Sexism in Venture Capital: Why 'Penis' Is OK, But 'Vagina' Is Taboo

You can say "penis" at a VC pitch, but don't even think about saying "vagina." Female founders are "advised" to strike a more "neutral" tone, according to startling new research.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

This is Part 1 of an infinite series on empirical analysis proving that venture capital is a scam, especially in healthcare, and why alternative, more optimal, and better-aligned approaches to asset allocation and investment in innovative startups are needed.

Today, millions of Americans are voting, with women’s rights and health squarely on the ballot. Yet, in the “VC bros” world, women’s progress is a rounding error.

In femtech—a sector supposedly focused on women’s needs—male founders are statistically more likely to get funded than female founders, often with half the merit.

In the world of the so-called “VC bros,” merit never even makes it to the ballot. And I’ve got the numbers to back that up.

In this article, I lay out the facts and opinions on why women VCs and founders are marginalized by “VC bros.” With a focus on femtech, I also spotlight a few hard-won victories along the way.

Forget DEI. Forget racial bias. Forget inequality. I’m talking about plain, unfiltered merit in venture capital. And here’s the brutal truth: there is none. Men are, on average, worse VC investors than women. Yet, according to recent research, they consistently receive more capital—even in femtech. It’s unbelievable. This is sexism in its rawest form, a disgrace that shouldn’t exist in today’s world.

I have two daughters. I just voted for their future—a future of equal rights and merit, where hard work and excellence are rewarded, regardless of gender, background, nationality, or anything else.

Here’s the TL;DR:

1. Naked Facts

2. Women’s Healthtech Startups Are Less Likely to Get Funding with Female Founders, according to The Guardian

2.1 The Barriers to Femtech Funding

2.2 The Funding Gender Gap in Femtech

2.3 The Exclusive VC Bro Club

2.4 Flo Health: A Case of Success and Industry Double Standards

2.5 Challenges Beyond Funding: Systemic Gender Bias in Distribution and Marketing

2.6 “Solution”: “Watch Your Language, Ladies!”

2.7 Small Steps Toward Progress and Accountability, and the Rise of Femtech Support

2.8 References

3. VCs Prefer White Male-Led Startups, according to PlanBeyond Study

4. Breaking Barriers: Women and Non-Binary Investors Reshaping Venture Capital

4.1 The Rise of Women-Led VC Funds

4.2 The Numbers Speak: Women VCs Produce Higher Returns, Faster Exits

4.3 Expanding DEI’s Reach Amid Backlash

4.4 Championing Diversity: Women and Non-Binary Leaders in High-Profile Sectors Like AI

4.5 Empowering Women Through Sustainable Capital Expansion

4.6 References

5. Small Investment Victories in Women’s Health and Femtech

5.1 The Rise of Flo: The New Unicorn Innovating in Women’s Health

5.2 Beyond Flo: The New Wave of Femtech Champions Attracts Major Funding

5.3 Femtech: Skyrocketing Valuations and the Road Ahead

6. Why is it Still So Hard to Succeed in Women’s Health and Femtech?

6.1 Capital Starvation and Risk Perception

6.2 Visibility and Representation

6.3 Social Taboos and the “Yuck Factor”

6.4 The TAM Problem: Misunderstanding the Market’s Potential

6.5 Structural Inequities in Funding and Reimbursement

6.6 The VC’s Macro Existential Crisis and Women’s Health

6.7 Toward an Inclusive Future for Women’s Health

6.8 References

7. Conclusion: What Future Awaits My Daughters?

1. Naked Facts

Gender Discrimination in Startups and Venture Capital:

🚫 98% of all venture capital dollars flow into male-founded startups. (Sources: Pitchbook, Bloomberg Technology.)

🚫 Men represent 85% of VC-backed startup founders, while only 13% are women. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

🚫 73% of all VC-backed founding teams are composed exclusively of men. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

🚫 60% of founding teams are exclusively white. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

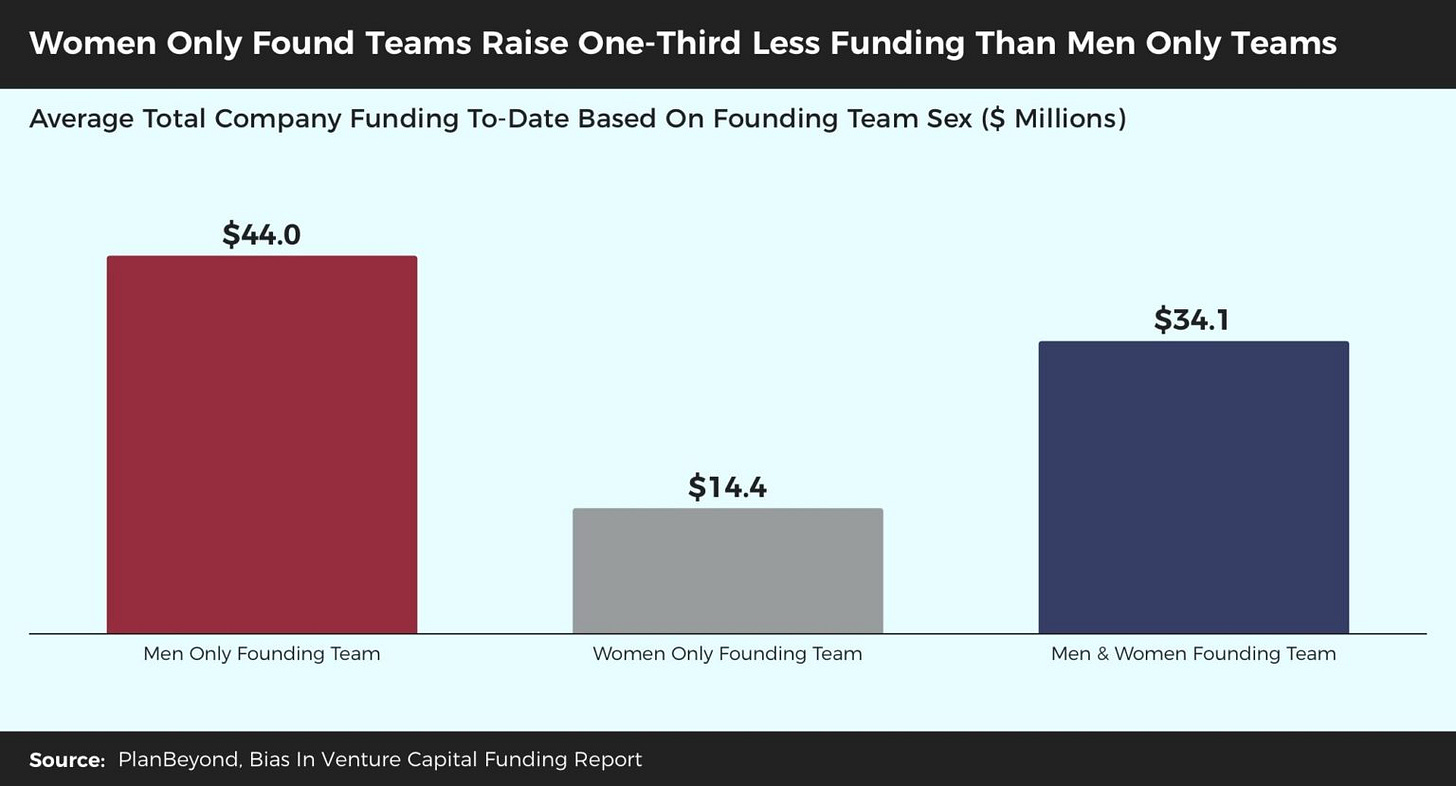

🚫 Men only teams receive 3 times more funding than women only teams, independent of company stage. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

🚫 Women-only teams raise fewer funding rounds compared to male-only and mixed-gender teams. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

🚫 Women-only teams receive almost half as much funding in later stages as those with mixed-gender teams, and even less compared to male-only teams. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

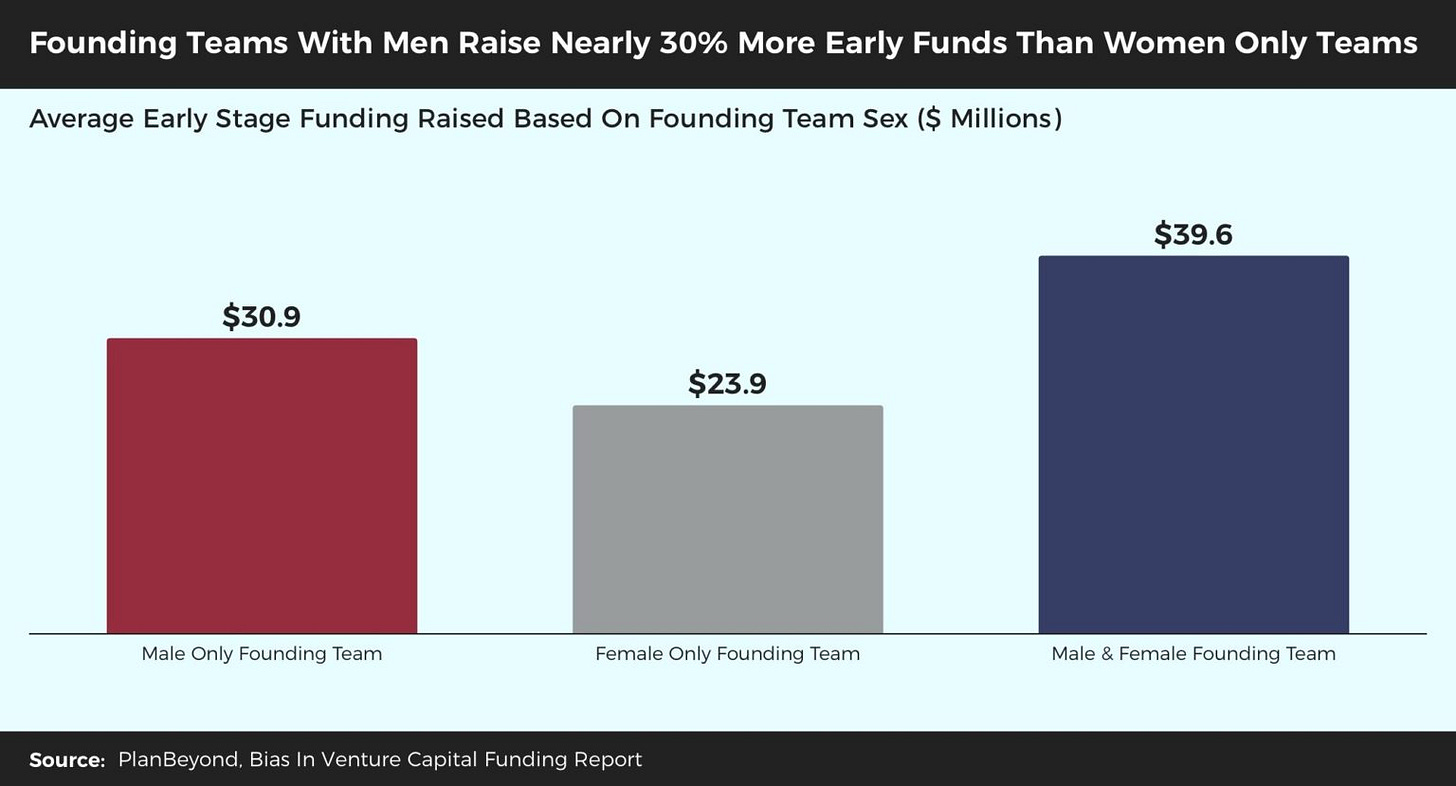

🚫 Founding teams with men raise nearly 30% more early funds than women-only teams. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

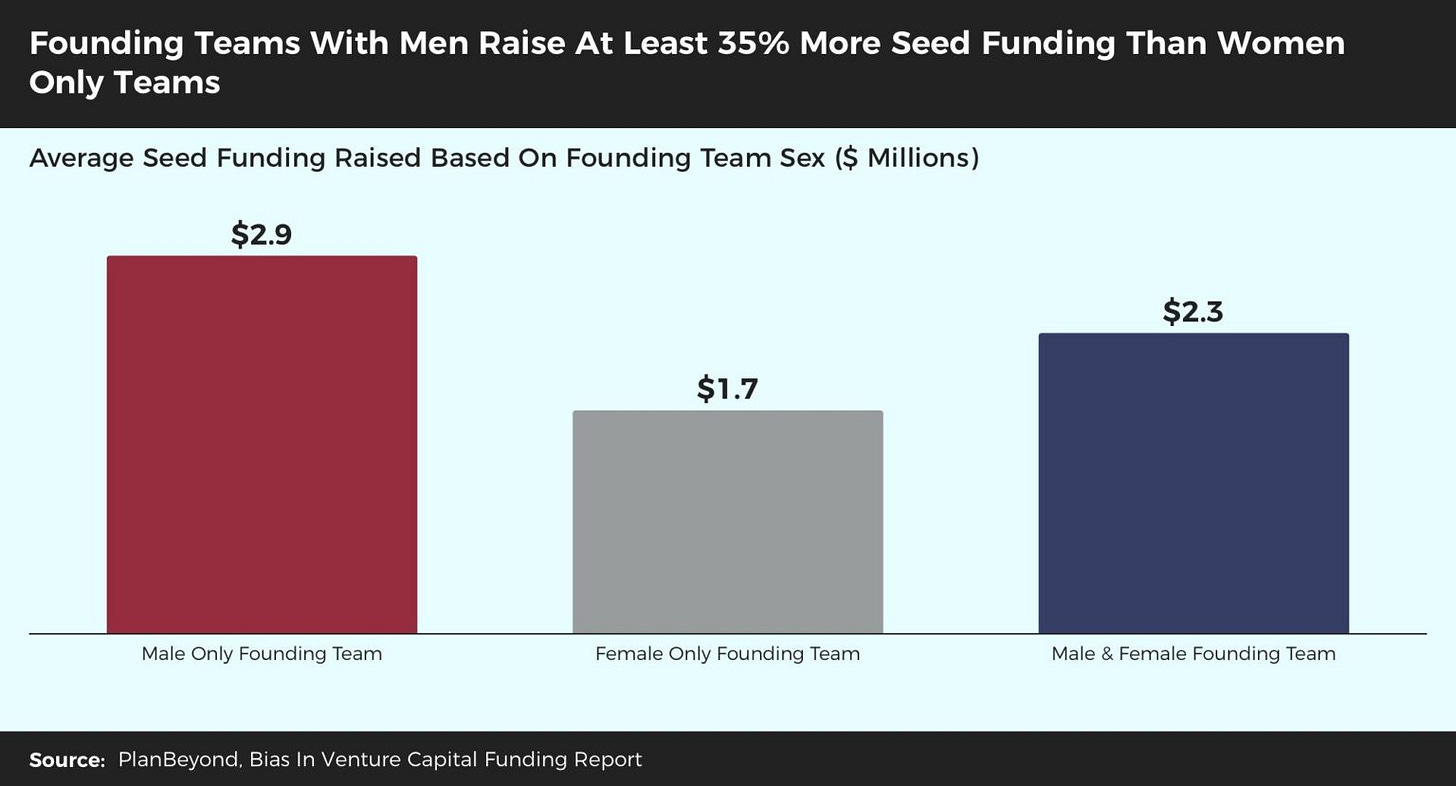

🚫 Founding teams with men raise at least 35% more seed funding than women-only teams. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

🚫 Founding teams composed exclusively of women average 4.67 investors while teams composed exclusively of men attract 6.17 investors. (Source: PlanBeyond's ‘Bias In Venture Capital Funding’ Report.)

🚫 75% of femtech companies are founded by women. Yet, they raise, on average, 23% less capital than those femtech companies founded by men. (Source: The Guardian.)

🚫 Only 15% of private equity’ institutional partners and managing directors are women. Venture capital has similar figures. (Sources: Strategex, Leslie Schrock on Second Opinion.)

🚫 Female CEOs are 45% more likely to get fired versus their male counterparts. (Source: Gupta, V. K., Mortal, S. C., Silveri, S., Sun, M., & Turban, D. B. (2020). You’re Fired! Gender Disparities in CEO Dismissal. Journal of Management, 46(4), 560-582.)

Facts:

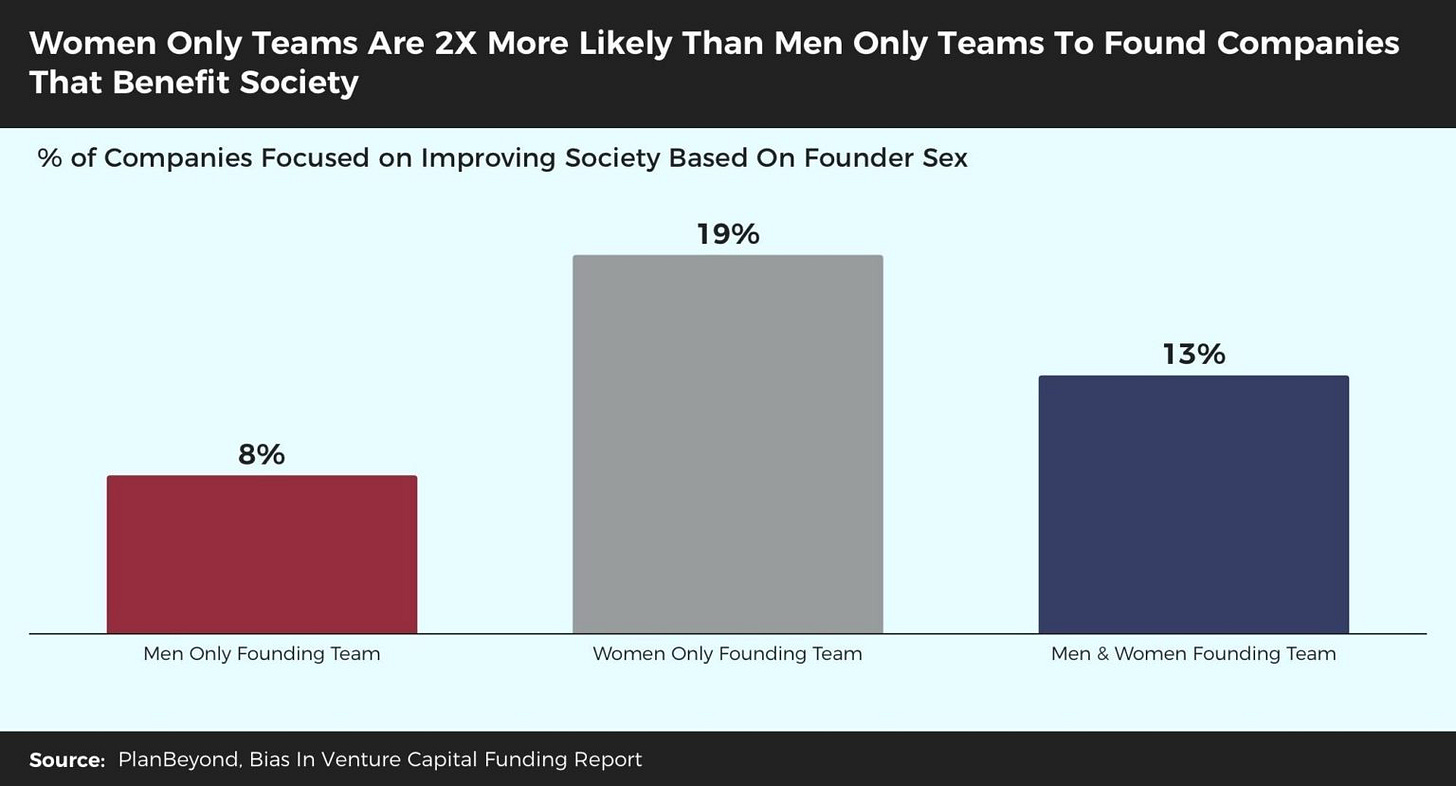

✅ Companies with women only founders are more than twice as likely than men only teams to develop companies that improve society. (Source: PlanBeyond’s ‘Bias In Venture Capital Funding’ Report.)

✅ Female entrepreneurs have been shown to deliver more than double the revenue per dollar invested compared to their male counterparts, and they tend to exit on average a year faster. (Source: Bloomberg Technology.)

✅ Female VC partners tend to back female-led startups at twice the rate of male partners, contributing to an ecosystem where diverse founders have more equitable access to early-stage funding. (Source: All Raise.)

✅ VC firms that increased their hiring of women partners by just 10% saw an average increase of 1.5% in overall fund returns and gained 9.7% more profitable assets. (Source: All Raise.)

✅ 69% of top-quartile VC firms feature women decision-makers. (Source: All Raise.)

✅ Female founders rated value-add as twice as important than males. (Source: Steve Ardire on LinkedIn.)

2. Women’s Healthtech Startups Are Less Likely to Get Funding with Female Founders, according to The Guardian

Sounds crazy, right? Just wait until you see the results of this groundbreaking research.

The story of funding inequality in women’s health technology—commonly known as "femtech"—is fraught with disheartening patterns of bias, contradictory standards, and systemic exclusion rooted in a venture capital culture dominated by men. For nearly eight decades, this "VC bros" culture has acted as a gated community, promoting values that favor male-led ventures and creating hurdles for female-centric health technology. Despite the immense potential, with femtech expected to reach a global worth of £45 billion by 2027, only a meager 1-2% of health technology funding is allocated to it. Research further highlights the barriers femtech companies face, particularly when women are on the founding team or when certain language is used in funding applications. This persistent bias has resulted in a cycle that continues to overlook the unique needs of women, leaving them marginalized by an investment ecosystem entrenched in men-focused values.

2.1 The Barriers to Femtech Funding

VC firms are well-known for their preference for high-return investments, yet they often overlook the immense profitability potential in femtech—a sector addressing the healthcare needs of half the global population. Femtech spans areas like maternal health, menopause, and sexual wellness, as well as cardiovascular and mental health, which often present differently in women. Despite these opportunities, investors routinely label femtech as “niche” or “ideologically driven,” wrongly associating it with social causes rather than financial returns.

This misconception persists, despite data showing that women spend 29% more on healthcare than men and are 75% more likely to use digital health tools.

2.2 The Funding Gender Gap in Femtech

Securing funding remains a persistent struggle for women founders in femtech.

Research by Ludovica Castiglia of IESE Business School, who examined 1,720 funding agreements from 513 VC-based femtech(!) companies across the U.K., U.S., and Canada, revealed a stark funding disparity: companies led by women raise, on average, 23% less capital than those led by men.

“The depressing message is that even when you’re working in an area where 75% of companies are founded by women, and you’ve developed a product aimed specifically at women, having a woman on your founding team – even when she’s paired with a male counterpart – damages your chance of getting funding.” —Ludovica Castiglia, IESE Business School

Castiglia found that terms like “women’s rights,” “empowerment,” and “gender gap”—and God forbid, any mention of female anatomy—tend to undermine credibility for female founders in pitches, suggesting emotional or ideological motives. (This falls under the “yuck factor” coined by Leslie Schrock, as discussed below in section 6.3.) Male founders, however, benefit from using these same terms, as investors view their statements as economically motivated. This bias underscores a troubling trend: while male founders are seen as market-savvy, women founders are often mischaracterized as social activists rather than business-minded professionals.

2.3 The Exclusive VC Bro Club

The VC industry, historically dominated by white men, has operated as an “exclusive club” for almost 80 years, fostering a “VC bro” culture that perpetuates systemic biases. This environment, built on male-centric perspectives and values, has created barriers for female founders pitching femtech solutions. Mo Carrier, co-founder of MyBliss, experienced this bias firsthand when seeking funding for a menopause-targeted lubricant. Her product was dismissed as “too niche,” while funding was instead allocated to yet another productivity app. Such incidents illustrate the disconnect between genuine market needs in women’s health and the narrow VC perspective on “market viability.”

2.4 Flo Health: A Case of Success and Industry Double Standards

A notable outlier, Flo Health—a period-tracking app founded by two men from my native Belarus—became Europe’s first femtech unicorn, securing a record-breaking $290 million investment and reaching a billion-dollar valuation. This success highlights the double standards in femtech funding. While Flo flourished, many female-led femtech ventures with equally compelling products struggle to attract comparable investment. Sarah Turner, CEO of Angel Academe, expressed frustration over this disparity, pointing out that female founders are often penalized for their gender, regardless of their innovation. The success of male-led Flo exemplifies how male founders in femtech receive a different reception, with investors more readily recognizing their business potential.

2.5 Challenges Beyond Funding: Systemic Gender Bias in Distribution and Marketing

Even after overcoming funding hurdles, femtech companies face discrimination in other areas. For example, Béa Fertility, which offers an at-home fertility kit, encountered censorship when Amazon required them to replace “vagina” with “birth canal” on product listings—restrictions not applied to male health terms like “semen.” Hanx, a female-focused sexual wellness brand, also struggled to secure payment providers, dealing with banking scrutiny, account closures, and inflated fees solely due to the nature of its business. These obstacles add operational costs and delay product launches, affecting customer satisfaction and revenue.

“[Men]’re not met with any sort of embarrassment or anything. I think you probably could say the word ‘penis’ in a board meeting and no one would worry. But if you were to start talking about women’s organs, then investors shrink back.”—Belle Taylor, co-host of Healthtech Pigeon podcast

Digital platforms also impose barriers. Daye, a company that provides diagnostic tampons, faces continuous bans and account suspensions on advertising platforms like Meta and TikTok, costing them nearly £100,000 per month. Shadow-banning—where platforms limit visibility without an explicit ban—is a common issue in femtech, curbing these companies’ ability to reach potential customers. Clio Wood, co-founder of CensHERship, highlights that femtech companies waste substantial resources addressing these biases, hindering their growth and competitive edge.

2.6 “Solution”: “Watch Your Language, Ladies!”

To navigate VC bias, some, including Castiglia, suggest that female founders should use more neutral language in pitches, avoiding terms that could be perceived as advocacy, women’s rights, or social justice-oriented. While practical, this approach highlights the lengths women must go to mitigate investor bias. Many femtech founders argue that the burden should not be on them to alter messaging. Instead, the ‘VC bro’ culture should become more inclusive, recognizing female health as a valuable profit-generating market opportunity.

2.7 Small Steps Toward Progress and Accountability, and the Rise of Femtech Support

Despite these challenges, organizations and initiatives are emerging to support femtech. In the U.K., groups like Femtech Lab, Women of Wearables, and the Oxford Femtech Society provide mentorship, funding resources, and lobbying power to help femtech companies navigate these barriers. Government funding initiatives, like those from the National Institute for Health and Care Research, also aim to bridge funding gaps for female-led healthcare technology. Increasing female representation among investors could further shift the landscape, as women investors tend to recognize the practical needs for these solutions. Sarah Turner and industry leaders believe more women in high-level investment roles would foster an inclusive environment where female-focused health products are valued for their market potential.

One such initiative, Kavanaugh Health, is making strides to support women in venture capital by fostering a community of mentorship and allyship. Their programs seek to dismantle biases that female founders face and encourage greater engagement from women in health tech and venture capital. By advocating for more female voices in investment decision-making, Kavanaugh Health and similar efforts aim to disrupt the traditional “bro culture” of VC and push for a more equitable funding landscape.

2.8 References

Hill, A. (2024, October 8). “Women’s health tech ‘less likely’ to get funding if woman is on founding team.” The Guardian.

Hill, A. (2024, October 8). “The huge disadvantage women behind femtech phenomenon face.” The Guardian.

Healthtech Pigeon. (2024, October 13). “Is it AI or is it just a really good algorithm?” Healthtech Pigeon Podcast.

3. VCs Prefer White Male-Led Startups, according to PlanBeyond Study

The story of women in venture capital funding reveals a troubling disparity, despite their dedication to societal betterment. PlanBeyond’s ‘Bias In Venture Capital Funding’ Report examines venture capital investments in U.S. startups during 2019, analyzing over 6,000 companies and nearly 12,000 founders. The findings are a stark look at the venture capital ecosystem’s preference for white, male founders over female and minority founders.

Startups led exclusively by women are more than twice as likely as those led by men alone to focus on societal benefits. These include areas like sustainable food management, digital mental health support, educational tech, and eco-friendly fashion. Black founders are 60% more likely than white founders to work on ventures that benefit society. However, these women-led and Black-led ventures face significant funding disadvantages.

Despite their focus on societal improvement, women founders encounter a venture capital world overwhelmingly dominated by men. Men represent 85% of venture-backed startup founders, while only 13% are women. The disparity extends to racial composition, with just 2% of founders identifying as Black and 4% as Latinx—far below their representation in the U.S. population.

This homogeneity is mirrored in founding teams: 73% are exclusively male, and 60% are entirely white. A mere 13% of teams include both genders, while only 20% have both white and non-white members.

Funding gaps are equally stark. Men-only teams receive, on average, 3 times the funding of women-only teams. The cumulative average funding for male-only teams is $44 million, dwarfing the $14.4 million raised by female-only teams. Mixed-gender teams do slightly better, but the presence of women alone does not level the playing field.

Female-only teams average just 4.67 investors, compared to 6.17 for male-only teams and 6.31 for mixed-gender teams. Teams with both white and non-white members attract the most investors, averaging 7.42.

Founding teams with men raise nearly 30% more early funds than women-only teams.

Founding teams with men raise at least 35% more seed funding than women-only teams.

Race also plays a significant role in funding. White-only teams raise nearly 35% more capital over time than non-white-only teams. Teams with at least one Black founder secure just a quarter of what white-inclusive teams receive, marking them as the least-funded racial cohort. The numbers are especially grim for Black-led teams in later funding stages, where they receive the lowest levels of support compared to any other group.

As companies progress through funding rounds, the disparity grows more pronounced. Women-only teams raise fewer funding rounds.

Women-only teams receive almost half as much funding in later stages as those with mixed-gender teams, and even less compared to male-only teams. Meanwhile, companies with Middle Eastern founders often excel in later funding stages. Conversely, Black-led companies continue to receive minimal support at each stage, a pattern reinforcing their underrepresentation in high-growth ventures.

VC’s preference for white, male-led ventures is not only a financial issue but a barrier to societal progress. Women and Black founders, more likely to focus on socially beneficial goals, are constrained by a system that underfunds and undervalues them.

4. Breaking Barriers: Women and Non-Binary Investors Reshaping Venture Capital

Despite the societal barriers and double standards described above, in recent years, women and non-binary individuals have made remarkable strides in the traditionally male-dominated world of venture capital (VC). With high-profile funds, initiatives, and advocacy groups dedicated to reshaping the investing landscape, representation of these groups has increased. However, despite these gains, significant challenges remain, particularly as backlash against Diversity, Equity, and Inclusion (DEI) initiatives threatens progress. Below, I explore insights from two leaders, Jenny Abramson of Rethink Impact and Paige Hendrix Buckner of All Raise, on the highs and lows of these advancements, the data-driven case for diverse investing, and the future of women and non-binary representation in VC.

4.1 The Rise of Women-Led VC Funds

Jenny Abramson, founder and managing partner of Rethink Impact, recently announced a $250 million fund, a record-setting achievement as the third-largest fund raised to date focused on backing female CEOs. This fund nearly doubles Rethink Impact’s assets under management, bringing their total to over half a billion dollars. Major institutional investors, including over 10 university endowments, 10 foundations, a hospital, and prominent figures like Sara Blakely of Spanx and Melinda French Gates, have contributed.

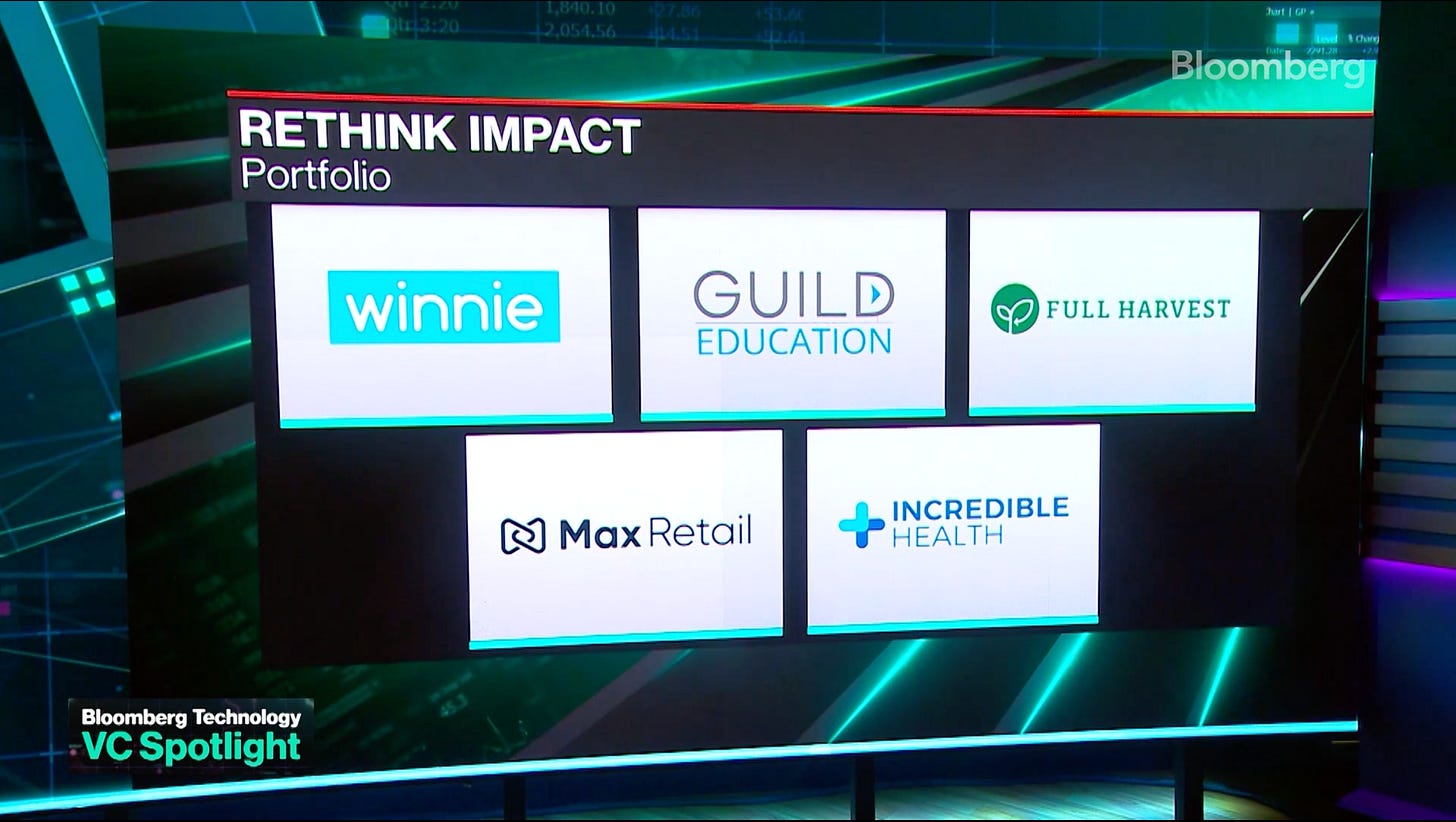

Abramson’s team has invested in notable women-led companies like Spring Health, Ellevest, Winnie, Guild Education, Full Harvest, Max Retail, Solv, Sempre Health, Neurotrack, Eleanor Health, Bold, and Incredible Health, which have not only shown strong growth but have also contributed to the visibility of female leaders in tech and healthcare.

The fund’s success signals that gender-focused investing is gaining traction among mainstream investors, who may soon begin recognizing it as sound business rather than a social obligation. As Abramson notes,

“Investing in women is no longer just a passing trend in the wake of the #MeToo movement, and investors increasingly view this as a mainstream opportunity. This moment makes clear that investing in women and impact is good business, good for the economy, and certainly here to stay.” —Jenny Abramson, founder and managing partner of Rethink Impact

4.2 The Numbers Speak: Women VCs Produce Higher Returns, Faster Exits

“Gender-diverse teams outperform.” —Jenny Abramson, founder and managing partner of Rethink Impact

The data behind gender-diverse investing provides compelling evidence for its financial viability. Female entrepreneurs have been shown to deliver more than double the revenue per dollar invested compared to their male counterparts, and they tend to exit on average a year faster. This has proven particularly valuable for VC firms that seek quicker paths to liquidity through IPOs or acquisitions. Abramson highlighted Spring Health, which recently reached a $3.3 billion valuation, as a prime example of the valuation growth possible under female-led leadership.

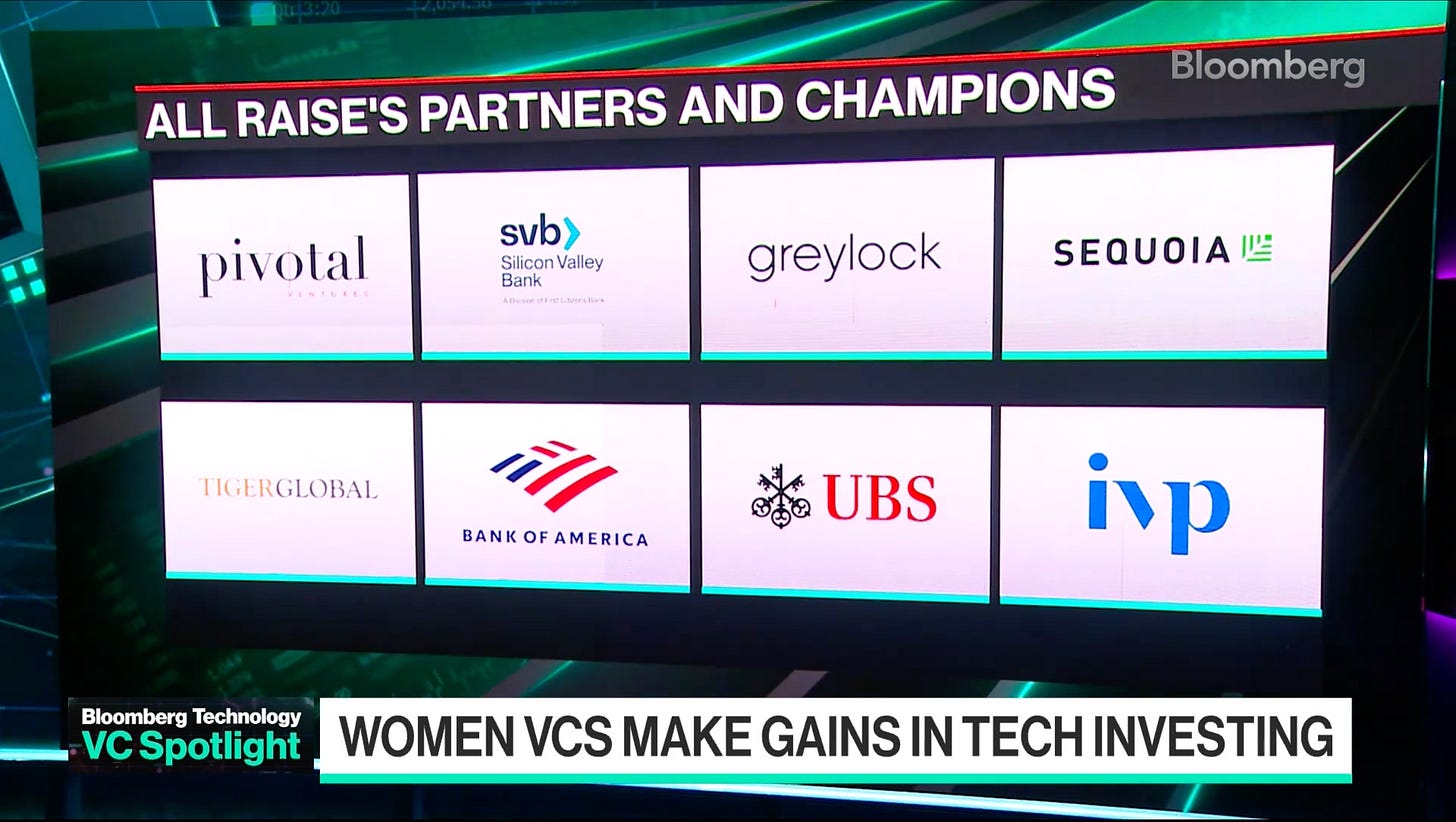

Further validating this approach, All Raise CEO Paige Hendrix Buckner shared that female partners tend to back female-led startups at twice the rate of male partners, contributing to an ecosystem where diverse founders have more equitable access to early-stage funding. According to Hendrix Buckner,

“[VC] firms that increased their hiring of women partners by just 10% saw an average increase of 1.5% in overall fund returns and gained 9.7% more profitable assets.” —Paige Hendrix Buckner, CEO of All Raise

These statistics are not only powerful in terms of direct returns but also critical for driving an industry-wide shift towards greater diversity among check-writers and founders. According to Hendrix Buckner, 69% of top-quartile firms feature women decision-makers, further illustrating the correlation between diversity in leadership and fund performance.

4.3 Expanding DEI’s Reach Amid Backlash

Despite these successes, the push for DEI in venture capital has faced notable obstacles, especially amid a national backlash against such initiatives. While investors in Abramson’s latest fund have shown strong support, the backlash is still a palpable barrier for many gender-focused funds. Hendrix Buckner noted that DEI programs are increasingly scrutinized, and venture funds like the Fearless Fund, which aims to support women of color, have encountered legal battles over DEI-focused grant allocations.

This backlash has raised concerns among VC leaders about the sustainability of these gains. While the presence of women and non-binary decision-makers has doubled from 9% to 17.4% over recent years, and early-stage funding for women founders has grown from 11% to 27%, these numbers are still a fraction of the total venture funding landscape. Male-founded companies continue to dominate with 98% of VC dollars, creating an uneven playing field where the vast majority of capital flows to male founders.

In this climate, leaders like Abramson and Hendrix Buckner are tasked with not only raising funds but also advocating for DEI as a core investment principle. Abramson’s view that “this raise makes clear that [diversity] is good business, good for the economy, and here to stay” underscores the need to present DEI as an economic imperative rather than a charitable initiative. Hendrix Buckner similarly emphasizes that telling the stories of women and non-binary check writers and founders is essential to counteract the narrative that diversity is peripheral to success in venture capital.

4.4 Championing Diversity: Women and Non-Binary Leaders in High-Profile Sectors Like AI

The tech industry, particularly in areas like artificial intelligence (AI), remains a challenging space for women and non-binary founders and investors. While some of the largest recent funding rounds were secured by companies with women at the top, many high-profile VC targets in AI are still dominated by male or non-diverse founders. This creates an environment where women and non-binary investors and founders must fight for visibility and legitimacy in the most coveted sectors.

All Raise has made it a priority to spotlight women and non-binary investors and founders in AI, with Hendrix Buckner sharing that the organization will continue to tell the stories of its community members who are experts in AI and other emerging fields. She notes that firms within the All Raise network have seen success due to the diverse perspectives brought to the table, particularly in tech and healthcare. This initiative aims to bridge the gap between diverse investors and the rapidly evolving sectors in which capital is flowing, which in turn could lead to increased representation and funding for women-led companies in AI.

4.5 Empowering Women Through Sustainable Capital Expansion

The progress made by women and non-binary investors and founders is undeniable, yet the structural barriers they face are profound. Both Abramson and Hendrix Buckner point out that while the data in favor of diverse investing is compelling, the capital allocation landscape has been slow to adapt. Despite female founders proving their capacity for faster growth and exits, and diverse leadership teams achieving higher returns, male-led firms continue to dominate the funding space, receiving 98% of venture dollars.

As Hendrix Buckner highlights,

“This is the moment where it’s starting to turn.” —Paige Hendrix Buckner, CEO of All Raise

The recent success of funds like Rethink Impact’s $250 million raise and the growing recognition of the economic benefits of diversity suggest that institutional investors may finally be taking DEI—and, most importantly, merit—seriously. The hope is that these recent achievements will spark a more permanent shift, where diversity in venture capital isn’t just a trend but becomes a central tenet of investment strategy.

The path forward for women in venture capital will require continued advocacy, education, and data-driven storytelling. Leaders like Abramson and Hendrix Buckner are committed to ensuring that the economic value of diverse teams remains front and center. By driving change from within and demonstrating the profitability of diversity, they aim to create a more inclusive investment landscape—one that can fund the next generation of diverse innovators in tech, healthcare, AI, and beyond.

4.6 References

Chapman, L. (2024, July 24). Women VCs Make Gains in Tech Investing Amid DEI Backlash. Bloomberg.

Bloomberg Technology. (2024, July 25). Stocks Whipsaw and ServiceNow Gains on Positive Outlook. Bloomberg.

Bloomberg Technology. (2024, September 13). Tech Charges Higher and Adobe Misses the Mark. Bloomberg.

Landi, H. (2024, September 13). Fierce Healthcare Fundraising Tracker—Gen AI startup nabs $25M; Rethink Impact raises $250M for female-led companies. Fierce Healthcare.

5. Small Investment Victories in Women’s Health and Femtech

In a world where healthcare investment dollars typically funnel into well-trodden tech arenas, femtech has started to carve out a much-deserved niche. Slowly but surely, this industry—dedicated to advancing women’s health through technology—is seeing a surge in venture capital, fueling companies that focus on everything from fertility to maternal health, menstrual cycle tracking, and overall wellness. Recent funding rounds for femtech leaders illustrate a sector that is finally being recognized for its impact and growth potential. Here, I look at the small but significant investment victories that are reshaping women’s health.

5.1 The Rise of Flo: The New Unicorn Innovating in Women’s Health

A recent episode of the Healthtech Pigeon podcast showcased the growth potential of femtech with an announcement from Flo, a widely used health and wellness platform dedicated to women’s health. Anna Klepchukova, Flo’s Chief Medical Officer, revealed that the company raised $200 million from General Atlantic, pushing its valuation to a groundbreaking $1 billion.

Flo has not only achieved profitability but also aims to channel this fresh funding toward expansion. With new markets in Mexico and Brazil in sight, Flo is positioning itself as a global health resource. In addition to geographic expansion, Flo plans to use the capital to personalize its platform further, targeting new demographics such as perimenopausal women—a segment that has historically received limited attention in digital health. The emphasis on serving these underserved groups signals Flo’s mission to holistically support women across various life stages.

5.2 Beyond Flo: The New Wave of Femtech Champions Attracts Major Funding

Flo isn’t the only femtech star drawing investor interest. During the podcast, several other names came up, reflecting a broader trend in women’s health tech:

Maven Clinic: As of October 8, 2024, Maven Clinic emerged as the world’s most valuable women’s health company, boasting a valuation of $1.7 billion. CEO Kate Ryder shared in an interview with Bloomberg that Maven recently raised $125 million, with plans to bolster its capabilities in data and AI. This infusion of capital is set to enhance Maven’s comprehensive virtual care offerings, which cater to women’s healthcare needs across different stages of life—from fertility and family planning to menopause support.

BillionToOne: Known for its non-invasive prenatal testing (NIPT) technology, BillionToOne is carving out a space in femtech by focusing on maternal and fetal health. Its tests are designed to improve the precision and accessibility of prenatal care, which is critical in supporting the health of both expectant mothers and their babies. With its advanced technology and clear alignment with the goals of femtech, BillionToOne continues to gain traction and attract investment, reaching a valuation of $1 billion.

Bellabeat: Positioned at the intersection of women’s wellness and tech, Bellabeat provides wearables and tracking tools specifically for women, addressing everything from reproductive health and menstrual cycles to stress management. The company’s targeted approach to women’s health has allowed it to grow its user base and solidify its place in the femtech market, drawing investor attention for its holistic focus on wellness.

The growth of these companies highlights a diverse range of focus areas within femtech. From non-invasive diagnostics to comprehensive digital care platforms, the femtech sector has shown a capability to address multifaceted aspects of women’s health.

5.3 Femtech: Skyrocketing Valuations and the Road Ahead

These funding rounds also underscore a fundamental shift: femtech is no longer seen as a niche or experimental sector. Maven Clinic’s $1.7 billion valuation, Progyny’s $1.4 billion, Flo and BillionToOne each reaching the $1 billion mark, and Mithra Pharmaceuticals’ $500 million valuation collectively signal that femtech is becoming mainstream. Investors are increasingly drawn to these companies for their potential to not only generate returns but also disrupt traditional healthcare delivery models.

The recent influx of capital into femtech demonstrates that investors are recognizing the value in supporting women’s health companies, especially those leveraging data and AI. This wave of investment is empowering companies like Maven, Flo, and others to innovate and expand their offerings, laying a foundation for femtech’s long-term impact on the healthcare industry.

6. Why is it Still So Hard to Succeed in Women’s Health and Femtech?

Women’s health and health tech face unique challenges that make it an uphill battle for startups to gain traction, funding, and visibility. The insights of Halle Tecco, Cecilia Callas, and Leslie Schrock reveal the complex layers that hinder progress, even as success stories emerge. This article explores how systemic issues like biased investment, cultural perceptions, and structural constraints contribute to the slow growth of women’s health startups and how we might address these challenges.

6.1 Capital Starvation and Risk Perception

As Halle Tecco points out, one fundamental issue is that venture capitalists, many of whom are men, perceive women’s health as a risky investment. This reluctance stems from a belief that the sector lacks profitable exit opportunities, creating a cycle where limited funding restricts growth, and slow scaling reinforces investor hesitation. However, Tecco emphasizes that the successes of Maven, Progyny, and others prove profitability is possible. These companies, with billion-dollar valuations, defy the misconception that women’s health must be a winner-takes-all market. Nevertheless, new founders face an added hurdle: investors question why established players wouldn’t simply absorb or outcompete any novel innovation. This myopic view stifles the sector’s potential for diverse growth, ignoring the reality that multiple companies can coexist, each serving distinct needs within women’s health.

6.2 Visibility and Representation

Cecilia Callas highlights the imbalance in visibility, with women typically working behind the scenes while men dominate the stages and narratives in tech events. This lack of representation extends to the broader health tech ecosystem, where male-dominated decision-making stymies women-focused innovations. The absence of women’s voices from major platforms means that pressing women’s health issues—like menopause, fertility, and incontinence—don’t receive the public and policy attention they deserve. This disparity not only limits awareness but also reduces the empathy and understanding needed from investors and consumers alike.

6.3 Social Taboos and the “Yuck Factor”

Leslie Schrock describes how cultural discomfort with women’s health topics, such as incontinence or menopause, limits open discussion and subsequently stymies investment. Male investors often shy away from products addressing intimate issues, contributing to what Schrock calls the “yuck factor.” This discomfort reflects societal taboos that render women’s health concerns invisible. This “yuck factor” doesn’t just impact product development but affects the entire marketing and fundraising journey, where conversations around these topics are often sidestepped or underplayed. The result? Women are less likely to seek help, and companies that could provide solutions struggle to gain the funding needed to scale.

6.4 The TAM Problem: Misunderstanding the Market’s Potential

Another barrier is the perceived limited total available market (TAM) for women’s health. Investors often view the sector as niche, questioning the profitability of startups focusing solely on women-specific conditions. Schrock argues that this is a narrow perspective, noting that the industry’s potential expands far beyond traditional health services. Conditions like endometriosis, PCOS, and menopause represent vast markets with millions of affected women. The demand is undeniable, but without sufficient investment to drive innovation, the market remains constrained by legacy healthcare systems that don’t prioritize women’s needs.

6.5 Structural Inequities in Funding and Reimbursement

Schrock also discusses the structural inequities that make scaling women’s health businesses difficult, especially in the context of reimbursement rates. For example, reimbursement for essential women’s health services, such as well-woman visits, is abysmally low. This lack of financial viability deters investors who see healthcare startups as high-risk, low-return ventures.

Additionally, while telehealth shows promise for specific women’s health services (such as menopause care), in-person services remain underfunded and understaffed. Schrock notes that policy changes are needed to create fairer reimbursement structures to support sustainable business models in women’s health, but these reforms are slow to materialize.

6.6 The VC’s Macro Existential Crisis and Women’s Health

The venture capital world itself is undergoing shifts that exacerbate the challenges in women’s health. As Schrock observes, venture funds are currently constrained by broader economic forces, such as inflation and market volatility, which limit the pool of available funding. Large funds dominate the landscape, absorbing capital that might otherwise support smaller, more specialized funds, including those interested in women’s health. With fewer resources directed toward emerging sectors, startups in women’s health face increased competition for attention and dollars.

6.7 Toward an Inclusive Future for Women’s Health

Despite these obstacles, there is reason for optimism. Public awareness is growing, and influential figures are beginning to advocate for greater investment in women’s health. The federal government’s recent funding commitments, along with pledges from private philanthropists like Melinda Gates, signify a turning tide. These funds not only support research but also validate the sector’s significance. However, Schrock suggests that we need more than just investment. We need empathy and a readiness to dismantle ingrained biases against women’s health topics.

A more inclusive future will require systemic changes: equal representation, open dialogues that destigmatize women’s health issues, and policy adjustments to address reimbursement gaps. It’s about creating an ecosystem where women’s health startups are viewed as essential, high-potential investments—because, as Tecco notes, the sector has already proven it can deliver returns. By recognizing women’s health as both a social imperative and a viable business opportunity, we can finally give this sector the resources it deserves.

6.8 References

Tecco, H. (2024, October 8). One issue women’s health founders have faced with funding and scaling [LinkedIn post]. LinkedIn.

Callas, C. (2024, October 29). Navigating the bias in women’s health entrepreneurship. Substack.

Schrock, L. (2024, October 15). Why is it still so hard to succeed in women’s health?. Second Opinion Media.

7. Conclusion: What Future Awaits My Daughters?

In a “normal” world, women’s health would be seen as a lucrative economic opportunity. But instead, we’re stuck in a “VC bro” culture where femtech companies are held back by a venture capital system entrenched in gender bias. Despite rising demand and a growing market, women founders in femtech face funding inequality, operational discrimination, and limited representation in investment decision-making. Although incremental changes are underway through female-led initiatives and advocacy, a truly equitable landscape for femtech remains an ongoing challenge.

As awareness grows, so too does the push for reform. While the venture capital landscape remains a hostile terrain for female founders, the increasing focus on the issue could signal a shift. The “VC bro” culture that has long defined the venture capital world is facing scrutiny like never before. Articles like this bring to light the contradictions and biases that many have faced in silence, urging a re-examination of what counts as a “good investment.” These conversations are more than a fleeting trend. They are part of an essential, overdue discourse on equality in an industry that has for too long been exclusionary. The question remains: Will the venture capital world adapt to this new reality and embrace a merit-based approach, or will it remain tethered to its deeply ingrained biases?

Despite female founders demonstrating their capacity for rapid growth and faster exits with solid evidence, and diverse leadership teams consistently delivering higher returns, male-led firms still dominate the funding landscape, pulling in a staggering 98% of venture dollars. It’s a complete absurdity and utterly anti-meritocratic. This must change!

👉👉👉👉👉 Hi! My name is Sergei Polevikov. In my newsletter ‘AI Health Uncut’, I combine my knowledge of AI models with my unique skills in analyzing the financial health of digital health companies. Why “Uncut”? Because I never sugarcoat or filter the hard truth. I don’t play games, I don’t work for anyone, and therefore, with your support, I produce the most original, the most unbiased, the most unapologetic research in AI, innovation, and healthcare. Thank you for your support of my work. You’re part of a vibrant community of healthcare AI enthusiasts! Your engagement matters. 🙏🙏🙏🙏🙏

From Liz, my wife:

Thanks for writing this Sergei, I feel like I saw a good, thorough summary of my 10 years as a female founder/CEO of a femtech company. 😂

Something I’d be curious about, though don’t know if the data is already out there or how hard it’d be to triangulate, is how many companies are funded where the entrepreneur was in VC before or has a partner/spouse in VC. And also how many companies/what portion of funding goes to second-time entrepreneurs. Basically, what portion of funding goes to founders with some sort of preexisting relationship. I’d bet it’s pretty common across all sectors, but I definitely saw this trend in femtech.

One of the things that is still striking to me during my Lioness days was several years ago when I went to a VC-hosted dinner of femtech female founders and nearly everyone there had been in VC before starting their company or had a spouse in VC (James wasn’t a VC yet, lol). It was a bit of a relief because I was really down on myself over how hard it was to fundraise and it felt like it was a nepotism game, but also it felt more and more frustrating because… it felt like a nepotism game. I think this has gotten better in the last few years, especially with more interest in women’s health and some success stories, but it’s still really tough to navigate as you’ve written about.

Too true here, with nothing but lip service towards improvement over the years…