Digital Health in 2025: Expect Massive Public Bankruptcies and a Historic IPO Drought – The Covid Middle Finger Returns to Haunt Us

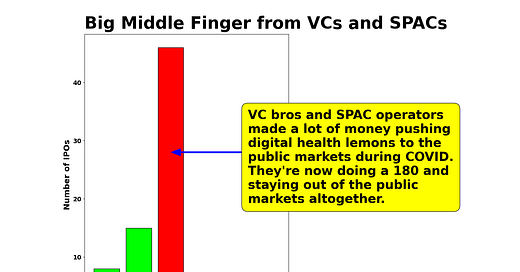

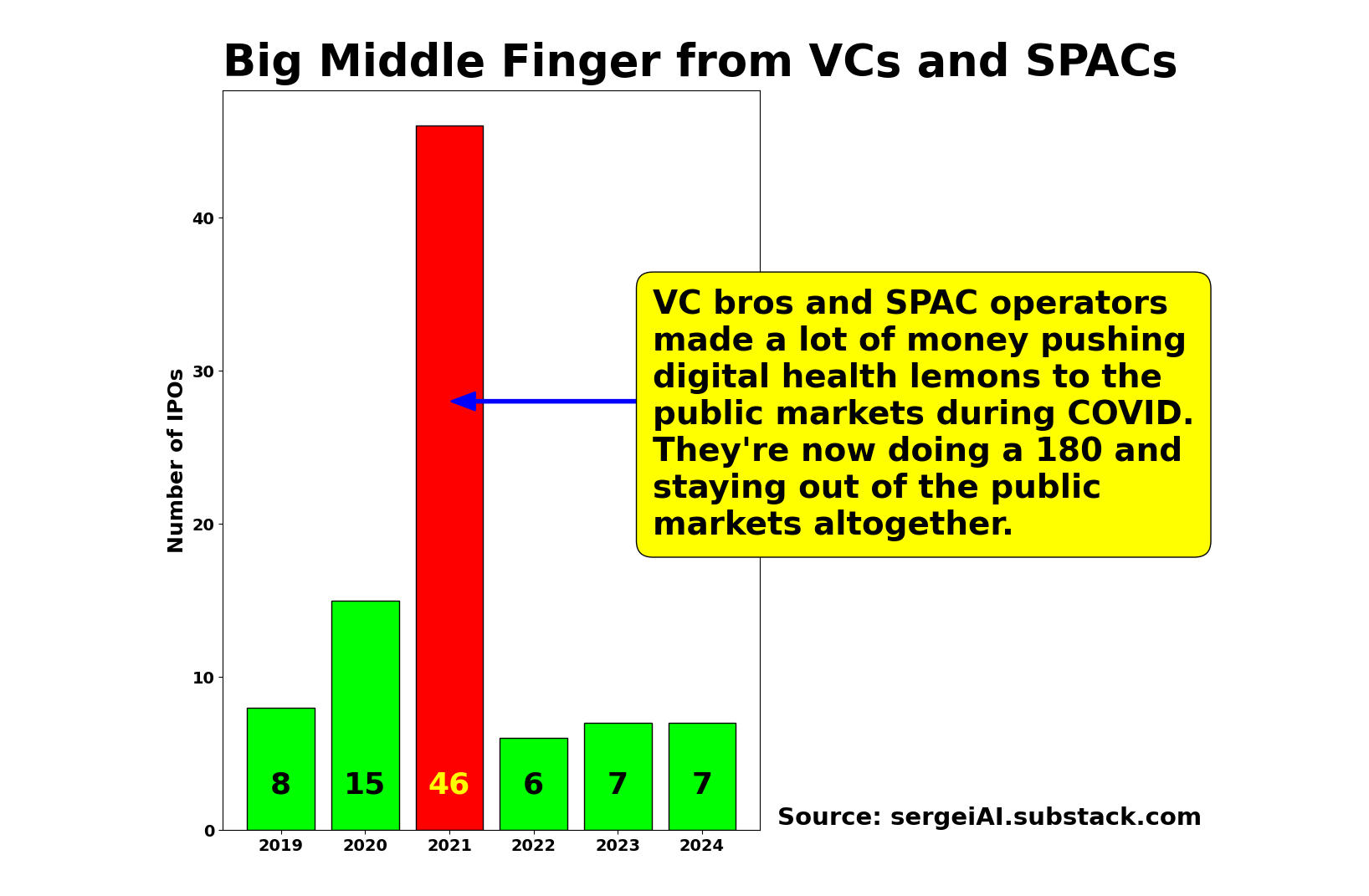

For the first time in the history of publicly traded digital health, bankruptcies have outpaced IPOs. And the worst is yet to come.

Welcome to AI Health Uncut, a brutally honest newsletter on AI, innovation, and the state of the healthcare market. If you’d like to sign up to receive issues over email, you can do so here.

🎄🌟🎅🤶 Merry Christmas to those celebrating today! 🦌🎁❄️⛄

If you ask my mom, she’d probably say I’m the most optimistic person she’s ever met (and I’d happily return the compliment 😊). Yet, to many, my publications might paint me as a pessimist.

Here’s the truth: I am an optimist. The problem is, there’s just nothing about digital health that inspires optimism—no matter what the money shufflers in this space (and let’s face it, there’s no better term for them) want you to believe. These players certainly aren’t delivering financial results, not to mention tangible outcomes.

Tune into VC-backed news, and you’ll hear a carefully curated narrative: cherry-picked outliers framed as the norm. Words like “innovative,” “resilient,” “significant,” and “brilliant” abound—not because they reflect reality, but because those spreading the message are paid to do so. Whether through sponsorships or client relationships, many of the voices championing digital health optimism are bankrolled by the very VC bros investing in the sector. It’s a cozy arrangement, isn’t it?

Note: My definition of “VC bros” refers to those General Partners (GPs) who drive strategic and valuation decisions for startups - essentially, tier-one GPs.

But I’m not here to perpetuate feel-good myths. I’m here for the truth. And the truth about digital health ain’t pretty.

The average experience—whether for investors or customers—isn’t shaped by outliers. It’s shaped by the norm. And the norm, frankly, is abysmal.

Until mediocrity—not innovation—is rewarded in healthcare (seriously, we’ve got 126(!) AI medical scribe apps, and 122 of them are blatant ripoffs), I’ll continue reporting on digital health as I see it: grim.

And it’s not just the stale innovation. Enter the so-called (I called it so 😊) “Covid middle finger” – VC bros and SPAC operators who dumped lemons into public markets, exploiting fear during the pandemic. Fast forward to 2025, 2026, 2027, and 2028, and we’re poised to witness some of the most spectacular failures in digital health history. This isn’t a prediction—it’s a fact. Stick around, and I’ll show you why, backed by data.

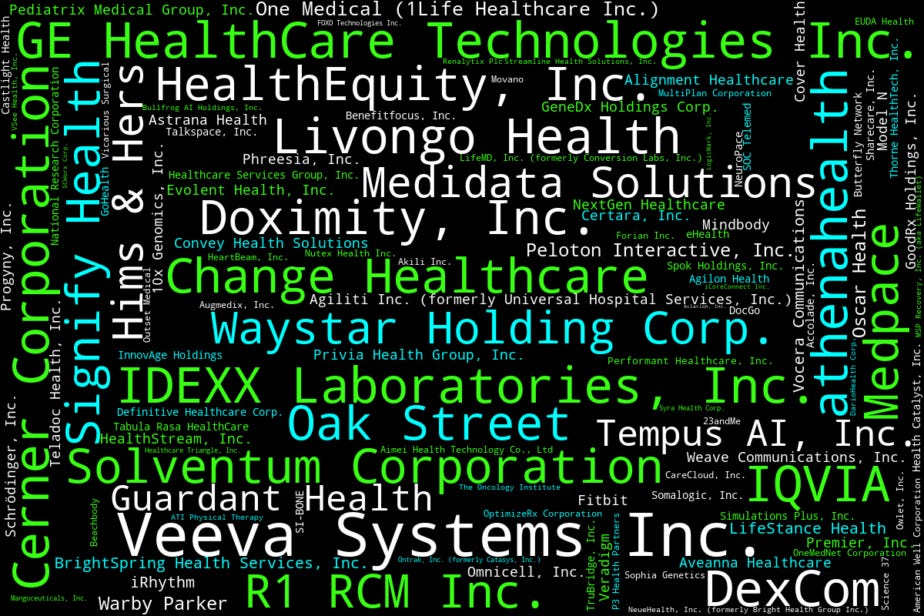

How do I know all this? For months, I’ve been painstakingly building the most comprehensive digital health public companies database: 132 companies, dead and alive. I’ve been tracking market performance, earnings reports, and operational trends across all of them.

For each of these 132 companies, I ensured they are using AI and/or information technology as an essential component of their core business. For example, a biotech company using deep learning to develop new gene therapies would qualify as digital health and, therefore, be included. However, a biotech company that does not utilize AI or IT in its core business, even if it is otherwise tech-savvy, would not be part of this list.

For those interested, you can access the most exhaustive spreadsheet of 132 U.S.-exchange-traded digital health companies right here.

TL;DR:

1. 2024 Digital Health Review: Mediocre Funding and a Historic High in Public Bankruptcies and Delistings

2. 2024 Digital Health IPO Market

3. 2025 Digital Health IPO Candidates

4. Forget IPOs. VCs Are Hiding Their Mediocrity With a New Magic Trick: Secondaries.

5. Where Will Massive Digital Health Bankruptcies Come From? Ask Chamath (Start with the Amalfi Coast).

6. Rise of Solo Bootstrapped Founders Amid the Decline of VCs

7. “Alternative” Startup Financing: Just More Cash for VC Bros. It’s Time for Real Reform.

Keep reading with a 7-day free trial

Subscribe to AI Health Uncut to keep reading this post and get 7 days of free access to the full post archives.