presents a fascinating and historic opportunity to innovate within the struggling U.S. healthcare system. I am impressed by the promises this deal has made to patients and clinicians in the Ohio-based healthcare system. However, my concern focuses on the financing of this deal. When an entity transitions to a for-profit model, it’s often the customers - the patients, physicians, and nurses - who inadvertently bear the burden. I sincerely hope this situation is different, and that my math is incorrect. But if I’m correct and the financing of this deal is not as straightforward as the initial reports have suggested, the implications for patients and physicians could be detrimental. For their benefit, I am eager to see this deal succeed. If it does, it could herald a significant breakthrough in digital health and bring numerous advantages to both patients and physicians.

👉👉👉👉👉 Hi! My name is Sergei Polevikov. In my newsletter ‘AI Health Uncut’, I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏

A must-read brand new article by someone passionate about uncovering the shady private equity transactions in healthcare and other industries: https://www.businessinsider.com/how-wealthy-investors-got-rich-looting-needy-hospitals-healthcare-system-2024-3.

While most corporate healthcare journalists (like those from Bloomberg, Forbes, Fortune, Axios) appear to have cozy relationships with private equity firms, with some even engaging in a "revolving door" practice, Bethany McLean stands out. She is one of the few nationally acclaimed journalists and world renowned authors who remains truly unbiased and never hesitates to reveal how private equity firms enrich themselves at the expense of patients.

The primary issue with private equity lies in its use of leverage—borrowing significantly more than they have in the hopes of realizing substantial profits. Unfortunately, more often than not, these deals go south, and it’s the patients who suffer the consequences.

As outlined in my recent article, the largest leveraged buyout that corporate journalists seem to avoid investigating is General Catalyst acquiring Summa Health. This deal allegedly involved borrowing a sweet $1 billion that General Catalyst doesn’t have.

My concern regarding the miscalculated risk of leveraged buyouts (LBOs) is substantiated by data: "Roughly 1 in 5 large companies acquired through leveraged buyouts go bankrupt within a decade. This is vastly more than the roughly 2% of comparable companies not acquired by private equity firms that do." (Source: Brendan Ballou, author of "Plunder: Private Equity's Plan to Pillage America", 2023.) The fact that the General Catalyst-Summa deal extends beyond mere financial considerations, impacting communities at large, renders this deal not only unethical but also irresponsible.